Check out this guided Frugal Year Challenge to audit one new area of your spending and life every 30 days.

When some people hear “Frugal Year Challenge”, they think it means an extreme budgeting, no-spend challenge for the year.

Don’t get me wrong – I personally love reading about people who take on such a demanding and inspirational lifestyle choice.

But what I think will be FAR more accessible and helpful to the rest of us is to do a year-long, focused frugal challenge where we get into the habit of auditing each area, spending category, and habit of our lives.

With the intention to “come out ahead”.

And not all at once – in fact, over 12 months is best.

Before we dive into these monthly challenges, let’s go over the 10,000-foot goal of why you would want to do this.

Because while doing this will definitely increase your cash flow, it’s about far more than saving money.

What’s the Goal of the Frugal Year Challenge?

The goal of the Frugal Year Challenge is to audit your life for ways to be more frugal, one category or area at a time.

So, what’s “being more frugal”?

Frugal Living Definition: Frugal living is about taking all the resources you have in your life – your money, your time, your energy, your friends, your family, your job, your side hustles…everything – and figuring out ways to both maximize them and not waste them.

In other words, you want to take each of these 12 monthly focuses I'm about to give you and find ways to:

- Cut down on waste (wasted time, wasted money, wasted resources)

- Maximize things (maximize enjoyment, maximize rewards, maximize use of the resources)

Notice how that doesn’t say “Find ways to save money?”

Here’s the cool thing: saving money is just ONE by-product of frugal living and taking this frugal year challenge.

It’s an important one that will happen naturally with the tasks I’m going to give you to do.

But you’re also going to get things like more time on your plate, more enjoyment out of what you have, and a better method of prioritizing what really matters in life.

Hint: here are all the benefits of frugality – there are 14 in total.

Frugal Year Challenge – Are You Ready?

Not only will doing this in monthly chunks take away the overwhelm, but working on just 1-3 new frugal habits for an entire month at a time (instead of tackling tons of new daily frugal habits in a week before giving up) means you’ll be much more likely to stick with them.

Even as you move on to building new frugal habits the next month.

Do this all year, and there’s no telling how much extra cash flow and time you’ll have left in your day-to-day and month-to-month by the end of the next 12 months.

Okay, okay, worried that you won’t know what to do in your own life to achieve all this goodness?

Take a deep breath – I’ll show you plenty of examples of how to do this in each of the themes and categories.

Let’s dive in!

Hint: the good thing about this is you can start it ANYTIME of year – just pick the month you’re in, and go for it. OR, write in your calendar that you’ll be starting on the first of the following month, then come back to get that month’s challenge.

What to do each month of this Frugal Year Challenge

| Step | Task | How to Complete the Task |

| 1 | Audit where you are right now | :: Write down your pain points for this area of your life :: Write down how you feel overall about this area :: Write down changes you've been meaning to make |

| 2 | Calculate total “before” spending | Go through your bank statements, credit card statements, and receipts for the last 3 months of spending in this area, and find the average spent per month |

| 3 | Choose what tasks you'll do | :: Read the ideas and examples given, then highlight the ones you want to try + the ones you thought up yourself :: Make a list of what you'll try (better yet, write which week or day of the month you'll try each one on your calendar) |

| 4 | Do your end-of-month reflection | :: Tally up how much you spent this month in this area of your life, and subtract that from the average “before” spending to see the difference you made :: Write down a few things that you learned, tweaks you could make if you were to do it again, and how you feel about this area now |

January Frugal Challenge Area: No Spending

Okay – I know that I said the Frugal Year Challenge is not a no-buy challenge for a whole year.

But no-buy and no-spend challenges definitely have their place in this, and since most people have just finished spending gobs more money than they usually do the month before on the holidays…it just makes sense to start the year with some sort of restraint on buying things.

Plus, this will reset what I like to call your “consumer pulse” to a much slower one – causing a ripple effect of less spending over the months to come.

Note: do be aware of the “elastic effect” of no-spend challenges – meaning, if you push yourself too hard on these, you might just snap back and spend like it’s your first full-time paycheck still living under your parent’s roof.

What kind of restraints should you put on yourself? Well, that’s up to you.

In order to set yours up for a Frugal January, you simply need:

- The Motivation: Choose a goal you’ll put all the extra savings towards

- The Rules: Choose your no-spend challenge rules

- The Length of Time: Choose your duration of time for the challenge

Here are a few examples (get more no-spend challenge ideas here):

- Choose 1 weekend where you’ll spend nothing “extra” (you define “extra”)

- Choose one category where you will stop spending money for a whole week or month

- Do a week-long or month-long pantry challenge where you only allow yourself to spend $50/week on fresh ingredients (like milk, veggies, etc.)

- Do a 30-day No-Eating-Out Challenge (here's how to stop eating out so much)

Hint: definitely keep track of everything with one of these free no-spend trackers. Also, for some extra accountability + fun, join Mrs. Frugalwood’s January Uber Frugal Month challenge.

February Frugal Challenge Area: Love & Money

Ahhhh, the month of love.

Let’s take this opportunity to audit some things that will not only save you money but will enrich your relationship.

- Make inexpensive, at-home date nights a consistent routine in your household (we do this – here are 37 at-home date nights for married couples we’ve personally tried)

- Try out some Dollar Store Date Nights

- Fill out the State of Your Financial Union printable together to see what your overall financial picture looks like (plus discuss money roles)

- Take on a Couple’s Money-Saving Challenge

- Get on the same page with finances using a couple’s budgeting app that syncs accounts, money goals, and spending

- Hold a financial meeting with your spouse

March Frugal Challenge Area: Subscriptions

Ready to laser-focus on your subscriptions?

Not just on what subscriptions to cancel, but potentially, what subscriptions to add that can help make your life simpler (and even save you money – yes, those types of subscriptions exist, too!).

Here are a few example tasks:

- Cancel in-app purchases and monthly subscriptions on your smartphone (here’s how to do that on Android, and how to do it on iPhone – very simple)

- Calculate how often you use a service either currently or in the future (such as over the summer), and how many times you’d need to use it for the membership or subscription to make sense – such as museum memberships, pool memberships, etc.

- Take one expensive cost in an area of your life, and choose a subscription to do instead that will cost less money (for example, instead of taking your family out for family date night for $80, choose a $39 kid subscription box to do at home with them)

You get the idea.

April Frugal Challenge Area: Food

You may be looking at this challenge thinking that you’ve already done it (a gazillion times), or that there’s no way you can possibly save here given the current prices and the way your current household runs.

In fact, I had these thoughts as well.

Then I did my own food frugal audit. And WOW was I impressed with the results.

Just one month of focusing on the food in our lives – where we buy it, how we eat it, how we prepare it, etc. – and I have consistently shaved $150 (at least) off of our food spending every month since.

Since I did this challenge in our household about a year ago? That means we’ve enjoyed an extra estimated $1,800.

Tasks to complete:

- Complete a pantry cooking challenge (you can start off with a week, or even go for one month – we did, and saved $250 using some of these pantry meal ideas)

- Use one of these frugal cooking tips each week of the month, so that by the end of the next 30 days you have four new frugal cooking tools in your belt

- You might even try the Daniel Fast (here’s our 21-Day Daniel Fast Menu we used)

- Check out these articles on how to save money on snacks, and how to save money on groceries without coupons

- Start making Dollar Tree Meals, and here are Dollar Tree Lunch ideas

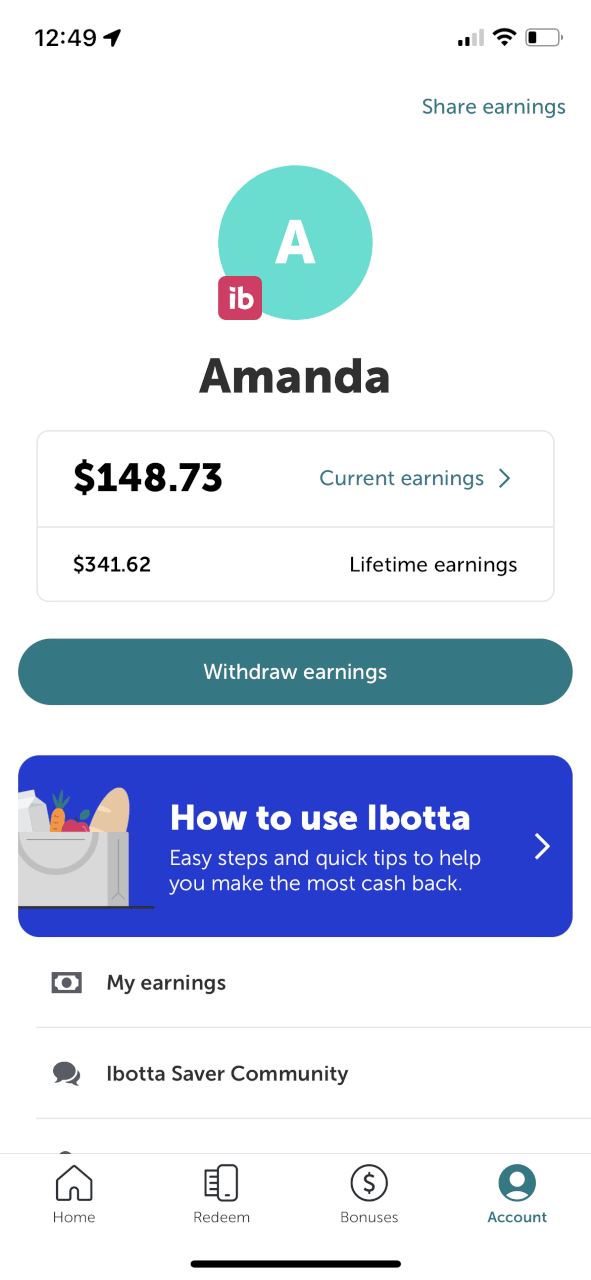

- Start scanning your receipts into three different cash-back apps (I use ibotta (my current dashboard is shown below), then Fetch, then ReceiptPal – same receipt, and I earn enough to buy a week’s worth of groceries every single year, plus a few purchases off of Amazon)

Psst: Here’s the difference between ibotta and fetch apps.

May Frugal Challenge Area: Get One Month Ahead on Bills

Have you ever been one month ahead on your bills? I’m not talking about a savings account – I’m talking about your checking account.

Where you pay your bills with last month’s income, not waiting until your next paycheck comes in to pay some bills, then your last paycheck comes in to pay the rest.

It’s a freeing thing.

You’ll want to get my free tracker and read all about your how to get one month ahead on bills challenge, here.

June Frugal Challenge Area: Money Saving Challenges

Have you ever attempted a money-saving challenge?

They’re a truly awesome way to stretch your frugal and money-saving muscles. You’ll be surprised what you can do when someone gives you the inspiration and a tracker, and you pair that with what you want to accomplish.

Here’s how to start a money-saving challenge.

Here are a few to pick from:

- Bank-It Savings Challenge (my personal favorite…because I invented it!)

- Mini Saving Challenges

- Daily Saving Money Challenges

- Couple’s Saving Challenges

- 12-Month Savings Challenges

July Frugal Challenge Area: Mini-Frugal Experiments

It’s time to get out of your comfort zone.

Because there are always things we think we can’t do, or don’t want to do, or have mental obstacles about doing (that’s what I call it, anyway) – and sometimes, these are just the things that will level up everything.

This month, I’m challenging you to complete a few mini-frugal experiments that you previously thought you’d never do.

Such as:

- Swap out a generic brand with a name brand for a product you’re constantly using

- Buy one thing you need from a thrift store

- Batch-prep and freeze two freezer meals (check out this free freezer meal prep session)

- DIY something instead of buying it

August Frugal Challenge Area: School Systems

Got school-aged children?

Then you know what a hectic time of year is coming up. Sports might’ve even started for you already, and then there are the first days of school, new routines, homework, after-school events, doctor appointments…and the list goes on.

That’s why I’m challenging you to take the month of August to prep. Get ahead of your “school systems” and routines so that you can naturally add some frugality into them.

A few ideas:

- Batch prep and/or cook freezer meals for the busy-ness that is to come

- Set a budget for back-to-school shopping, and a way to track it (maybe use one of these free printable cash envelopes)

- Create a lunch and snack system so that packing lunches and getting kids afterschool snacks is much easier to handle (here’s an interesting one)

September Frugal Challenge Area: Kid's Allowance and Responsibilities

How old are your children? When was the last time you tweaked their allowance/chore commission system and money responsibilities?

I have an entire blog on how to teach kids and teens about money – and this month, I want to help you focus on your Kid Money System.

Here are some tasks:

- Create or tweak your existing kid money system (this is your allowance, chore commissions, or any other way you get money into your child’s hands for them to learn how to manage it)

- Create or tweak your child and teen’s money responsibilities (these are the things your child is expected to pay for with their own money, such as a teenager paying for their data plan and gas in their car, or a child buying siblings Christmas gifts)

Not only will doing these tasks help you teach your children about managing money, but it will also take some financial pressure off of the household (that’s a frugal win-win in my book!).

Bonus: Take part in Jordan Page’s Free Shelftember challenge she holds each September – I’ll be there! She challenges everyone to eat from their cupboards, pantries, and freezers while only spending $25/week on groceries. Great prep for the upcoming holiday

spendingseason.

October Frugal Challenge Area: Personal Habits Audit

Write down your personal habits that cost the household money. Have your partner do the same.

Your challenge this month is to find a way to cut personal habits costs by at least 25% (50% would be even better!).

For example, I did this with my Starbucks habit (gah! I know – it was quite bad).

After our little guy was born, those 4:30 a.m. wake-up calls went on for years. So, I would play with him until our local Starbucks opened, then strap him into the car seat and get 30 minutes of quiet morning time to myself (the round-trip to Starbucks).

It was something that got me through at the time, but then became a habit that I didn’t enjoy any longer. I was just doing it.

Then when everything shut down, it forced me to finally confront this habit that I wasn’t too happy with – the results were amazing! My husband and I figured out a really simple cold brew drink with a homemade vanilla-cinnamon simple syrup I make every two weeks.

In the mornings, I just add ¼ cup of the cold brew, 1 tbsp. of the simple syrup, ½ cup unsweetened almond milk, and a bunch of ice (exact recipe and links, here).

We made this change over two years ago now, and I only go to Starbucks once a week to work. I calculated that this has saved our household an astounding $2,500-$3,000 already!

November Frugal Challenge Area: Family Frugality

In this month of gratefulness, reflection, and family time, let’s sprinkle in some frugal tasks you can get the whole family involved in.

- Create a family savings goal

- Each family member chooses 10 (approved) items you’ll all then donate together to a Goodwill or other location

- Have a family meeting and discuss a few ways the kids can help save money (for example, show them how much electricity different household items use up plus the cost of that with a Kill-a-Watt)

- Put your child or teen in charge of finding coupons to use on items on your grocery list (make the list ahead of time – my sister did this as a teen, and saved my stepmother like $15 in one trip!)

December Frugal Challenge Area: Disposables Audit

You’ve made it to the last month. Bravo, you!

I want to leave you with one last frugal audit in your Frugal Year Challenge – the kind that you might need some extra money to complete (which you should definitely have if you’ve been working on these monthly audits), and that will help you to save money for the entire new year to come.

It’s the Disposables Audit. Which just means to go through the things in your life that you use a bunch of, and research/purchase reusable options instead.

I’ve done this in several ways:

- We use kitchen towels instead of paper towels

- I use the Reveal Mop instead of the Swiffer Mop (MAN is this a money-saver – those disposable refills are super costly and do not last long)

- I substituted reusable freezer plastic bags to cut down on the number of disposable plastic storage bags we were using

- We use vinegar + water, plus reusable micro-fiber cloths to clean most things in our home

- I put my kitchen meal planning sheet into a sheet protector and purchased wet-erase markers so that I could reuse it week after week after week

Honestly, this is one of my favorite ways to not only save money but consume less. Perhaps that’s why I saved it for last!

I hope you can see that completing this Frugal Challenge Year will save you gobs of money. But even more than that, it has the potential of simplifying your life, bringing more joy into your days, and helping you prioritize what’s really important (and what’s not, that you’ve been giving too much life energy to). I can’t wait to hear your own experiences and experiments in the comments below.