Make some sweet money moves and improve your relationship by tackling one of these financial goals for married couples together.

Why am I writing about financial goals for married couples?

Well, they hold a special place in my heart.

My husband and I started our marriage off tackling one of the biggest financial goals we ever thought we’d achieve together – paying off the remaining $25,000 of our $59,496 individual debts, paying for our wedding and honeymoon in cash, and putting a down payment on a home all in the same year – and it brought us so much closer.

It was like an anchor that gave our marriage a place to grow from.

Think of what choosing and working on one of these financial goals with your spouse could do for your finances AND your relationship!

Financial Goals for Married Couples

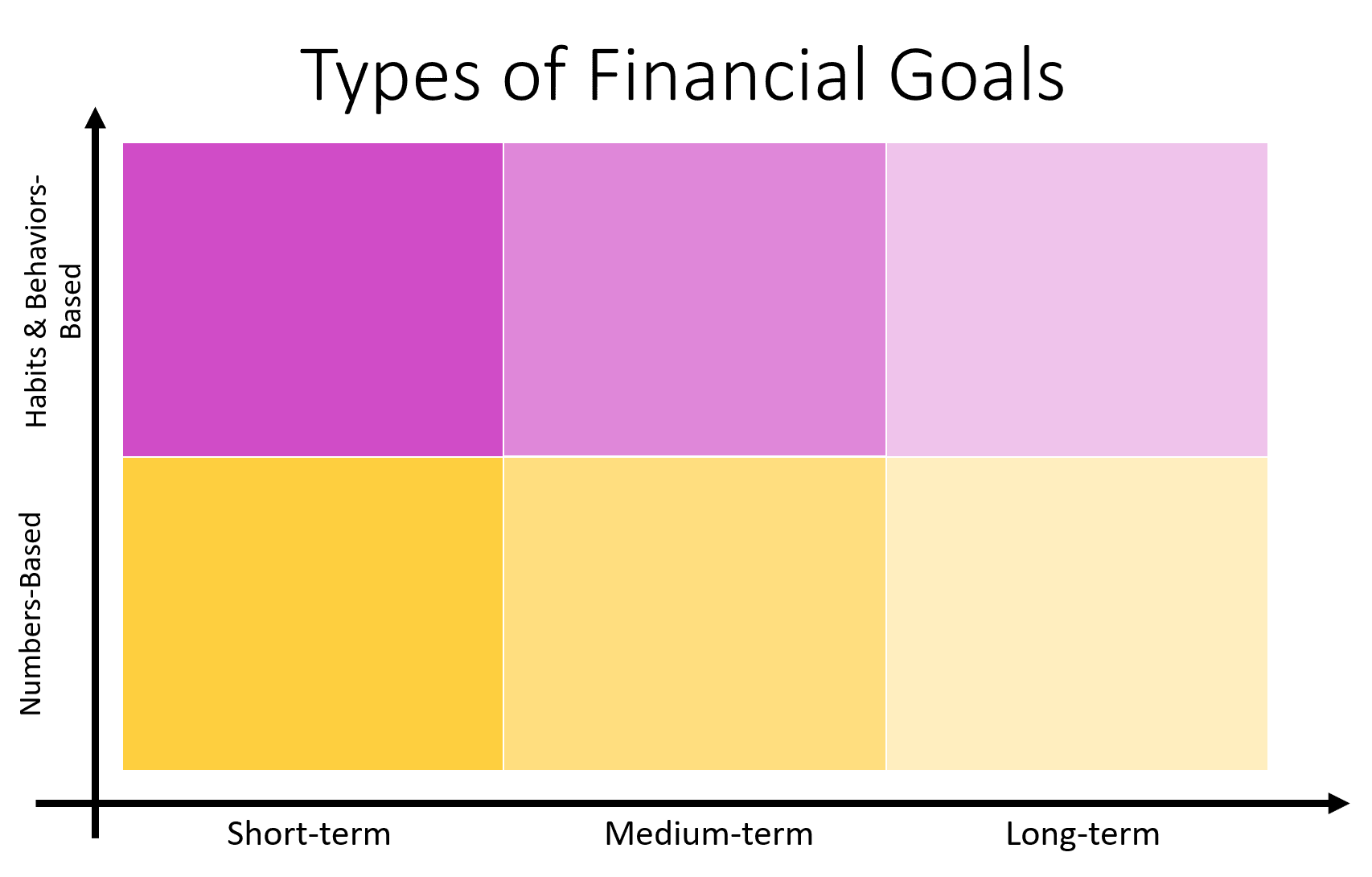

Before we dive into a list of great financial goals for married couples to set and do together, let’s briefly go over the different types of financial goals.

There are 5 types of financial goals.

The first three types categorize the goal by the time it'll take you to reach it:

- Short-term financial goals

- Medium-term financial goals

- Long-term financial goals

And the last two categorize the goal by how the outcome is measured:

- Behavior-based (how the two of you handle money)

- Number-based (an actual number amount you’re trying to hit in some way)

The matrix comes in to show you the different combination possibilities.

For example, you guys could have a short-term behavior-based financial goal (to start using a daily spending log), or a long-term number-based goal (save $10,000 towards a new roof in 3 years).

Lots of options.

Let’s jump in!

1. Pay for a 10-year, 15-year, or 20th Anniversary Trip in Cash

Type of Goal: Short-term, numbers-based

Figure out when your next big milestone anniversary is, and brainstorm where the two of you would like to go for it.

How long do you have until you’d need to book this trip?

And approximately how much will the trip cost (you can do this fun research together during a money meeting with your spouse, or you can work with a travel agent for some quotes)?

Work backward to see how much you’d need to save each month between now and when you need to book it so that you can pay for the whole thing in cash.

What a sweet time together that will be – and to come home with no debt from it? Well, that adds the cherry on top.

2. Start a Weekly Money Spouse Meeting

Type of Goal: Short-Term, Behavior-Based

Taking the time to talk about money, where the finances are, what spending is coming up over the next week, weekly “allowances” or “mad money” to spend, etc. will improve not only your finances but your marriage.

You’ll learn how to communicate about money better, and you’ll learn about what each other finds important, troubling, confusing, etc. about money.

It’s a win-win!

Here’s how to set up weekly money-spouse meetings (plus ideas for how to give it more of a date night feel than a PTO-meeting-feel). It's one of my favorite financial exercises for couples!

3. Pay Off Your Home Before Retirement

Type of Goal: Long-term, numbers-based

Paying off your mortgage together is one of the most satisfying financial goals you’ll ever achieve as a couple.

It’s also one of my favorite long-term goals for married couples.

Because over 44% of people aged 60 – 70 still pay on a mortgage (yikes!). And having a mortgage on the smaller income many have when they retire? Well, it certainly takes away from all those retirement dreams that kept you fantasizing at work.

That’s why I challenge you and your spouse to choose the long-term financial goal of paying off your mortgage before you retire.

And if you’re really up to the challenge? Why not see what it would take to pay off your mortgage in the next 5 years (just for funsies – who knows where this could take you?).

4. Get Your Couple’s Money System Tweaked + Updated

Type of Goal: Short-term, behavior-based

There are umpteen couple’s money systems out there. But the one that matters? Is the one that works for the two of you.

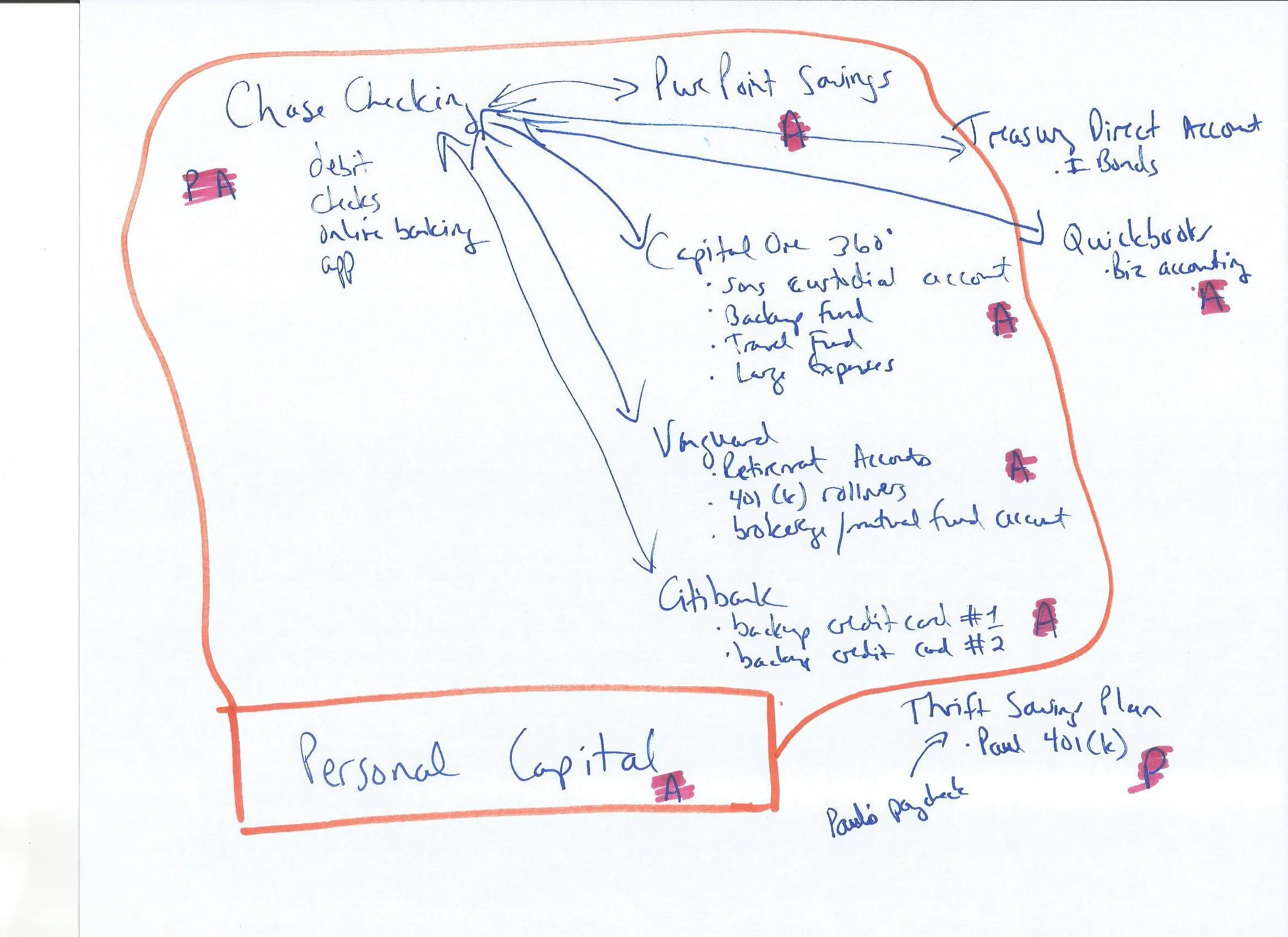

Take a minute to write down all the different parts of your money system – I actually like to draw this part, because it shows me which accounts are connected to which others, and where some of the weaknesses are.

Ours looks something like this (excuse the handwriting…it’s a darn good thing I can type my thoughts out instead of writing you all a letter!):

Pay attention to the following:

- Which accounts are connected, and which accounts aren’t

- Who has access to which accounts

- Financial apps are used individually, and couples’ budgeting apps are used together

Hint: here’s my couples financial planning worksheet to help with this.

Doing this will probably give you a small (or large) list of things to do and tweaks to make. For example, when I did this exercise just now, it made me aware of a few things we needed to edit.

I did the following:

- Logged into Empower's Dashboard to update the previous month (I like to change a few of the transaction categories)

- Associate Paul’s Thrift Savings Plan account to our Empower's Dashboard

- Finish a Savings Bond I series purchase on Treasury Direct

- Reminder to Paul to fill out his annual health survey to get $75 in health spending from our health insurance company

- Shopped around to compare savings account rates

- Sent a request to Empower's Dashboard to associate with the Treasury Direct website (fingers crossed they can accommodate)

Something else that became immediately clear to me is that if something were to happen to me, Paul would be in a world of trouble trying to figure out how to gain access to each of these accounts (you can see in the image that where I have access only is an “A”, where Paul has access only is a “P”, and then there is “P A” for where we both have access). Something to definitely put on our to-do list to sort out.

Hint: in the same boat? It’ll be helpful even to keep this drawing that you do in your financial folder so that your partner/you have an idea of all the different accounts to look for in the event of something happening.

5. Pay Off One Category of Debts

Type of Goal: Short or Long-Term, Numbers-Based

Debt is a pretty “normal” thing most couples have, and so what I want you to tackle with yours is to:

- Categorize your debts (for example, all student loans/education debts, all credit cards, all car debts, all house debts)

- Add up the total amount

- Set a goal to completely pay off one category of debts first

Here’s my article on how to Pay Off $40K debt in one year for lots of help working this one out (how to calculate it, example calculations, etc.).

6. Save Up to Buy Something for the Family

Type of Goal: Short-term, Numbers-Based

What’s something that, if you guys purchased for the family, would make a big difference for everyone?

This is a great savings goal to set and work on together.

I’ll share the one that my husband and I are working on right now: family bicycles. Our six-year-old started riding a bike (with no training wheels!) last summer, and so we now want to get bikes for both of us. <Family bike trip images dancing through our heads>.

The way we decided to get there is to literally get our food spending under control. We don’t have any debt, and have more than a year of emergency savings – so we’re doing great.

But we noticed that our food and restaurant spending has ballooned to uncomfortable levels.

SO much so, in fact, that I calculated if we do some food challenges (like this pantry challenge) for the next two months, then we can source all the money we need from what we would’ve spent there, for bikes.

How exciting!

Hint: Having trouble coming up with an idea? Here are 47 cool things to save up for.

7. Pay Off All Student Loans Before Your Kids Start School

Type of Goal: Short-Term/Long-Term, Numbers-Based

Do you have a young family, or are you a new couple and you’d like to have a family one day?

A really neat financial goal for married couples to tackle is kind of a psychologically heavy one: getting your own student loans paid off before your kids start school.

Hint: kids already in school? Set a meaningful goal, like “before my kids start high school”, or “before my kids graduate high school”, or “before my kids start college”.

8. Get Out of the Car Payment Loop

Type of Goal: Long-Term, Behaviors-Based and Numbers Based

Picture this: the two of you driving around in safe, good cars without making a car payment each month.

You’re reading the blog of someone who has never owned a car payment in her life – I’ve paid cash for beater cars that slowly got nicer over the years, as I drove each into the ground and used my savings to buy a better one.

FYI: My husband came into our marriage with car debt, and that was part of what we paid off within 4 months of getting married. We haven’t had a car loan since.

In order to accomplish this, you guys both need to save up a certain amount of money each month AND change your thinking about cars in general.

Some thoughts on cars you might need to adopt:

- A car is to get you from Point A to Point B, and nothing more (thanks, Dad!)

- You don’t need a car payment to get a car

- You don’t need to get a new car every few years – cars can last for 10 years or more

- Etc.

9. Do a Savings Challenge Together

Type of Goal: Short-Term, Behaviors-Based

I absolutely love savings challenges. And couple’s savings challenges? Can be even more fun.

That’s right – they’re one way to keep managing money fun and fresh. And you always learn something plus change a few habits after doing a money challenge!

You could choose one of the following:

- 30-Day No-Eating-Out Challenge

- 9 Mini-Saving Challenges for Small Budgets

- 12-Month Savings Challenges

Hint: never done a savings challenge before? Here’s how to start a money savings challenge.

Marriage and money – it can be a complicated topic. Instead, I hope that you and your partner learn to manage a limited resource better by taking on one of these financial goals for married couples. Not only that, but I hope that you have FUN together on the journey!