Watch out now – your food bill is about to drop! Steal my tips + strategies for how to save money on groceries without coupons.

Not a “coupon” person…and you need to know how to save money on groceries without coupons, stat?

You know, because your food bill is starting to resemble a separate mortgage payment?

You’re in the right spot.

Today, I’m going to teach you my best tips and tricks for how to take your grocery bill back down to a reasonable level.

And we’re gonna do it without using coupons.

Hint: this article pairs really well with my 14 frugal cooking tips – so definitely check that out, too!

How to Save Money on Groceries Without Coupons

I’m about to drop a truth-bomb: I stopped using most coupons a few years ago.

And guess what? I still save a lot off of our grocery bill each month.

Especially when compared with average grocery spending for our household size (for a household of 3, that’s between $694.60 and $1,149.90, depending on how thrifty or spendy a family is).

I do this using a combination of the strategies and tips I’m about to give you – so don’t be afraid to try one, master it, then add another one into the mix.

Before you know it, your bill will be noticeably smaller.

Hint: don't forget about snacks! here's how to save money on snacks (from a

cerealserial snacker).

1. Mirror Your Week of Meals on a Two-Week or 4-Week Rotation

I noticed in our own home that I naturally started doing this in the past few months, and it makes a lot of sense from both a money and a time savings standpoint.

Think about what goes into feeding your family for a week:

- Meal planning/figuring out what to make

- Shopping/gathering the ingredients

- Making the meal

- Cleaning up from the meal

Instead, make a meal plan for a week, and for each meal, make sure there’s enough to freeze a second one. Label each item so that you know what’s in there.

Then, either two weeks or four weeks later, mirror this week’s meals by eating the same things (that are already cooked!) from your freezer.

That means:

- When you grocery shop during that week, you’ll just need some fresh ingredients that accompany the meal (such as herbs and sour cream)

- You’ll have far fewer dishes to grapple with on these nights (just the dishes your family uses to eat with)

- You won’t have to take time to plan out meals for this week

- You’ll get some economy of scale by reusing the same ingredients from that first week, instead of having to buy a new batch of ingredients for all new recipes

See all those time and money savings?

Recently, I’ve done this with sausage and veggie foil packs, a killer Mexican Tater Tot Casserole, shredded BBQ chicken for BBQ-chicken stuffed sweet potatoes, etc.

While some foods/meals will not freeze well, many will – lots of options here.

Psst: if you have a family member who is not a routine eater, meaning, they like tons of variety, then you’ll want to mirror your week of meals a month or so from now instead of saving big in the same month. It can still work!

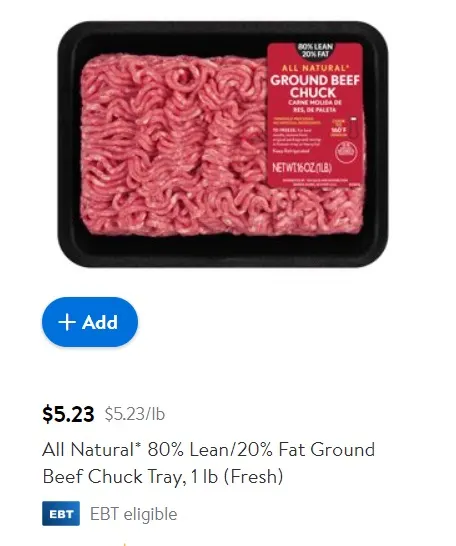

2. Rethink Your Ground Beef Options

I looked at beef prices the other day, and my mouth about fell open.

I mean, we don’t eat a ton of beef. But it’s nice to have for a few of our go-to recipes throughout the month.

You’ll be happy to learn (as I was) about Frugal Fit Mom’s great hack when it comes to beef: buy the pack of 100% pure beef burgers at Walmart, then use a meat masher to mash it up like ground beef.

Right now, that simple hack will save you around $0.96/lb., bringing your cost of ground beef back down to less than $5.00/pound.

Just look at this comparison of 80% Lean/20% Fat beef:

Psst: you’ve gotta check out her YouTube channel – I have binge-watched about a month’s worth of episodes and just love her enthusiasm.

3. Shop for Food at the Dollar Tree

I'll be the first to say that not everything is cheaper at the Dollar Tree than at, say, your local Walmart.

BUT, a lot of things are.

That's why I created these recipes using only Dollar Tree ingredients (seriously – you need to check 'em out):

- Dollar Tree Meal Plan for 2 ($37.50 for the week)

- 7 Dollar Tree Dinner Ideas

- 9 Healthy Dollar Tree Snacks

4. Shop Clearance FIRST, Not Last (Especially for Meats)

Almost every grocery store I’ve ever shopped in has a clearance – you typically just need to look around for it (near the restrooms is a popular area).

My favorite clearance section? Is at the meat department.

In fact, the clearance section in the meat department is the reason why our family started eating about 60% of organic meat instead of non-organic (at a fraction of what we were spending on non-organic meats).

When I hit the meat department, I go straight to the clearance section. I typically find organic chicken, sometimes grass-fed beef, and the occasional salmon fillets (oooohhhh – salmon is my favorite!).

I stock up with what I can, then when I’m home I portion the meats out to what we need per meal, and freezer them right away (the reason why these meats are on clearance is because they will spoil within a week and the managers would rather sell them at some price then at a complete loss).

Our freezer is stocked, and we’re eating healthier than we did before using this strategy!

5. Choose Some Frozen Veggies + Fruits Over Fresh

You might be a fresh, fresh, fresh kind of gal. But unless you’re eating those veggies and fruits raw, then I challenge you to buy frozen the next time you shop.

Frozen produce:

- Is much cheaper than fresh: For example, at the time of writing this, you’ll pay $2.32/lb. for fresh broccoli, versus just $1.12/lb. for frozen broccoli florets.

- Keeps wayyyyy longer: Say goodbye to food waste in the veggie bin.

- Is healthier than canned vegetables and fruits

For things like broccoli in quiche, smoothies, pasta dishes, and other cooked meals, we buy frozen. Or for veggies going into stir fry.

For stuff we want to eat in its raw state, we buy fresh.

Psst: I wouldn’t have tried this, either, except we moved to a desert that also happens to be considered a food desert. The fruits and veggies are much less plentiful here, and so I started trying to frozen. I’ve been pleasantly surprised!

6. Find a Grocery Outlet Store

As I mentioned, we’re in a food desert here in El Paso.

And I haven’t been able to find a grocery outlet store.

But I clearly remember shopping at one by our home growing up (I believe it was called Amelia’s). We took slightly dented and unsold food items, and got them at a great discount.

Don’t have a grocery outlet? Then keeping reading…

7. Make Strategic Use of the Dollar Tree’s Food & Freezer Section

As of a month ago, you never would’ve found me purchasing food from the Dollar Tree.

The occasional summer fun supplies? Of course. Maybe some kitchen foil pans and plastic storage containers? Yes.

But food? Not so much.

Then I came across this video on YouTube, and decided that those spring rolls and fried rice looked SO good, we needed to have it for a Friday night take-out-from-home situation.

They did not disappoint! My husband – who didn’t know any of the food I purchased for it was from the Dollar Tree – said it was the best stir fry, ever.

And here’s the cost breakdown:

- 2 lbs. brown rice: $1.25

- 1 package Spring Rolls (these were delicious!): $1.25

- Peas, carrots, cauliflower (our addition), soy sauce, and 2 eggs: $0, because we had all of these in our freezer/pantry (if you had to purchase these for this meal, then you’d pay another $3.75, bringing your meal total to $6.25 for several people)

Not only that, but we have plenty of rice leftover, and so much of the fried rice, that I saved it for another night (I just need to pick up one more container of those delicious, $1.25 spring rolls).

Hint: some food items are great deals at the Dollar Tree, and others are not because they’re smaller in size or even the same cost as what you’ll find at a Walmart. As long as you pay attention to product sizes and amounts, you can really cut your grocery bill using this strategy.

8. Swing by the Deli + Prepared Foods Area

I know, I know – you’re probably wondering what I’m talking about here. But listen up: the deli has freshly prepared foods that, if they don’t sell in time, will expire within a few days.

That means there’s usually always at least one item on clearance near the deli area.

You can score something to take into work for lunch the next day, or a side dish of fruit that needs to be used up for dinner tonight. All kinds of options here.

I’ve found small tubs of watermelon for way cheap that needed to be used up that day that I freeze and use to make my Monster Pops (one banana, a bunch of watermelon, and one steamed carrot – my son gobbles these up since he was around two, when I started making them).

9. Go on JUST a Clearance Shopping Trip

This is more of a challenge for you: to spend one grocery shopping trip only buying products that are on clearance.

You could do this just at one store, or hit up multiple stores.

And no cheating (well…unless you need that one ingredient you forgot your last grocery shopping trip. Okay – get that one ingredient).

10. Take the “Eat from Your Pantry Challenge”

Money Saving Mom started talking about this wayyyy back in the blogging day, and people are still taking the challenge (because it really works!).

In fact, I take this challenge at least once a year with Jordan (she calls it’s her Shelftember challenge – and it takes place in September each year).

The idea is to eat only (mostly) through the food items you have in your pantry, freezer, and cupboard foods instead of going to a grocery store for an entire month!

That might sound extreme to you, so you can try it out for half a month or so to start. Just remember that the key to doing one of these challenges is that instead of rushing out to the store for specific ingredients, you find substitutes within your own stockpiles of food.

Hint: here are my pantry challenge tips, and 17 cheap pantry meal ideas to get you started.

11. Grocery Shop Every Other Week

If I had to pin just ONE strategy that was the end-all-be-all for us to save money on our groceries, then this is the one.

Years ago, I got the idea to take our weekly grocery shopping to a bi-weekly affair. And it’s made quite the difference.

After starting this strategy, we calculated savings of approximately $100-$160 a month (and that was when there were just the two of us!).

Why does grocery shopping every other week work as a money-saving strategy?

Well, I’ll give you three reasons:

- Staying Out of Stores: There’s less opportunity and temptation to spend money.

- Making a Commitment to Stay Out of the Stores: If you make a conscious effort to make sure you stick to our every-other-week schedule – meaning you plan out your meals (we’ll discuss more), and instead creatively substituting ingredients with what you’ve got at home, then you’re going to save money.

Skeptical that you can pull this off?

When I first shared this with my readers all those years ago, I had a very good question as to how we can grocery shop every other week but still have plenty of fruits and vegetables for both of those weeks.

Since some of you may be interested in doing this pantry challenge, or at least in trying to scale back the number of grocery store trips you make, let’s take a minute to discuss this.

After getting that question, I spent a few months watching our vegetable/fruits intake like a hawk. And you know what? It turns out, we’ve got a fairly good system in place for making these food groups last in between our grocery store visits.

I chose an example from September of last year (mainly because I saved the receipt from this particular trip to the market), and this should give you an idea of how to have fresh fruits and vegetables for both weeks in between your grocery trips.

In the first few days we gobbled down the fruits that spoil the quickest: bananas, peaches, and strawberries. Then we began to use up the green peppers, made some eggplant parmesan, used some of the cilantro and chives in cooking, and took the red grapes to lunch.

We made a salad with the romaine lettuce and spinach in equal parts to make the romaine lettuce last longer (plus spinach is just so healthy for you – did I mention that the spinach in boxes always seems to last twice as long as the mixed salad varieties?).

At the end of these two weeks, we were still left with a few potatoes, carrots, a lemon, cilantro/chives, a tomato, and some onions.

12. Know How to Price Something by Use

Are you buying something you only need for one-use or just a tablespoon from? Or are you buying something you’ll use again and again and again until you restock it?

This matters when finding the best deal.

For one-use items you only need a bit of, you’re just looking for the cheapest price. For items you’ll eat again, again, and again until it’s used up, you want to look at the price per unit to get the best deal.

Bonus: Avoid Common Supermarket Tricks

In this last section, I’d like to cover some sneaky, supermarket tricks that can get you to spend more money without you necessarily realizing it.

I’d like to just list out a summary of some of these; you can get much more detail about these in my article on supermarket tricks.

- Buy 10 for $10 Promotions: Each product is being sold for $1.00, which seems like a steal! But be careful, as stores love to stick in products that normally sell for less than $1.00 to make up for the loss in money (like gum, cans of tuna, etc.).

- Pricing Products so that You Overspend for the Sake of a Promotion: There are promotions where you need to spend $20 or so worth of products in order to get a free $10 Catalina (coupon for $10 off your next visit). The way you can spend more than intended here is that they price the items in an odd way so that you normally have to buy one more to get over that $20 threshold (in other words, the items you want to buy comes to like $19.97, so you’re forced to buy one more item because you need to spend $0.03 more).

That’s 2 tricks…and I’ve got 9 more.

How to Know if You’re Actually Saving Money on Groceries

I hope you’re just as excited as I am about these seriously great grocery hacks.

But you might still be wondering, how do you know if the efforts you’re about to put in amount to something? You know, to saving money off of your grocery bill?

The first thing you want to do is figure out what savings looks like for you.

You can do this in two ways:

- Calculate your average grocery spending for the last three months (this is much easier to do if you use a free personal finance dashboard like Empower, like we do).

- Look up the average spending for a family of your size, and then set out to smash that number into smithereens (for reference, the USDA says the average grocery bill in 2022 for a family of four is typically between $1,009.40/month and $1,520.90/month, depending on how thrifty or spendy you are in the food department, and the age of your kids).

Hint: and if you’re a money nerd like me? You’ll likely dig into both of these numbers.

Then, you want to save your receipts from each grocery trip.

This will help you to track your monthly grocery spending, so that you can subtract your total monthly spending from your average and/or from the U.S. average for your household makeup, and see how much you saved.

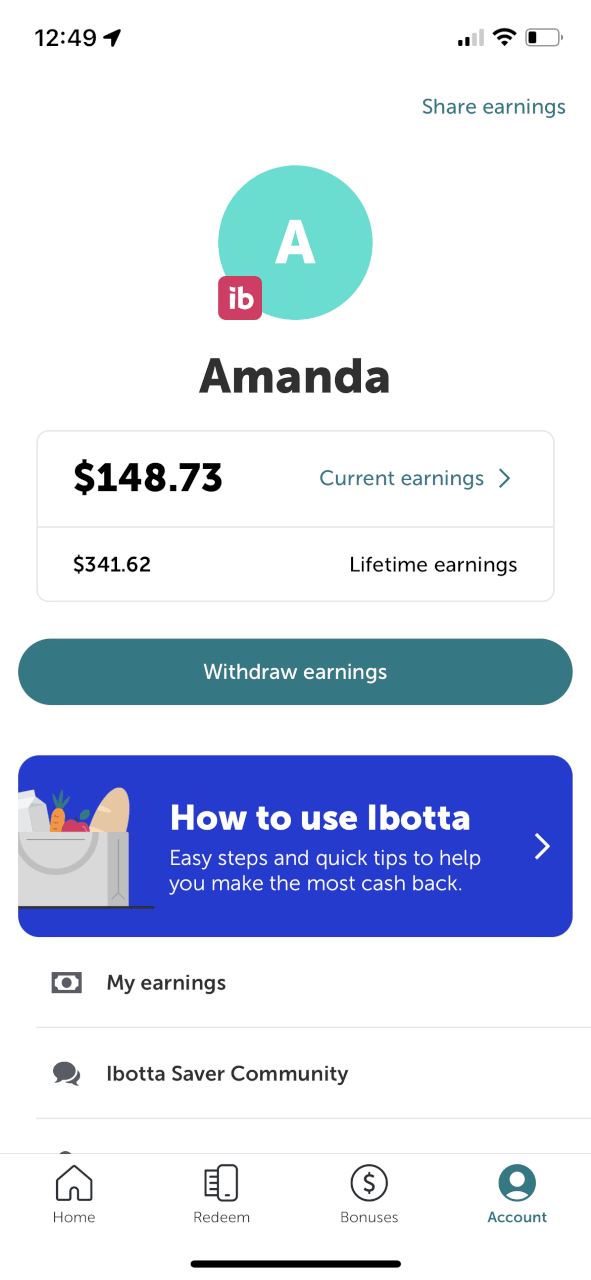

Bonus tip: take all those receipts, and put them into my favorite grocery cashback apps, ibotta and Fetch. You can use the same receipt for each, and earn cashback.

Save Money Groceries App – Coupons on Phone Without Printing

I know, I know…I promised tons of strategies to save money without using coupons.

But digital cashback apps where you just need to click a button and scan a receipt to get money? Well…that's wayyyyy different than clipping coupons (at least in my book).

Most grocery stores have their own digital apps full of digital coupons for you to use on top of regular manufacturer coupons.

And you can get digital manufacturer coupons (coupons on phone, without printing) as well!

But those aren’t the only kinds of save money groceries apps. You can also get cash back by scanning in your receipts, no matter what store those receipts are from.

Just look at my grocery cashback – I let them get big enough that it'll pay for an entire weeks' worth of groceries, then I cash out:

Let’s dig into all three of these options – you’ll want to layer/stack as many together as possible (hint: you can stack multiples – great opportunity for your kids to get in on your household’s personal finance management!).

Store Save Money Groceries Apps

- Target: Do you grocery shop at Target? Download their app for exclusive savings on anything in their store (including food). Here’s the app for iPhone, and for Android.

- Kroger: The Kroger app offers digital coupons (plus a whole lot of other things you can do).

- Giant: Giant offers an app where you can get digital coupons to use at their store.

- HEB: Get the HEB app for digital coupons.

Manufacturer Save Money groceries Apps

- Coupons.com: You can save money three different ways using Coupons.com (by the way, they have an app) – by printing the coupons out, by loading digital manufacturer coupons to your loyalty store card, and by scanning your receipt to get cash back.

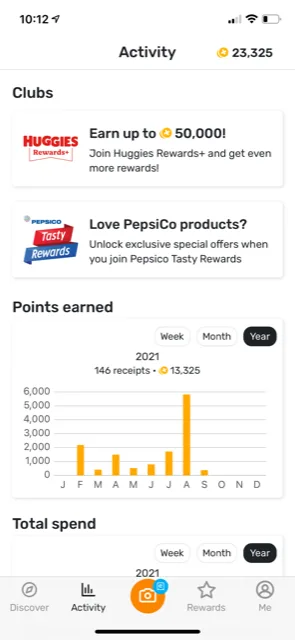

Apps that Give Cash Back for Scanning in Grocery Receipts

- Ibotta: Using this app, you’ll choose offers before you go shopping. Then, go shopping, and scan your receipt to get your rewards.

- You can also use Fetch (what is the difference between fetch and ibotta?)

Pro tip: you can take the same receipt and scan it into both ibotta and fetch to get double the cashback — that's what I do!

How to Save More Money on Groceries Without Using Coupons

Well, you've made it all the way to the end. Or perhaps you've skipped around, and just gotten the juicy tidbits that will work for your situation.

I hope that I've shown you that you can save money on groceries without using coupons.

By pairing some time-old wisdom about how to save money on groceries together with some modern tips, you'll be able to get on the lower end of that USDA grocery-spending range.

So, the next question is: what will you do with all that extra money each month?