These no-spend challenge ideas will make your no-spend challenge focused, doable, and full of BLOCKBUSTER results!

“No” shows up in lots of different ways when it comes to finances.

You know, when you say things like:

- We can’t afford that (even though you want it)

- It’s too expensive (even though you could buy it if you prioritized your spending)

- Not today (which turned into “not this year”)

How about if your financial “no's” into something meaningful, like a no-spend challenge that'll help your money goals?

I’ve got some killer no-spend challenge ideas you likely haven’t thought of yet. These ideas will help you to get some BLOCKBUSTER results plus enjoy the process more.

How Do You Do a No Spend Challenge?

In my No Spend Challenge guide article, I talk about the basic definition, rules, and examples of how people set up their own challenge.

Let me briefly go over that here, too.

A No Spend Challenge is:

A length of time you set and follow strict rules that limit your spending in most categories (bills excluded) so that you can funnel that saved money towards something that you want (like debt, saving towards a trip, etc.).

And it can be about more than just saving money, too.

Other motivations to do a no-spend challenge include:

- To “call out” your spending behaviors so that you’re more aware of them, and can rein them in a bit

- To decrease the amount of materialism in your life

- To rewind the tape on lifestyle inflation (you know – when you spend more as your income increases? Here are lifestyle inflation examples)

- To challenge your spending “musts”

- For a Frugal January after an expensive holiday season

- etc.

In order to set yours up, you simply need:

- The Motivation: Choose a goal you’ll put all the extra savings towards

- The Rules: Choose your no-spend challenge rules

- The Length of Time: Choose your duration of time for the challenge

- The Tracker: You want a way to track your no-spend challenge, and a free no-spend tracker is just the thing.

That’s it – if you do those three things, you’ll have created your own no-spend challenge.

But that’s not entirely what this article is about. In THIS article, we’re diving into some cool + helpful No-Spend Challenge ideas.

No Spend Challenge Ideas

You want ideas to make your no-spend challenge easier, more profitable, and even a little fun, right?

Great!

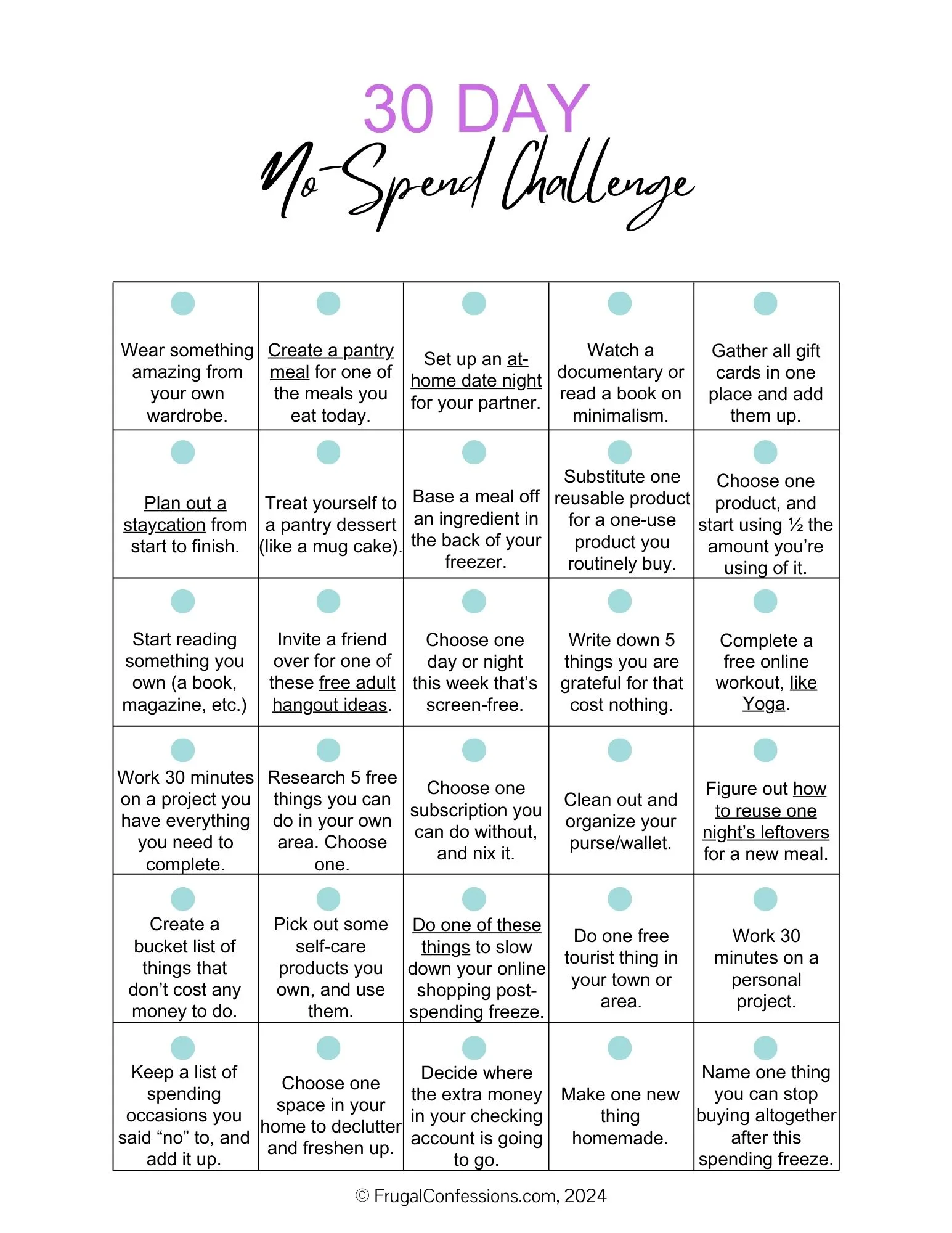

Psst: Don't forget to download your free 30-day no-spend challenge printable, too (just click the image – no optin needed).

1. Choose a Word for Your Challenge

Have you ever heard of choosing a word for your year? It's where you choose one word that you want to embody throughout the year.

I challenge you to choose a word for your no-spend challenge. To help you remember your why for doing the challenge, keep your eye on what you're hoping to get from it, and set an intention for how you want it to feel.

Example words to choose from:

- Balance

- Enough

- Pause

- Mindfulness

- Self-discipline

- Transform

- Abundance

2. Build Your Lifelines

You know how on the show, Who Wants to Be a Millionaire, the contestants get lifelines – last-ditch help to turn to when they’re stuck?

You want to put together a list of your own lifelines before you get stuck during the challenge.

Smart No-Spend Challenge Lifelines:

- Grocery Store Lifeline: One of the things I hear time and time again is having to break a no-spend challenge due to needing something last minute from the grocery store. To get around this, spend less of your grocery budget one week in prep for your challenge, then buy yourself a grocery store coupon in the difference. For example, if your weekly grocery spending is $250, then aim to spend $240 or $220, and buy yourself a gift card there for the $30 or $10 less you spent, to use as a lifeline during your no-spend challenge.

- Drive-Thru Lifeline: We all get busy (sometimes foreseen, sometimes out of nowhere), and going through the drive-thru will get tempting. Are you taking a 30-day, no eating out challenge? Prep at least one freezer meal ahead of time as your drive-thru lifeline. This is something that you can quickly put into a Crockpot or oven, with no prep on the day of, so that you have much less of a reason to go through the drive-thru. Here are 15 healthy freezer meals on a budget (with a shopping list) that my family loves!

- Pantry Meal Lifeline: Get familiar with resources that show you how to use what’s already in your pantry to cook dinner. That way, if you just can’t figure out what to cook one night, you’ll have ideas to fall back on. Here’s my article on 17 cheap pantry meals. Here are 9 pantry challenge tips, and 7 free kitchen inventory printable sheets so that you know what you've already got.

Get creative here – think through problems you might come up against, then figure out a lifeline you can pre ahead of time (that won’t cost you extra to build).

3. Make a Family Leaderboard

You need your family to buy into this process so that it goes better (not only that, but it can be a fun, bonding experience for everyone).

Why not create a little friendly competition among everyone, with the overall goal of working together through a No-Spend Challenge?

Create a simple family leaderboard with a point system, and decide on rewards to give out at the end.

Points can be given for:

- 1 point to each family member for thinking up a new way to use something you already own at home

- 1 point to each family member for coming up with a free entertainment idea (either for themselves or for the family)

- 1 point to each family member who comes up with a snack idea or pantry meal idea that doesn’t use anything you have to run to the store for

- Etc.

Reward Ideas:

- The family reward for everyone gaining a minimum of 3 points

- Individual gag awards for things like best-non-spender, most creative in substituting a spending occasion for something you already own, etc.

Pssst: Here's another way to track your challenge: using a free no-spend tracker app or printable.

4. Do a Post-It Note Download

One of the surprising benefits of doing a No-Spend Challenge is the new awareness you’ll gain on your spending habits.

I want to take that up a notch and show you how to really get a hold of how to spend less money.

Every time you have the urge to buy something, enter a store, or get something online, I want you to grab a Post-It Note and write down the exact (even silly) reason WHY.

And you know what? These might sound ridiculous when they pop out of your head. But stick with me here.

Like, you might have things like this on your notes:

- Because I’m bored

- Because I forgot something at the store

- Because I saw my friend got this and it would be perfect for me

- Because there’s a sale that might not happen again, if ever

- Because I need something positive today

Stick with me here.

Because if you do, then at the end of your No Spend Challenge, you’re going to have a much better grip on your personal cocktail of emotional spending.

Psst: finding that you spend money to make yourself feel better? Here’s my article on emotional and psychological reasons for overspending.

5. Consume Like-Minded Stuff

When you’re doing something new, it’s best to bring like-minded people into your life.

I mean, why would you want to watch and read things about people spending tons of money when you’re trying to squeeze the wallet shut?

Two resources you might want to queue up for your challenge:

- TLC’s Cheapskates: Have you ever heard of TLC’s Extreme Cheapskates show? Some of it’s completely wacky (which is pretty entertaining to watch). But it can also be inspirational! Go to YouTube, and search for “TLC Cheapskates full episodes” to find a bunch of them.

- The No Spend Challenge Guide: I had the pleasure of meeting Jen, the author of this book, a few months ago at FINCON (a conference where we money-nerd bloggers get together). She gave me a copy that I devoured, and have to say, really enjoyed it! It’s a great read that will help inspire and guide you with your own challenge.

6. Attack Your Highest-Spending Category

Filter your bank account and credit cards for the entire last year, and add up how much you spent in each of the following categories (you can request an annual review from some banking dashboards to help with this):

- Clothes

- Restaurants

- Books

- Groceries

- Amazon deliveries

- Office Supplies

- Craft Supplies

- etc.

Which category did you spend the most amount of money in? Choose that category of spending to cut out during your no-buy challenge.

Hint: here's how to start a money savings challenge, which will help with this.

Let’s move on to rule ideas to help you pick the best rules for you.

No Spend Challenge Rules Ideas

What are the rules you’ll stick to when you do your challenge?

In this section, we’ll go over specific ideas you can use for your own No-Spend Challenge.

1. Make Family-Member Specific Rules

To get better family member buy-in (and participation), have each family member choose one type of spending they’re going to cut out entirely for the month.

For example:

- Dad could cut out coffee drive-thrus

- Mom could cut out online shopping

- Kids could cut out vending machine use at school (pack snacks from home, instead)

2. Vary the Length of Challenge Time

You might think about changing up your no-spend challenge lengths of time.

You could do:

- No spend weekend

- No spend holiday weekend

- No spend week

- No spend holiday week

- No spend month

3. Use Saved-Up Gift Cards

You can decide to save up some gift cards people gifted you or that you earned through things like Swagbucks (a search engine that rewards you with actual gift cards for surfing the web – I’ve earned over $3,700 in cash to my PayPal account since 2009!).

Hint: if one of your goals is to curb materialism or the habit of spending money? Then I’d skip this rule.

4. Choose to Stay Out of Just One Store

Do you have a particular store spending habit that you want to attack during this challenge?

Like, maybe you go to Target when you're bored? Or, you can't go to a Costco without spending $200 and you'd like to stop that?

Great. For this spending challenge, decided to choose just one store to stay out of for a duration of time.

See how that goes!

No Spend Challenge Month Ideas

Going for a whole-month-long moratorium on spending?

Awesome!

Let me help make it easier on you.

1. Phase Out Your Spending Categories

Instead of cutting out all spending (except bills) in a cold-turkey fashion, do a phased approach.

Pick one new no-spend category to phase out for each week in the month. You’ll be adding these on top of what you already cut out the week before.

Let me show you how this could play out:

- Week 1, you work on cutting out all eating out

- Week 2 you do that and also cut out vending machines at work

- Week 3 you do all of that and also cut out trips to any store outside of the grocery store

- and by Week 4, you do all of that and cut out grocery shopping

2. Focus on Just One Category

Sometimes you can get the most results from really focusing in on one area of your spending (or even one habit – check out my 17 powerful daily frugal habits for more ideas).

For the whole month, you can focus your spend nothing challenge on one of these:

- No eating out

- No eating out for any lunches at work

- Only essentials from the grocery store

- No entertainment spending

- No new clothes

- No new books

- No online shopping

You can really focus in on the habits you want to change using this idea.

How Can I Stay Busy Without Spending Money?

What can I do instead of spending money…as a way to stay busy?

Great question!

I’ve got some killer posts that will help you to still have fun and stay busy without spending money (even with friends).

You’ll want to check out these no-spend activities:

- 74 Things to Do with Friends without Spending Money

- What to do When Bored, Broke and Alone (37 Ideas)

- How to Set Up a No-Spend Pamper Yourself Day

And one other idea I have for you?

Come up with a list of 3-5 things you’d like to accomplish during your No Buy Challenge.

Here’s my personal list to give you ideas:

- Burn candles I already own, and read a book I’ve been meaning to

- Put together my child’s baby book

- Clean out the garage

- Rearrange my kitchen cupboards so that they actually “work” for me

- Organize my “favorites” folder on my computer, and go through and read up on everything I have saved

Not only will these keep you busy (i.e., thinking less about what you can’t have, and more about what you can DO), but they’ll move you ahead on things you want to get done in your life.

Take these No Spend Challenge ideas, and use them the next time you want to concentrate on cutting your spending down and using your cash for a specific goal of yours. Pick one or two for this challenge, then pick new ones for your next challenge!

Kathryn McCoach

Thursday 4th of February 2021

"How Can I Stay Busy Without Spending Money?" Stay busy with making money online from the comfort of your home. I think it's not bad at all to earn instead of spending.