A No Spend Challenge Guide full of ideas to set up and survive your challenge (plus tips from others who've done it!).

The No Spend Challenge: a way to get ahead of your debt, pad your bank account with money for your savings goal, and curb your family's appetite for spending on, well, everything.

But are you a little worried if you'll be able to pull one off?

I hear you!

Let me walk you through how to set up a no-spend challenge that's meaningful for you, as well as prep work that'll increase your success rate (plus comfort).

Quick Rundown of a No-Buy Challenge

Call it the Use It Up Challenge, the Zero Spending Challenge, a spending freeze, the No Buy Year…whatever you’d like. It’s all the same thing.

A no-spend challenge is where you choose a specific amount of time to reduce your spending dramatically or altogether (not including the regular bills you have to pay to keep your lights on).

It's an intentional act where you focus on:

- supercharging your debt payoff to credit cards, student loans, etc.

- curbing materialism/getting a shopping addiction under control/pulling the plug on unnecessary spending

- saving money fast towards something you want to be/do/have

- some combo of all of these

For example, Ashley Patrick and her family do no-spend challenges several times throughout the year to keep on top of their spending. Each time, she focuses on something different.

For example, Jason Vitug recently completed a No-Spend Challenge as a way to buffer his emergency savings fund during a time when he lost his income.

Jason writes,

“During the pandemic when all my travel, speaking gigs, and events went to a screeching halt, I decided to not spend money for 30 days (beginning in April 1). I wasn't sure how long the lockdown would last and if any of my events and speaking gigs would resume. I already had 1 year of basic living expenses. I was able to move $1800 for the 2 months into the EF. That's a rough estimate but included cutting back on all the nonessentials but primarily travel/transportation costs/restaurant/social expense.”

Jen Smith, author of The No Spend Challenge Guide, wanted to deal with less stress:

“When my husband and I were paying off $78k of debt I thought I could side hustle my way out and not deal with my impulse spending issue. But I quickly realized that wasn't possible when I got shingles from over-working myself. I used month-long no-spend challenges to detox my spending and show me where I needed to improve.”

Here's how to prep for one for more success getting through it (with the results you want).

How to Prepare for a No-Spend Challenge (for a Week, Month, Year, etc.)

Look, you can wing this thing.

You can just declare a no-spend weekend the next time you’re short on cash, or a no-spend week to get you through to your next paycheck.

But if you put in some prep work for your no-spend challenge? Then it tends to go a lot smoother (plus, your results can actually be even greater).

So, let’s get to preppin’ to figure out how to get ready for your next no-spend month/year/weekend/etc. (this is a great strategy to start the year with – a Frugal January):

1. Choose Where You’ll Funnel Your Savings to

This is Numero Uno because, to be honest, a no-spend challenge can be tough.

If you can hold onto the reason why you’re doing this – the place or goal or thing that is going to get all the money you don’t spend – then you can win the battles in your head.

Ideas for where you’ll funnel your extra money:

- To your credit card bill

- To your student loans

- To your travel fund account

- To your piggy bank

- To your Christmas savings account

- To grow your emergency fund savings account

- To your retirement investments

- To an account where you can save up to start your own business

Here are the results from each person I interviewed to inspire you:

- Ashley's 30-Day Challenge: “I likely saved at least $300 because we were out of control on eating out.”

- Jason's 64-Day Challenge: “I wanted to have 18 months in my Emergency Fund. Prior to the pandemic, I was at 66%, now I'm at 100% [because of the No-Spend challenge].”

- Jen's 30-Day Challenge: “…The amount we put in during the month was nice but it wasn't significant. The significance came in how it changed my spending going forward. Overall what I've learned has saved me thousands.”

- Nicole's 2-Week Challenge: “Saved $1000 and saw that, while it wasn’t totally sustainable, we were just frittering away lots of money!”

2. Choose Your Challenge Intensity Level – No Spend Challenge Rules

Wondering, “How do I not spend money at all?”

It’s a really good question.

You might be surprised (or, really, not surprised) to learn that a no-spend challenge does NOT have to equal $0 spending on your part.

I mean, let’s be real – not spending a single dime is difficult to do. Actually, it’s nearly impossible, unless you’re this man living in a cave.

So, you’ve got to decide what intensity level you want.

- Do you allow yourself to spend on bills only (like the mortgage/rent, data plan, gas, electricity, etc.)?

- Do you take on the pantry challenge (see below), but allow yourself $50/week for milk, veggies, lunch meats, and fruits?

- Do you cut your grocery budget in half and call that your no-spend challenge?

- Do you keep your regular spending, but just spend $0 on entertainment for the month?

- Do you allow yourself to go to free events, and spend the extra gas money on it? Or do you only count free events “free” if they’re within walking/biking distance?

- Do you read my article on Amish finances and use only candlelight for the night (just kidding – the Amish actually have propane, natural gas, or even kerosene lighting)?

It’s up to you to make the rules and decide how intense you want to get.

Nicole Rule shares more about her own family's no-spend challenge rules.

“We like to write the ground rules we've decided down on paper so we can all refer to them. We don't allow ourselves to “stock up” on things beforehand as it feels a bit like cheating. We also don't allow the use of gift cards, as it feels similar. So, no, we don't usually spend extra money beforehand as that would defeat the purpose of trying to save as much as possible.”

Jason Vitug had his own set of rules.

He says,

“I did spend on rent, utilities, and groceries, but all non-essential and discretionary spending including streaming services were paused.”

3. Choose Your Challenge Duration

You can choose to do a no-spend weekend, no-spend week, no-spend pay period, no-spend month, no-spend holiday, or even…a no-buy year.

How long you want to go depends entirely on you.

You want to consider things like how much you would love to have saved from this challenge, if you’ve ever tried a no-spend challenge before, and how strong (or weak) your delayed gratification muscle is.

Each person I interviewed chose a different duration (and some of them even extended because they found out the challenge's benefits outweighed any inconvenience!).

Different Challenge Durations Picked:

- Ashley: She chose a 2-week challenge length.

- Jason: He chose to do a 30-day challenge, but ended up going for 64 days!

- Nicole: She chose a 28-day challenge.

- Jen: She chose a one-month challenge.

4. Remove All Spending Temptations

You want to remove as many spending distractions and spending triggers as you can.

For example:

- Opt out of some of the behavioral targeting that happens online by going through the steps in my article on how to stop spending money online.

- Start paying for your gas at the pump. That way, you won’t be triggered to buy a coffee or candy bar while paying inside the convenience store.

- Take 30 minutes and unsubscribe from all the store email newsletters you currently have popping into your inbox.

- Resolve to only watch shows on DVR or On Demand so that you can fast forward through those tempting commercials.

- Un-link your credit card information from online shopping sites to create another physical barrier between you and an online purchase.

5. Make a Resource List of What You’ll Use Up

This is where I get excited – making a resource list ahead of time will help you in moments of pure boredom to have a list of at least 10 things you’d like to use up during the challenge.

These will help keep you busy, help you declutter your home, and make your no-spend challenge way more comfortable.

For example, in my own no-spend challenge, I plan to use up/use the following:

- Inflate my bath pillow, bust out that bath bomb I received two years ago, and actually use them.

- *Actually* use all those nail tools and accessories I have and paint ‘em black.

- Sit still long enough to work on my baby’s (errr, 3.5-year-old’s) baby scrapbook.

- Clean out our recorded shows and movies.

- Read a book from my 2-year waiting list (my husband laughs at me because he knows that if he buys me a book or when I purchase a book it automatically goes on my two-year waiting list. I literally have about a hundred books waiting to be read at this very moment!).

- Use some of my beautiful stationery to write a handwritten letter. People rarely write letters anymore, and it is such a pleasure to receive one. Perhaps there are people that you have been meaning to thank. Now’s the time to do it.

But don’t just stop there. This is both for items (these 7 free printable kitchen inventory lists will help) you’ll use AND for experiences you’ll have.

Psst: you'll definitely want to check out my 74 things to do with friends without spending money, and how to do an at-home Pamper Yourself Day without spending money.

So, add another 10 items to your list of experiences or things you can DO during your no-spend challenge that will cost you nothing.

Here are some ideas:

- Make a Family Video and Upload it to YouTube: Do you have a video camera, or can you borrow one from a friend? Barb Friedberg suggests making a family video and taking it live on YouTube. What a fun project! You could also do a video to send to family and friends.

- Scrapbook/Organize your Photos: I love to scrapbook and find that I buy the materials I will need, but take years to get around to actually creating the book. With all of the extra time you have, get your creative juices flowing, or even just organize your photos into boxes.

- Geocache: Check out the Geocaching website, look up locations in your area, and then go and find a hidden container to see what other people have put inside.

- Window Shop (but only if you have lots of self-control): I used to do this while living abroad in both London and Japan. I didn’t have a lot of extra money to spend, and I found out that you didn’t have to spend any to have a good time and to learn something. What kind of new products are out there? What are the latest trends? Any ideas you find that you can make yourself?

- Update your Recipe Box or Create One: I get such pleasure from trying out new recipes, and then copying the memorable ones onto index cards and putting them into my recipe box. I only take the time to update my recipe box about twice a year, but it gives me such pleasure to do so.

- Update your Address Book: It was great to have a reason to update our entire address book for our wedding in 2010. Why not undertake this when you have nothing but time on your hands? The organization will save you time in the future.

- Scout out Your Next Road Trip: What could be more fun than sitting down with your map or the internet and mapping out a future road trip? Make mix CDs of your favorite tunes to listen to, a list of places to visit at each point along the way, and figure out how much you need to save to make it a reality. Perhaps you want to plan the road trip around an event, like a concert you really want to attend, or during a festival.

- Pick Up Running Again: Or yoga (I love this woman's free, at-home yoga videos). Or any number of things you could do with the exercise equipment and body you already have.

- Update Your Resume: You never know when this will come in handy, and it’s probably been more than the suggested six months since it’s been last updated (especially if you've held your current job for several years).

Here are more ideas for how others stopped spending money (without being bored):

| Name of Person | “My favorite way to avoid spending money is to spend time making it. Anytime I had free time I would look for some way to monetize it. That came in the form of data entry and odd jobs on the internet. They weren't making me much money but they were keeping me from spending money and had the added benefit of bringing in extra. We'd also go to movies or concerts in the park, go for runs, and be intentional about utilizing subscriptions or memberships we'd already paid for.” |

|---|---|

| Jen | “I have found that ultimately, what helped the most is waiting at least 72 hours between wanting something and purchasing it. Even with groceries. I can usually make due and feel more fulfilled and happier with not having spent the money than if I had just turned to the Target or Amazon app to purchase things immediately. “ |

| Nicole | “I have found that ultimately, what helped the most is waiting at least 72 hours between wanting something and purchasing it. Even with groceries. I can usually make due and feel more fulfilled and happier with not having spent the money than if I would've just turned to the Target or Amazon app to purchase things immediately. “ |

| Ashley | “I went through my pantry and planned meals based on what I already had.” |

Choose Your Own Flavor – No Spend Challenge Variations

Women (and men) have probably been undertaking no-spend challenges for generations.

But because they’ve become so mainstream and people can share ideas more easily over the internet, the no-spend challenges of today look QUITE different than the ones our grandmothers did for themselves.

Because of that, I want to open your eyes to all the varieties of no-buy challenges out there.

Use these to follow along with, and to help shape your own challenges.

- Take the Pantry Challenge: You only eat from your pantry/freezer/cupboards (except maybe milk and bread and eggs, or something like that) for a period of time. Like this lady did. Melissa from Mom’s Plan concluded her pantry challenge, where she challenged herself to eat through her food in the pantry and cupboards instead of purchasing more food (she did allow herself $100 per month, then banked the $200 she saved from her typical food budget). Use your creativity and eat that food before it expires! Here are 9 pantry challenge tips.

- Take the Zero Entertainment Challenge: Hey…this one is mine! I challenge you to take your entertainment spending down to $0 for a year. There are TONS of free things to do if you live in a city and tons of things around your home that are just waiting for you to explore. On top of that, if you have parents or family members who ask what to get you for the holidays (like we do), ask for experience gifts (such as movie theater gift cards, a cooking class, a foraging hike, etc.). Then, use them one by one throughout the year as your entertainment.

- Take the No Spend January Challenge: Do you have extra holiday bills lurking over your head? If you’re dealing with a spending holiday hangover, then use your entire entertainment budget in the month of January (and any other spending categories you can lop off) to pay off holiday bills.

- Pair with a Savings Challenge: I’ve noted a bunch of different savings challenges in my article on 250 money-saving tips. One you might want to shoot for during a no-spend money challenge is to save one entire person’s paycheck!

- Take a “No Eating Out” Challenge: You can try a no eating out challenge, either with your no-spend challenge or AS the no-spend challenge. Besides adding some extra cash flow back to your life, you’ll become more aware of how often you DO eat out.

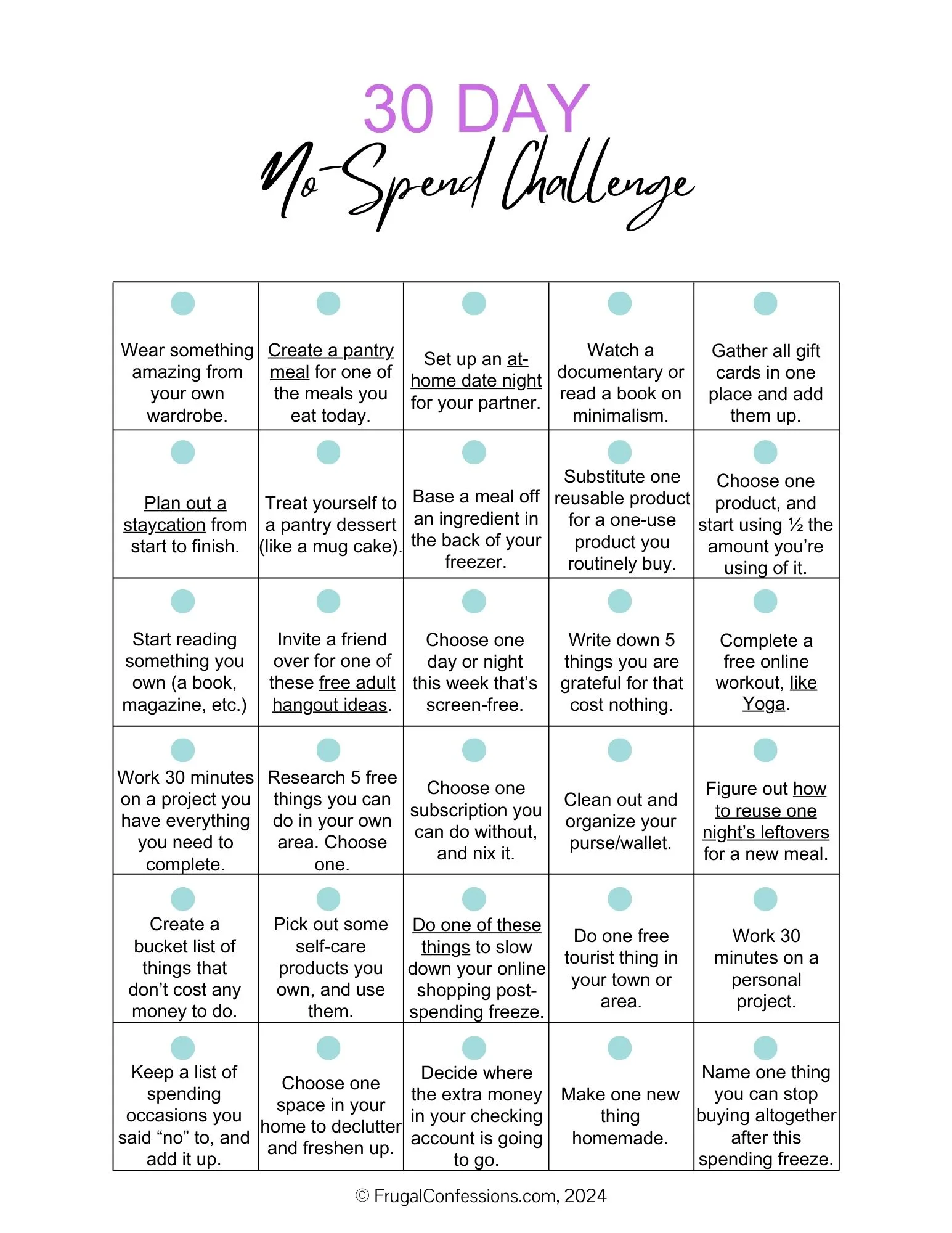

30 day no spend Challenge Printable (Plus Tips & Tricks)

As a person who has done a few no-spend challenges over the years, I’d like to leave you with some no-spend challenge ideas, tips, and tricks.

1. Take the 30-Day Challenge

I've created a 30-Day Challenge that you can print out.

Click on this 30-day no-spend challenge printable, download it, and take the challenge!

Choose one task to do each day, for 30 days.

These will enhance your no-spend challenge in some way, and help you get through it. Challenge you to see things differently. Squeeze savings out of new areas. See that you have “enough”, and to cultivate a feeling of satisfaction.

- Wear something amazing from your own wardrobe – dress to the nines using the clothes and accessories that you have, right now. Bonus points if you wear something you always mean to, but never get around to.

- Create a pantry meal for one of the meals you eat today.

- Set up an at-home date night for your spouse, boyfriend, or girlfriend.

- Watch an episode or documentary on minimalism (list several examples). Don’t have any, check out a library book about it.

- Gather all gift cards in one place and see what you have to spend.

- Plan out a weekend or week-long staycation from start to finish.

- Make a pantry dessert (like a mug cake).

- Base a meal off an ingredient in the back of your freezer.

- Substitute one reusable product for a one-use product you keep buying.

- Choose one product, and start using ½ the amount you’re using of it.

- Start reading something you already own (a book, magazine, eBook, etc.).

- Invite a friend over and use one of these free adult hangout ideas.

- Choose one day or night this week that’s screen-free.

- Write down 5 things you are grateful for, that cost absolutely nothing.

- Complete a free online workout, like Yoga.

- Work 30 minutes on a project that you already have everything you need to complete.

- Research 5 free things you can do in your own area. Choose one.

- Choose one subscription you can do without, and nix it.

- Clean out and organize your purse/wallet.

- Figure out how to reuse one night’s leftovers for a new meal.

- Create a bucket list of things that don’t cost any money to do.

- Go through your bathroom drawers, pick out some self-care products, and use them.

- Do one of these things to slow down your online shopping (post-spending freeze).

- Do one free tourist thing in your town or area.

- Work 30 minutes on a personal project.

- Keep a list of spending occasions you said “no” to, and add up the estimated amounts you didn’t spend.

- Choose one space in your home to declutter and freshen up.

- Decide where the extra money in your checking account is going to go.

- Make one new thing homemade.

- Name one thing you can stop buying altogether after this spending freeze.

2. Lean on THE Frugal Foundational Principle

Whenever you think you NEED to purchase something in those 30 days (or however long your challenge is), go through the four-step process of figuring out whether you can use it up, wear it out, make it do, or do without!

Substituting with something else really works as well.

3. Use a Habit Tracker App for a No Spend Tracker App

You can use a habit tracker app, such as Coach.me, to track your no-spend challenge.

Here are 11 other no-spend tracker printables and apps.

4. Scatter a Few No-Spend Weekends Around

If I were you, I wouldn't start off with a 30-day no-spend challenge. Instead, I would sprinkle in a few no-spend weekend challenges for yourself.

You'll get a taste of how this works, and the amount of money that you can keep in your life by doing them, and THEN you can start aiming for longer challenges (say, a one-week, pantry-eating challenge).

Find lots more no-spend challenge ideas here.

Lessons Learned after Doing One of These Challenges

One thing that each person I interviewed pointed out is that the most beneficial result of their challenge was what they learned about their spending habits by doing it.

This, in turn, has saved them loads more money over the months and years after.

For example, Jen writes:

“I learned about my impulse, emotional, and habitual spending patterns. I learned that some of the things I'd been putting in my budget that I thought were “needs” weren't that important to me. Other things I learned were really important and resulted in me putting them in my budget without the guilt I'd felt before. I had a lot of guilt whenever I'd spend money on non-necessities because I thought everything should be going to debt.

The biggest “need” that I found out wasn't a need was going out to eat at sit down restaurants. I had to dissect everything about why I spend money and this was a big shocker to me. I found that it wasn't the experience of eating nice food or being served that drew me there. What I loved about dining out was eating food that I didn't have to cook or do dishes and I love spending time with friends. But I could hang out with friends for free at home or do a potluck or when I'm not on a no-spend challenge just go to a quick-service place or get takeout.”

And Nicole says,

“Honestly, the things that we cut out are often things we may want to continue buying the future, but the no-spend rules allowed us to see that our old way of just purchasing things immediately when we want them instead of considering alternative ways of solving that problem without throwing money at it is not our preferred way of doing things anymore.”

You now have a powerful tool in your hands to accomplish some crazy financial goals, like paying off $50,000 in one year or paying off $2,000 on a credit card in just 30 days. You can do all sorts of things with the money you're earning now, especially with periodic no-spending challenges!

Dana Twight, CFP

Monday 10th of December 2012

Just found these-a great list and well worth a review for the end of 2012! Dana

twentysomethingmoney

Thursday 6th of January 2011

I like just spending time surfing the net -- so much to read/watch, that you can spend hours upon hours... all that time, not spending a dime.

Amanda L Grossman

Thursday 6th of January 2011

Hello Everyone!

Thank you for all of the comments--I was super busy yesterday, but read them all.

LifeAndMyFinances

Wednesday 5th of January 2011

I love that you put geocaching on the list! My brother-in-law is big into this and even goes to the conventions! I thought it was dumb at first, but treasure hunting is just plain fun. Plus, you get some good exercise!

johng arlington auto

Wednesday 5th of January 2011

Oh I LOVE the make a family movie idea! I've had this flip mino HD sitting aorund in a box and I haven't had a chance to use it, thanks for the memory jogging!