Totally doable, mini savings challenges that are perfect for you if you’ve got a small budget, but big savings dreams. Seriously – you’ve gotta try them!

Thinking about taking up a savings challenge…but every time you look at the amount they expect you to save, you just sigh and get back to your normal life?

That’s why I’m writing today – to give you lots of mini savings challenge options that will fit well with your small (or even non-existent) budget.

These are going to make you feel like a savings HERO, because you’ll be able to do them and win instead of feeling like you’re barely keeping up!

Psst: you'll also want to check out how to start a money saving challenge, plus 9 savings challenge ideas to help you crush your next challenge.

Mini Savings Challenge #1: The Bank It! Receipt Savings Challenge

What it is: You take the amount that it says you saved at the grocery store, convenience store, Walgreens/CVS, etc. on the bottom of your receipts, and you move that amount into your savings account.

How Much You’ll Save: This one varies a lot, but I would think you’ll sock away at least $10/week.

A personal mini-savings challenge I came up with years ago – when I was making tons less and still had debt – was my Bank It! Challenge.

It was around the time all the stores started posting an area on the bottom of their receipts, showing how much you “saved” during your visit.

The thing is, those aren’t real savings because the money doesn’t go into your savings account – you have to do that. Which is why I called it the “Bank It! Savings Challenge”.

In one month of doing this, I banked over $153!

Pro Tips: This challenge really gives you an incentive to use coupons and digital cashback apps, because every time you do, your savings at the bottom of the receipt go up (which means those coupons and such will actually add money to your savings account! Well…after you move the money over). Two apps I’ve really enjoyed using are the Ibotta app (In just 4.5 months I earned a total of $133.41 in actual cash that I then put into my savings!) and Fetch. You can use the same receipts for both apps, by the way.

Mini Savings Challenge #2: The Penny Challenge

What it is: Start by saving one penny a day, and then increasing that by one penny each day, for 365 days.

How Much You’ll Save: Follow this plan, and you’ll have an extra $667.95 socked away this time next year!

How would you like a 365-day challenge where you can start in January, saving just between $0.01 and $0.31 a day?

I think this mini-savings challenge is perfect for that post-holiday hangover period because it allows you to still do a savings challenge since you can actually come up with the money while you dig out of your post-holiday spending hangover.

As the year progresses, so does the amount you save each day. BUT, it only grows by one penny each day…so it’s totally doable and is a great low-income savings challenge.

Pro Tip: Here’s a free penny savings challenge printable.

Mini Savings Challenge #3: The $5 Challenge

What it is: What is the $5 challenge? It’s when you take all the $5 bills that come across your path and save them. No questions asked.

How much You’ll Save: This one varies – it’ll really depend on the length of time you do it for, and on how much you use cash (versus plastic).

If you take up this savings challenge? Then you’ll commit to setting aside every single $5 bill that comes into your life, into your savings.

Totally doable, right?

Pro Tips: You can substitute the $5 challenge for the $1 challenge if you’d like. And if you’re even shorter for cash than that? Go ahead and rename this the Quarter Challenge and own it.

Psst: you'll probably want to check out these 7 daily money saving challenges. And if you're with a partner? You guys can rock these 5 money saving challenges for couples.

Mini Savings Challenge #4: The 100 Envelope Savings Challenge

What it is: What is the 100 Envelope Challenge? It’s where you number 100 envelopes from 1-100, you choose a new envelope each day for 100 days, and then you set aside the amount of money according to the numbered envelope drawn.

How Much You’ll Save: Usually, people give a value of $1 for each number on the outside of the envelope (so, envelope #33 would mean you have to save $33 that day when you draw it). At that rate, you would save $5,050 in 100 days. But keep reading to tweak this for small budgets.

I’m including this one as a mini-savings challenge because you can tweak it to bring it down a notch.

See, right now, you would save a crazy $5,050 in just 100 days.

That’s a bit much for a small budget.

SO, you could still do this challenge, but take it down to just $0.25 for each number on the envelope.

With this method, you’d save a total of $1,262.50 by the end of 100 days.

Psst: Looking for more longer-term savings challenges? Here's my list of 12-month savings challenges to try.

Mini Savings Challenge #5: The Spare Change Challenge

What it is: Save every spare coin that comes into your hands.

How Much You’ll Save: This one varies and mostly depends on how long you keep it going before cashing it in.

My father used to do this thing that always blew my mind: he took all of his change and put it in a big pile on our dining room table. It would grow, and grow, and grow, and then he would cash it in and spend it on something.

We may live in a much more cashless society at this point, but if you’re still spending cash? Then you’ll definitely want to do this challenge.

My grandmother did this, and she filled a gigantic Coca-Cola savings bottle for several years with all the change she could get her hands on. At cash-in? She had over $800!!! That makes a huge difference to someone living on social security alone.

We did this as well, picking up a beautiful cow piggy bank from Austria (on our honeymoon) and saving all of our “silver” coins until it was full. We got to cash it in for $97, which we then spent on a date night to Medieval Times. What a cool mini-savings challenge that was!

Pro Tips: When you go to cash this in, be wary of the fees you might get. Sure, counting up all those coins by yourself could take way more time than it’s worth, but don’t automatically use a Coinstar machine and get the 11.9% processing fee (you don’t have to pay this if you instead cash it in through the machine for an e-gift card). Ask your bank if they offer a free coin-counting machine. Some do!

Mini Savings Challenge #6: The Spending “Swear Jar” Challenge

What it is: A savings challenge that penalizes you for spending habits you’d rather get rid of.

How Much You’ll Save: Varies.

I got to thinking that one of the biggest reasons people can’t save money is because they’re spending most of it (duh!).

SO, wouldn’t it solve two different purposes to set up a spending swear jar that you have to pay into each time you let a spending habit get the better of you?

You’d increase your savings, AND start working on changing your spending habits (through negative consequences).

Win-win!

Example bad spending habits to penalize:

- Pay $1 each time you stop in extra stores while grocery shopping.

- Pay $1 each time you fail to comparison shop a significant purchase.

- Pay $1 each time you come home from shopping with something extra that wasn’t on your list.

- Pay $1 each time you insert your own personal spending habit you’d like to get rid of.

- Etc.

Mini Savings Challenge #7: The Dime Challenge

What it is: Take a 2-liter bottle, and fill it with any dime that comes your way.

How Much You’ll Save: People estimate that filling up a 2-liter bottle with nothing but dimes will yield you about $500!

This one is super simple and easy to follow through with. I mean, who is going to miss the dimes in their life?

Mini Savings Challenge #8: The (Affordable) 52-Week Savings Challenge

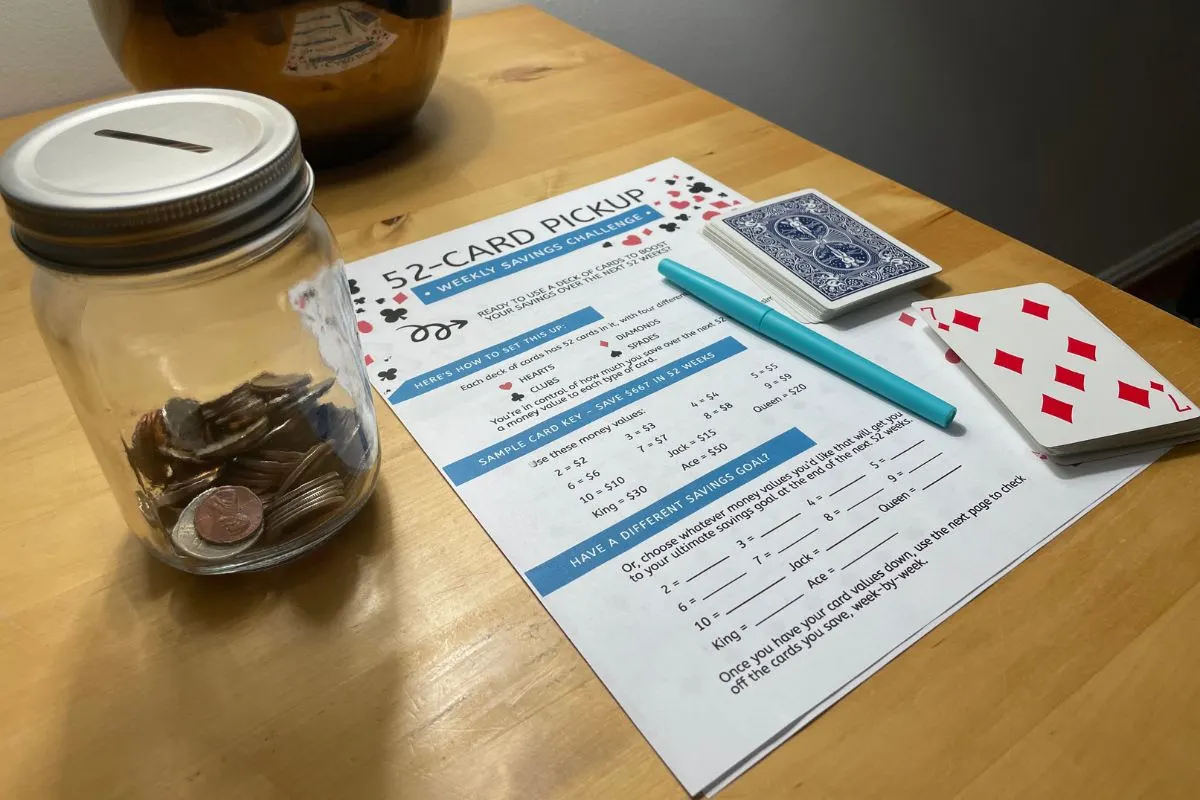

What it is: A twist on the 52-week savings challenge, using a deck of cards.

How Much You’ll Save: It all depends on how you set the challenge up.

I created this really fun, and free savings challenge that you can easily adapt to a smaller budget: the 52-Week Pick-Up Savings Challenge.

You take a deck of cards, write out a value for each one, and then pick one per week to figure out how much you’ll need to save that week.

Mini Savings Challenge #9: The 1% Bi-weekly Money Saving Challenge

What it is: You take each bi-weekly paycheck and save 1% of it.

How Much You’ll Save: Varies, depending on your paycheck amount.

Many people are paid every other week (bi-weekly), so setting up a mini savings challenge around your payday is a great idea.

Skimming just 1% off of your paychecks to put into savings is enough to make a difference to your account, but not enough to cause you to panic.

To find out your 1%, just multiply your take-home pay (after paycheck deductions are taken out) by 0.01.

For example, a person earning $2,032 every other week would put just $20.32 away on payday (0.01 X $2,032).

Psst: this becomes much easier when you stop eating out. Check out the 30 day no eating out challenge.

I’ve given you mini savings challenges you can feel good about – ones that you can participate in (and gain from) on any budget. Start with one, and let me know how it goes in the comments below! You might just surprise yourself with what you can accomplish.

Diana Spatola

Tuesday 4th of October 2022

I truly appreciate your offering a free savings challenge because I save money by not buying them on Etsy. Hey, I just created a savings challenge

Amanda L Grossman

Thursday 13th of October 2022

Awesome, Diana! I'm so glad you found this useful. Happy savings:).

Annette Evans

Thursday 15th of September 2022

I love these ideas. I'll probably implement several of them. I think they're more realistic and doable than a lot of other challenges that are out there, esp for people such as myself who does not make a lot of money. Thanks so much.

Amanda L Grossman

Thursday 15th of September 2022

You are so welcome, Annette! I can't wait to see what you can do with your money with these mini-savings challenges.