Take these examples of daily frugal habits from our personal lives and use them to save hundreds and thousands.

I don’t know about you, but I’m continually looking for ways to be frugal and save money at home.

Not necessarily big ways to save money (though I love those, too), but those daily frugal habits that add up to something powerful when you do them like clockwork, day in and day out.

Especially in these crazy economic times.

I’ve always found it extraordinarily helpful to get an inside view of someone else’s daily frugal habits to see what exactly they’re doing to save more of it.

That’s right – as frugal as I am, I’m always looking for more frugal examples from others. I’ve learned so much that way!

Which is why I’m offering up my own details on the specific things we’re doing to save money at home.

Soooo…grab a homemade iced vanilla latte (tip below on how to make one!), and get inspired to save more money.

Frugal Examples from Our Daily Frugal Habits

Check out these frugal examples and frugal choices that we use daily in our home.

My goal for you is to walk away with at least 5 different, SPECIFIC, things you can implement into your own household this week (heck, you should get started today!).

Pssst: looking for even more extreme frugal tips? Check out my articles on starting The Frugal Year Challenge, how people survived the Great Depression, extreme frugal stories, and why being frugal is good.

1. Pre-Make Coffee Barista Ingredients

I’m going to let you in on a little secret: Starbucks and I used to be a thang.

I don’t want to call it a senseless addiction – because I would work there 3-4 days per week. But it was certainly bothering me that we were shelling out around $120/month for me to do so.

Fortunately (and I really do think this has been fortune-ate), when childcare and in-store sitting areas were shut down, I was forced to find alternatives at home.

My first alternative was to buy this awesome Chike’s Iced Coffee. I LOVE this product. It tastes super-yummy (I’m not a big coffee person – for me to drink coffee, it has to be close to tasting like coffee ice cream, which I adore).

It has protein and low carbs, which is great for my health.

And it’s super, duper, easy to make (I use half the normal amount it says to use, which makes it last twice as long, while still tasting strong enough for this non-coffee-drinker).

But about two months ago? I made another switch to an even cheaper (and healthier) option: homemade vanilla iced latte.

I simply make a cold brew using my husband’s coffee, a mason jar, and one of his coffee filters. It sits in the fridge for about 24 hours, we filter it through the coffee filter into a clean mason jar, and it lasts me for a whole week.

Then, I make a simple vanilla syrup, plus add in 1 tsp. of cinnamon while it boils (love that there are no chemicals in any of this!). Which lasts me about two weeks, in the fridge.

Finally, I use my reusable iced coffee tumbler I got for free at a conference, and put in the following:

- ¼ cup cold-brewed coffee (see – I told you I’m not a typical coffee drinker!)

- 1/2 cup almond milk

- 1 tablespoon vanilla syrup

- Ice

BOOM. I estimate that, after purchasing the ingredients, this one daily frugal habit is saving us a whopping $100/month.

2. Read through the Books We Own

I’ve put a hiatus on buying books over the last year – yes, even buying used books.

My husband laughs at me when I say I have a “2-year waiting list” on reading books that I bring into our house…but mostly he’s right. I mean, he’s seen this in action over the last 10 years.

Since libraries are closed down (where we usually feed our voracious appetites for reading), I’ve been reading through all the books I bought used over the years.

Books like:

- The Birth of Venus

- Team of Rivals: The Political Genius of Abraham Lincoln

- Orange is the New Black

- The Art of Stopping Time

- Work Less, Earn More

- Etc.

Done, done, and done!

My husband also set up our local library’s eBook borrowing app, and he’s been enjoying reading a variety of new things through that.

Psst: want more books, but much cheaper? Here’s how we get books on average for $2.99 each. You’ll also want to check out how to read free full-length eBooks and listen to full-length audiobooks for free. Like horror books? Here's how to score horror audio books free.

3. Started an At-Home Family Date Night

One of the things I’m most proud of that we’ve accomplished during the past three months was establishing a weekly family date night – at home.

You see, we’ve been doing at-home date nights for married couples for years. But family date nights at home?

We never formalized anything.

For our family date nights every Saturday night, my husband comes up with something to cook and a family movie for us to watch, and I come up with an activity for us to do together.

I work on Saturdays in my office, but we all shut down by 4:00 p.m. and start the activities.

Here’s a sampling of how we’ve had tons of cheap fun at home instead of going out:

- Kiddie Pool + S’Mores: We introduced our 4-year-old to s’mores for the first time. Daddy set up a fire in our fire pit, we broke out some s’mores, and the little guy got to wade around in the water in a kiddie pool we already owned.

- Activity Dice + Night at the Museum: I printed out these awesome, free activity dice (give yourself 20 minutes of prep time to print, cut, and tape them together). Let me tell you how the three of us spent the better part of 45 minutes jumping around like frogs, flying like superheroes, and doing all kinds of other really fun moves in our living room. My husband also prerecorded Night at the Museum on TV, and we all gobbled it up with some homemade ice cream.

- Parachute Play + Worms in Dirt Dessert: You can use a large bed sheet to do some fun parachute play in an open space in your home or backyard! We did this in our library – sooooo much fun. Plus, I made a worms’n’dirt dessert that our little guy thought was pretty cool.

Psst: here's 100 family fun night ideas at home.

4. Switched to Purchasing an Ingredient in Bulk

My son has sensitivities to both cow’s milk and soy milk, so he’s been drinking vanilla-flavored, unsweetened, almond milk for a few years now.

It’s always been sold in half gallons, but starting earlier this year, I noticed that two brands we use introduced a full-gallon at significant savings (4.2¢ per ounce, versus 4.7¢ per ounce).

You can bet we buy two of those instead of 4 half-gallons every week now!

Psst: check out how to save money on groceries without coupons, plus how to save money on snacks.

5. Repaired Our Blender

Sooo…this one has an up and a down. But I’ll tell both sides – because I like to be real here.

I was so proud of myself when I figured out I could purchase replacement parts for the blender I bought in my early 20s. Instead of just buying a new one, I was able to buy a new blade and a new black screw-on-thingy (it had cracked).

And it worked well, for a whole year!

Until…my husband shattered the glass part into a gazillion pieces. Just last week.

*sigh*.

Another time I did this was when our vacuum cleaner went kaput. I actually got out the owner’s manual, cleaned it out, and then took it to a repair shop. Turns out it just needed a $7 belt! Can you imagine if we had just bought a new one instead?

Seriously saved ourselves like $80-$100.

6. Signed Up for (Limited-Time) Free Blogger Courses

One of the most awesome displays of genuine kindness I’ve seen over the last few months has been business owners giving away some of their premium courses for free.

What better way to not only save money (by not having to purchase the course – digital business courses can be expensive!) but to also learn how to earn more money than to continue my never-ending learning about online business?

I’ve taken free courses on productivity, influencer marketing, content creation, and so much more.

7. Sold Our Home

Even though this one isn’t technically a “daily frugal habit”, it’s a biggie.

And honestly, I’ll likely write an entire article detailing the challenges and difficulties we had trying to sell our home over the last year.

But for now, let me just say that NOT having to pay both a mortgage + utilities + taxes on top of rent + utilities on a second place is a HUGE money saver.

What a relief to have sold our home after 8 months of carrying it!

8. Crafted Together a Shopping List Pad

We always have a magnetic shopping list pad on our refrigerator. It’s part of our overall grocery/meal planning system (we always write down a missing ingredient or used-up ingredient on the list as the week goes on, then on shopping day, we take it off the fridge and write down ingredients we’ll need while meal planning for the next week or two. Here’s my post on how we grocery shop every other week).

Recently, ours ran out. And you know what? I could’ve easily bought a new one for $1.00 in the dollar section at Target, a Dollar Store, or Michael’s.

But ever since packing up our 3100-square-foot home and moving across the state, I’ve been on a huge kick to make use of what we have.

So, I found a longish pad of perfectly good paper, took the magnetic strip off the used-up shopping list, and used my glue gun to glue it onto the back of the new one.

Voila! Problem solved, resources used up, and we saved a buck (well…$1.08 if you include tax).

9. Started an “Out” Basket

I took everything out of a closet that was a completely underused mess, and one of the things that made it back in is what I like to call an “Out” basket.

In this basket, I collect things that go OUT of the home – like donations, library books (hello, no late fees!), and returns to stores.

In fact, I put all of my receipts into the basket as well so that I could just sift through those, get the item to return, and head out the door.

10. Repurposed Old Things into New Materials

I know you’ve heard of repurposing things before.

BUT, have you thought about looking at old things in a new light – repurposing not just the entire item, but just parts of the item?

For example, my husband gifted me a spa gift certificate several years ago. It came wrapped up in this cardboard thing with a HUGE, glittery flower on it. I’ve always kept the flower, even after moving to El Paso.

And now, I’m so glad I did. Because the other day my 4-year-old son asked me to come up with an alien activity for him to do.

After looking online, I found this cool idea to put together some galaxy Play-Doh. Turns out, we have white Play-Doh, and we have an alien, and we even have some small spaceships + glow in the dark stars.

But what we don’t have? Is any glitter. Not one ounce. EXCEPT, I remembered that I had that glittery flower!

It took me just 5 minutes to scrape off the glitter into a small container and make the galaxy Play-Doh.

This not only saved me money, but it saved me TIME, as I didn’t have to run to the store and gather the supplies, then come home and create it.

11. Negotiated More Cash Flow from the Cable Company

I am usually the one negotiating with cable companies and service providers every six months or so to get our prices back down.

But last month – when we received a $191 cable/internet bill after we were paying $142/month? I handed the task over to my husband.

And MAN was I surprised.

He got on the phone with them and managed to not only get all of our same channels for $118/month, but he also got a boost in our internet power (which happens to be on my list of things I was going to pay MORE for because the internet out here in the desert where we live is just not great for my online business).

Hint: like my husband, you might be tempted to do a chat negotiation first. I mean, chat boxes with customer service are less intimidating, and take less time than a phone call. However, you’ll find – as he did – that you’ll only get maybe a $20 discount through chat. If you call the cable company to negotiate? You could get between $40-$60/month off. Big difference over the course of 6 months to a year!

12. Price Checked on Amazon

Like it or hate it…but Amazon is the major online retailer of our time.

Not only that, but if you want to play on Amazon (which most manufacturers do since tons upon tons of people purchase from them)? Then you have to knock down your price.

A cool online shopping trick I do? Whenever I find something that I want to purchase on someone’s individual site, I immediately double-check if it’s on Amazon.

I do this because 9 times out of 10, if it’s on Amazon, then the price is lower. And not just a bit lower, but a lot lower.

Just look at these examples:

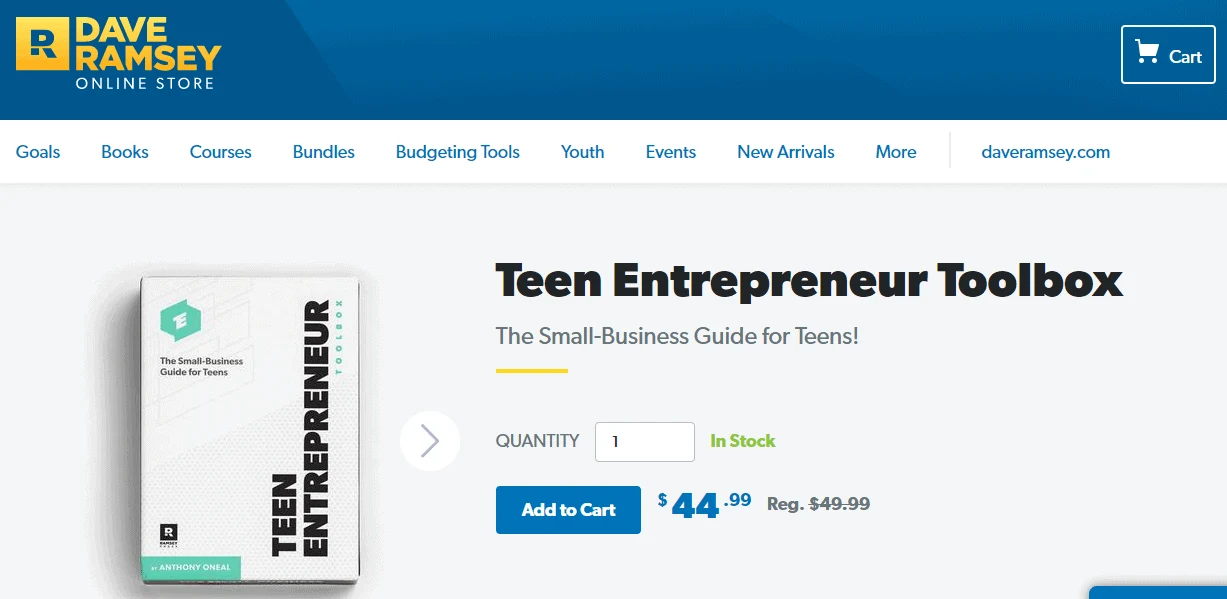

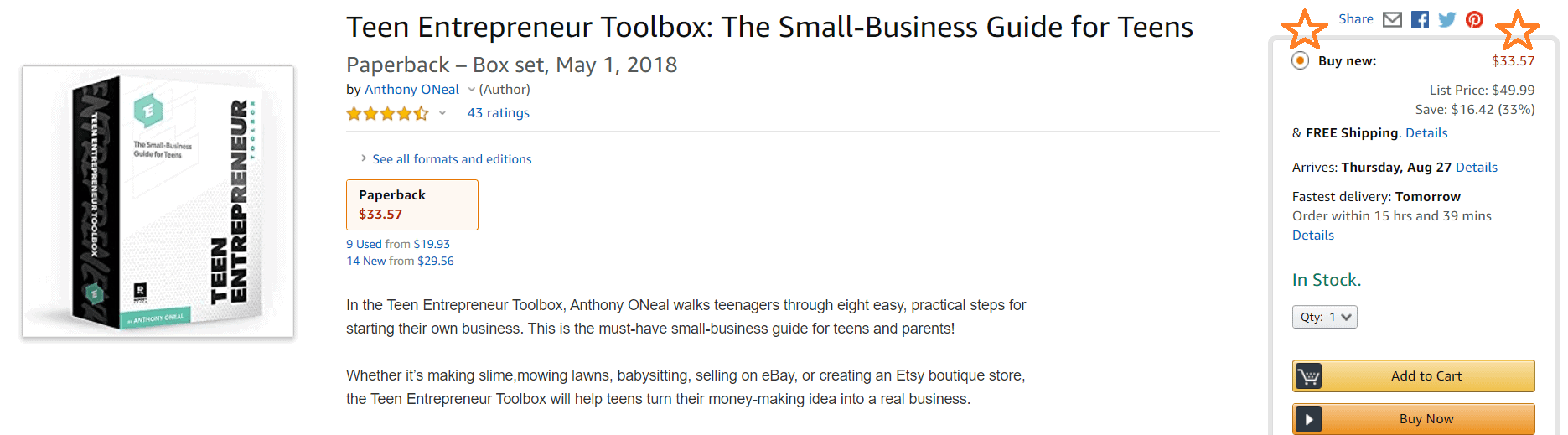

The Teen Entrepreneur Toolbox is a really cool product.

But if you purchase it on Dave Ramsey’s website instead of on Amazon? Well…you take a look and see for yourself how much more expensive it is.

Not only do you pay much less on Amazon, but you still get free shipping (you would get free shipping on Ramsey’s site, too).

13. Marie Kondo’d Our Supplies

We moved last summer from our home in Houston. We hadn’t moved in 10 years, so this was a biggie!

One of the things that worked in our favor? Was having an immediate reason to ruthlessly go through our belongings. Not only did we sell and/or give away 30% of our belongings, but we also had the chance to organize everything.

Actually, it’s what Marie Kondo recommends – to gather every single thing from one category into the same location, and then go through it – and I can honestly tell you that it’ll save you money.

For example, I use Post-It Notes in my business. A good bit. And I had no idea how many places we had them stashed around our old home.

When we moved, we stuck all the Post-It Notes together in the same location. And guess what? Looks like I don’t need to buy Post-It Notes (which I would’ve done) for about another year.

Same thing with pens, candles (I literally was able to burn a votive candle every night for the last year…and we still have more to “burn through”), dry-erase markers, journals, notepads (like the one turned into a grocery shopping list from above, after gluing a magnetic strip onto it – saving that moolah!), and binders.

Umm…we even found we have two copies of Marie Kondo’s Life-Changing Magic of Tidying Up. How embarrassing.

14. Got Rid of Two Business Subscriptions

I have this subscription that costs $239/year for software that I, embarrassingly, haven’t used in the last 9 months.

To be honest, I use a few free parts of the software, and I wasn’t sure if my access would be revoked on those particular things if I canceled.

SO, I finally took the time and courage and canceled it just this month.

Turns out, the stuff I was using? Is still there (part of its “free” version). What a weight off my shoulders! I only wish I had nixed it sooner.

The second subscription? I was paying $12/month for something that, again, turns out I was only using the free parts of.

That’s like $32/month in savings shaved from my business costs!

15. Divide the Cat Can of “Treats” into Thirds

We have one kitty cat (Danny Boy), who, each day around 4:00 p.m., squeaks and meows his little heart out to get his paws on some “treats”.

A “treat” to him is some of the canned, wet cat food.

But instead of handing him over an entire can? We use just 1/3 of it and put it into his dish. That way, each can of wet cat food lasts us for three days.

(You can just buy one of these nifty can lids so that there’s no mess or smell from keeping an unused portion of cat food in your fridge. It’ll pay for itself in, like, two weeks if you go from using one can a day to one every three days!).

16. Eating through Our Freezer

One of the things we realized when we knew we were about to move was the sheer amount of forgotten food in our freezer.

Because of that experience, we’re more committed now to actually eating leftovers and frozen food we’ve stashed away.

For example, we noticed we have less and less room in our freezer in the last month.

SO, instead of continuing to buy more food for it, we simply put a moratorium on buying meats and such until we eat through what we have. Hello, grocery savings!

In the last week, we’ve eaten:

- Chili baked potatoes from a batch of chili we froze a while ago

- Breakfast sausage we had left over from several months ago that we had forgotten about (paired with some homemade waffles)

- Chicken enchiladas using frozen hatch chilis found in the recesses of our top freezer shelf

It’s actually pretty fun to see what’s in there (haha! We feel blessed, that’s for sure). Not only that, but our grocery bill over the last two weeks has gone down by about $100 because of the moratorium.

17. Rearranged My Office Instead of Buying New Lighting

I’m going to be getting back into video soon with my other brand on teaching kids about money, Money Prodigy. But there’s just one problem: my new office has terrible lighting.

And the way it was arranged wasn’t helping the matter.

Instead of having to buy a bunch of different lighting components (I own a few already from a few years ago, but I’d have to buy more), I spent 1.5 hours last week rearranging my office so that natural light from the one window lights up my face.

It’s better for video lighting quality, anyway, and certainly saved me on both lighting costs AND electricity.

Hint: if I did need to purchase new furniture? I'd know where to buy good quality furniture cheap.

Welllll…did you see at least 5 frugal habits you want to pick up as your own? Which ones? Please share your own daily frugal habits and frugal examples in the comments below. We can all learn from each other. Also, be sure to check out more with these 67 frugal living tips with a big impact.

LeslieH

Tuesday 23rd of August 2022

I use a pressure canner and can up meals in a jar. When I'm under the weather or tired or my husband needs a lunch I have something for half the price of store bought. It also works great to save left overs or save items that have been in the freezer too long. Just finished a canner load of Chicken salsa verde soup. Dumped cable, we watch amazon prime or freevee. We stopped almost all eating outside of the house, better food and we save huge. We don't to other people for our own self care maintenance. I'm teaching my son how to cut his own hair, like I taught myself at thirteen. My husband does his own now too. It's much easier than people realize and we save easily over three hundred a year, because I also color my own hair. A major one is doing all of our errands in one or two trips a month instead of couple times a week. It saves gas, time, over spending on spontaneous purchases. Once a year we do a no purchase month and eat from our pantry and that saves close to $500.

Amanda L Grossman

Wednesday 24th of August 2022

Whoop, whoop, Leslie! You guys are killin' it. Great job finding daily frugal habits.

Trish Suvino-D'Anna

Thursday 3rd of February 2022

You can email a company or find out their phone #. Pay compliments and then ask for coupons. ShopRite will double the coupons up to .99. I know people who will call and complain to get coupons. I find that a compliment goes a longer way with a manufacturer. When you start couponing( not for 100 free toothbrushes) you will see how much you are saving. Keep a notebook to keep track of when and who you have asked. Again, I appreciate the chance to pass on some tips. I enjoy reading them as well!

Trish Suvino-D'Anna

Thursday 3rd of February 2022

I have found small ways to save money. I have long pretty thick hair. I noticed that I can take a bottle of conditioner and put 1/2 in one and fill it with water. I have 2 bottles now. I also use my used conditioner as a shaving cream for my legs. I will see these cute gifts for the grandchildren. I put them away until there is an occasion. I bake cupcakes and I can freeze the extras. I call food companies and ask for coupons. I always shop sales and use coupons. Thank You for listening.

Amanda L Grossman

Saturday 5th of February 2022

Hi Trish -- these are great daily frugal habits! I had to chuckle at the conditioner-as-shaving-cream. I once had like three bottles of conditioner I had gotten almost for free (from playing the Drugstore Game). Since I don't condition my hair that often...I did exactly what you do, used it as shaving cream. It lasted forever!

Trish Suvino-D'Anna

Friday 20th of August 2021

I wish that I could apply this to my savings. Unfortunately, I do not own a home. But, I am fortunate to have a rent controlled apartment! I'm sure their are several ways that I can save some money! I am glad to be reading things like this!

capricia

Saturday 19th of September 2020

A suggestion for the broken blender. Leave the base in your car and whenever you hit a thrift store or yard sale, keep an eye out for the glass part. They tend to turn up regularly. As well, at least once a year, sometimes twice we designate a month where we plan all the meals based on food we have in the freezer and pantry. That way we clean out all the old food and save money that month. We often do it on a month where food is expensive, like January and February as well as our wanting to save money due to Christmas bills

Amanda L Grossman

Monday 28th of September 2020

I love your tip, Capricia! I haven't purchased a new blender because it only needs the glass part...and it seems like a waste to buy a whole new one for that. Also, great idea to plan a whole month on freezer and pantry meals. Have you heard of Shelftember?