How to fill out a budget sheet and do Paycheck Blocking – plus a simple, visual tutorial with a sample budget sheet to follow along.

For most people, budgets are a drag. They represent limits, and “adulting”.

The word itself conjures up images of spreadsheets and the Grinch.

But let me ask you this:

- Have you ever felt like you had no clue where your money went?

- Or gotten into a fight over money with your partner (I have)?

- Do you get a nervous feeling in the pit of your stomach (or a noticeable pounding in your head) on certain days of the month because big bills are due and you’re basically hoping things will work out?

If you answer yes to any of these, then you need a budget. ASAP.

In fact, you should be excited to start budgeting…because it will eventually rid your life of all of these problems (plus more).

So, let me show you how to fill out a budget sheet (plus show you my new concept called Paycheck Blocking) so that you can stop dreading it, and instead let it get you back in the driver’s seat of your finances.

Because isn’t control what we all crave when it comes to our money?

How to Fill Out a Budget Sheet

Filling out a budget sheet is not something we’re born knowing how to do.

In fact, budgeting and how to do a budget sheet takes practice. So, when things don’t go quite as planned the first few times, you might be ready to give up.

Please don’t – just go back to the basics, instead.

And here are the basics of how to fill out a budget sheet.

Pssst: you’ll definitely want to check out my 14 stupid simple budgeting tips for beginners when you’re done with the basics.

1. Pick Your Budget Sheet & Budget Duration

You want to pick a budget sheet that fits your personality (because you’ll be more likely to want to use it – here’s my article on 11 cute printable monthly budget sheets, free printable budget binders, free budget by paycheck worksheets, and 7 free vacation budget worksheet printables).

You also want to pick one that has the right budget duration for you.

- Do you want to budget weekly?

- Bi-weekly to align with your paycheck?

- Or monthly?

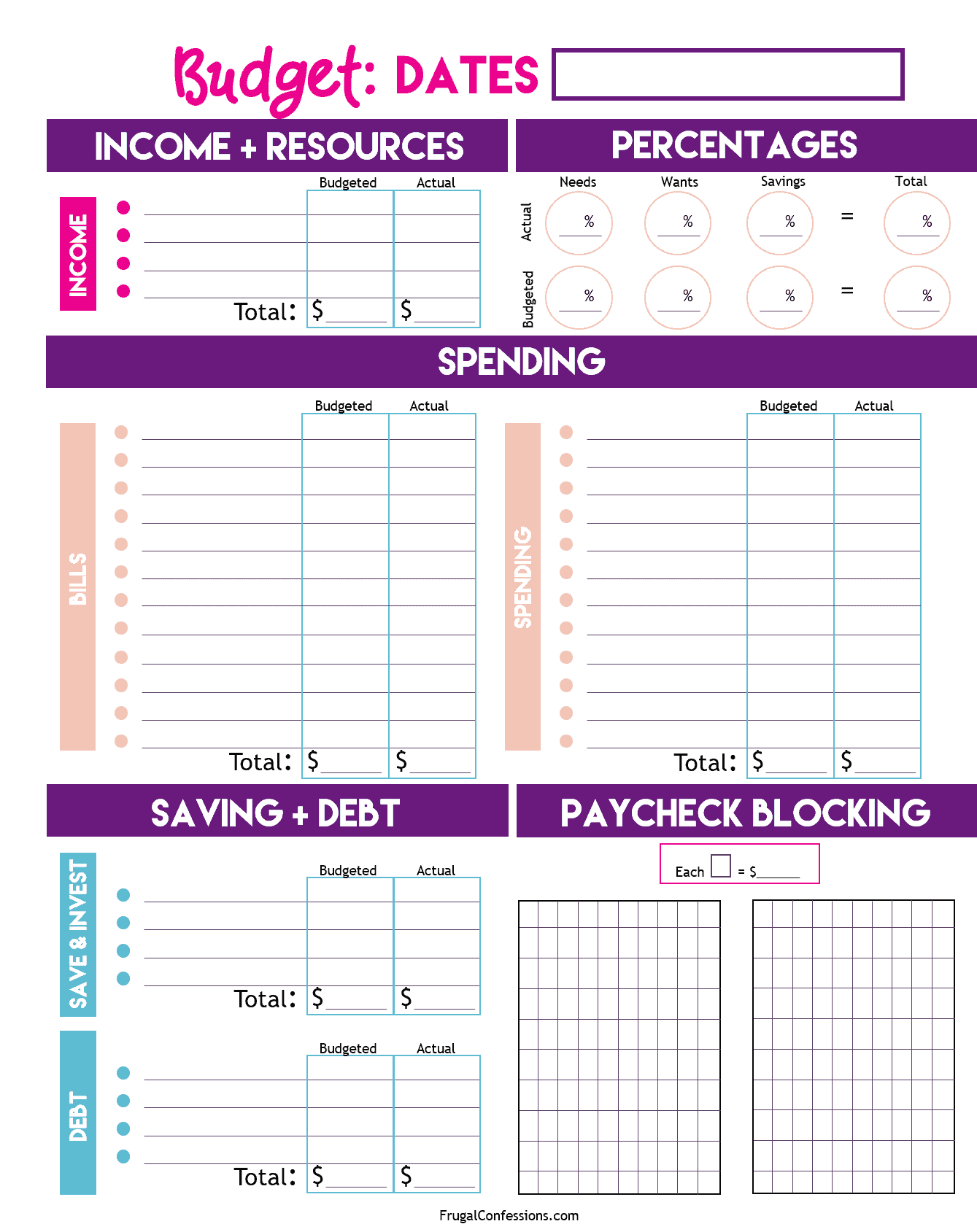

I’ll be using this one to show you how to fill out a budget sheet (sample of budget sheet):

Bonus points: using this free budget template, you can pick any budget duration you want – weekly, every other week, or monthly!

2. Gather Your Income & Resources Information

You’ll need to figure out how much you will earn for the budget period or duration you’ve chosen.

Note: I base all of my calculations and budgeting on take-home pay, meaning what's left in the paycheck that gets deposited into a checking/savings account.

And not only that, but what resources do you have to use in this next budget period.

For example, you could use any of these as part of your budget income and resources:

- Leftover money in your checking account

- Gift cards

- iBotta app earnings

- Cashed-in Swagbucks points

- Cashed-in change jar

- Rebate check you received in the mail

- Etc.

Meaning, if you chose a weekly budget sheet, how much will you earn in a week?

We’ll assume, for the sake of this article, that you’re budgeting monthly (the steps are the same no matter what you choose, FYI).

So, we’ll need to know how much will you earn over the next month.

If you’re paid by salary, then simply count up the number of paychecks you receive this month, and multiply that by your take-home pay for each.

For example, Jill and Ryan's household earns $85,228/year (both work). After taxes, retirement contributions, and health insurance premiums, their four take-home paychecks deposited into their checking account are each worth $1,639 (let's keep things simple and assume they both earn the same amount).

They each get paid every other week (bi-weekly), and this month they’ll each take home $3,278 ($1,639 X 2 paychecks).

Total monthly income for the household? Is $6,556 ($3,278 X 2).

Not only that, but they've got a free $25 gas gift card to use from their credit card reward points.

Here's how they fill out the income & resources section on their budget worksheet:

That’s their total monthly income and resources to work with.

However, the electrician, Ted, works by the hour ($45/hour). He doesn’t always know exactly how much he’ll bring home in a month. What he’ll want to do is to add up his income earned from the last three months, and divide by 3 to get an average of what his take-home pay each month is.

For example, here’s his last three months’ pay stubs:

- February: $5,556

- March: $4,164

- April: $5,810

That’s an average of $5,176 take-home pay each month.

It’s not an exact amount, and we’ll take this into consideration for what to do as we continue with the steps to fill in a budget sheet whether you work hourly or salary.

When you’re filling out the income portion of a budget sheet, don’t forget about other sources of income, too.

Things like:

- Overtime pay

- Expected bonuses

- Selling items on Facebook

- Work reimbursements

- Other ways to make cash from home

Some of these you can account for upfront, while others you’ll only know the true amount during the month. That’s okay! Do your best to estimate as close to exact as possible.

Fill in each of your income and money sources in the “budgeted” column, add them up for a total income amount, and then move on.

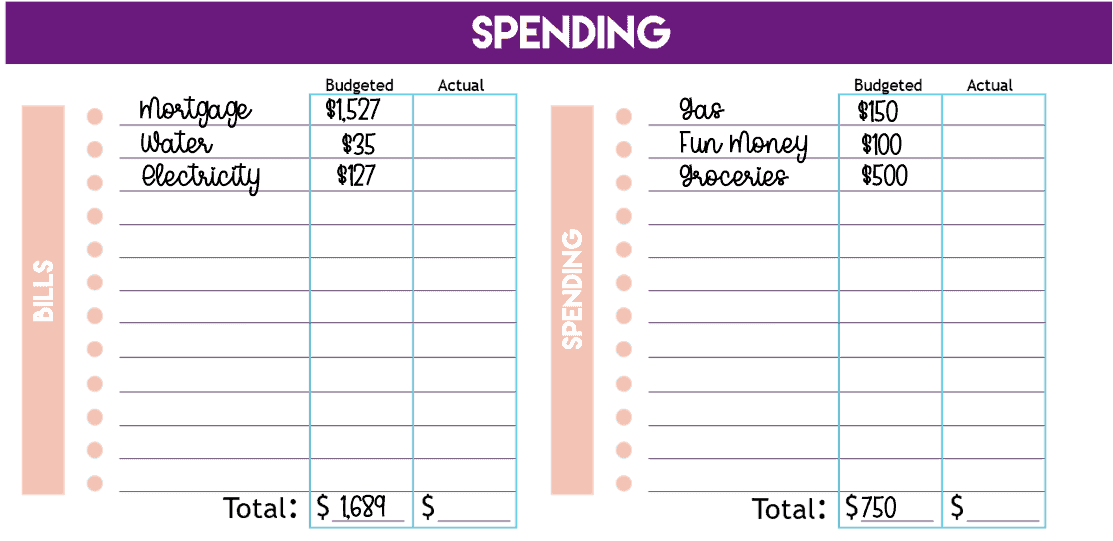

3. Gather Your Expense Categories – Spending & Bills

You need to know each of your bill and spending categories to be able to fill in this section of a budget sheet.

Hint: if you use a monthly bill pay checklist PDF, then this section will be a cinch. It's just one of the family budgeting tools I recommend.

A bill is mostly out of your control once it comes through the mail (you can definitely negotiate certain bills down, though). Bills include things like:

- Mortgage/rent

- Utilities

- Smartphone data plan

- School tuition

- etc.

And a spending category is something more variable – you spend it as you go through the month. These can include things like:

- Gas for your car

- Fun money to spend as you please

- Groceries (here are average household grocery bills for families of various sizes)

- Eating out

- etc.

The best way to start this section is by simply signing into your checking account and credit cards, and making note of each monthly bill you paid last month.

Hint: you can print out last month’s statements, and use this highlighter budgeting method to make the process a bit more fun and color-coded.

While you’re doing this, make a note of the date the fixed bill came out of your checking account, or was charged to your credit card. This will come in handy if you choose to use a bill payment tracker (one of the steps, below!).

This is also where a personal expense tracker works really nicely. What we use is the free tool, Empower. Not only does it keep track of our total net worth (including our home’s value – when we owned one), but it also tracks all of our spending into easy-to-find categories.

Fill your categories in the “budgeted” column, add them all up to get your total expense amount, and then move on.

Pssst: expenses too high? Check out my article on how to cut expenses on the family budget.

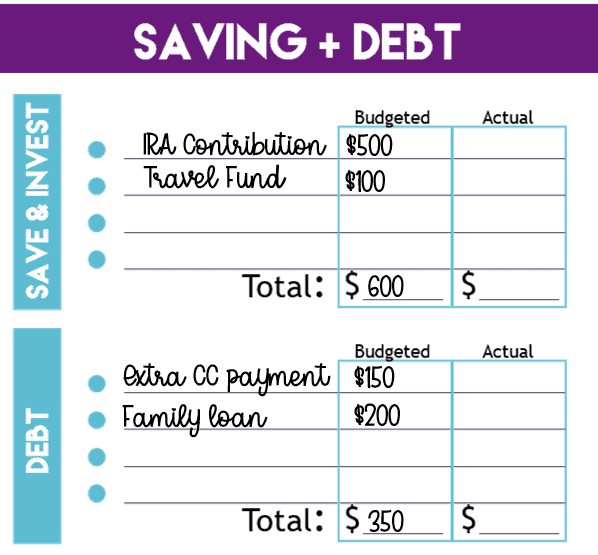

4. Fill In Your Savings, Investing, and Debt Amounts

The next section is dedicated to money you send to savings, extra debt payments, and planned investments.

Note, this is not the area for “regular” debt bills – things like your credit card minimum payment go under bills above, but rather the area for extra money sent towards debt payoff.

Also, if you're budgeting using your take-home pay, you wouldn't include investments that were subtracted out from your paycheck before it gets deposited into your checking account (such as a 401k contribution).

Below, you'll see I've partially filled this section out with an extra debt payment I'm sending towards a family loan, an investment in our Roth IRA, and money saved towards our travel savings account.

Fill your savings, investments, and extra debt payments into the “budgeted” column, and move on.

5. Subtract to Make Sure You’re in the Positive

Now's the time to do a quick gut check to make sure you haven't budgeted overspending into your life!

Add up your spending totals, your savings and investments, and debt totals, and subtract that from your income & resources area.

Are you still in a positive number?

Great, move on.

If you're not? Then head to Step #6 to rework things a bit.

Hint: is your credit card picking up the tab and overspending too often? Here's how to transition from credit card to cash.

6. Rework, if Necessary

Did you find that after paying all your bills, budgeting for spending money, and making extra debt payments you're actually in the negative territory for the month?

No problem – now's the time to rework things.

To rework a budget, you need to pull some levers.

Money levers include:

- Spend less money

- Negotiate your fixed bills down

- Earn more income

- Aggressively pay down debt to make your monthly cash flow work in the months to come

Let's start with the simplest way to do this, that's more in your control than the other options: see if you can take money out of your variable spending categories to get to at least $0 (if you're doing zero-based budgeting), or a positive number for a little buffer.

That means spending less money on things like entertainment, putting less in your “fun money” category (if you have one), spending less on groceries this month, etc.

Use these resources to help:

- 74 things to do with friends without spending money

- 19 free printable board games for adults

- 19 cheap mother-daughter activity ideas

Not enough money in that category to make things work?

There's lots of resources to help with this situation (of not earning enough money to meet your bills, obligations, and wants, OR of spending too much):

- 17 Stop Living Paycheck to Paycheck Tips

- 250 Money Saving Tips

- 17 Powerful Daily Frugal Habits

- Ways to Make Extra Cash from Home

7. Keep an Eye on Your Percentages

Have you ever heard of budget percentages or budget rules?

It's the idea that you should know what percentage of your money is going to three or four main categories so that you know how “healthy” your overall financial life is.

The main budget categories to keep an eye on are:

- Needs (rent/mortgage, transportation, groceries, etc.)

- Wants (fun or “blow” money, entertainment, going out to eat, etc.)

- Savings (investments, emergency fund contributions, travel savings, etc.)

While there are several budget percentages out there, experts mostly agree that if you stick to a 50/30/20 budget rule (50% to needs, 30% to wants, and 20% to savings), then you'll be on track for a healthy financial life.

Pssst: Check out these 23 types of personal budgeting methods.

These can help make you aware of problems with your money, and can also help you to tweak and make adjustments for a happier life. Which is why I've included not only your budgeted money percentages area but also your actual money percentages area on this free budget sheet.

To fill this section out, you'll want to categorize your needs, wants, and savings. Make a list of what are “needs” to you, what are “wants” to you, and what are “savings”.

Add up all the budgeted totals for the needs category, then divide that number by the amount you're paid in the budget period/duration you've chosen. This will give you a percentage of money spent (budgeted) in the needs category. Then, do this for the “wants” and “savings” category.

Your total should be 100% at the end (but doesn't have to be, if you're leaving a buffer, for instance).

A little much?

No worries. Let me walk you through this a bit more.

For example, with Jill and Ryan's example above, their total household income for one month – their budget period/duration – is $6,556. Let's say their total monthly needs, which include housing, utilities, gas for their car, groceries, etc. is $3,933.

You would calculate their “needs” budget percentage by dividing $3,933/$6,556. This gives them a monthly needs budget percentage of 60%.

Go ahead and write down which of your categories count as needs, which count as wants, and which count as savings. Add them each up, and divide by the total income for the budget period you chose.

Then, add in your budgeted percentages. Move on!

7. Track Your Spending

Alright – you've created what you BUDGET for your money this budget period. Way to GO!

Now, your budget and your spending are out in the wild.

Meaning, that you're going to go about your life and see what actually happens, versus what you thought or budgeted to happen.

As you go along during your next budget period – weekly, bi-weekly, monthly – you'll want to track what you actually spend in each category, and overall.

Hint: here's more resources for how to keep track of money on paper.

This will help you to see how far off you are, or how on track you are with your spending. It also helps to not over-withdraw on your back account, or outspend your paychecks.

You can choose one of these daily spending log trackers and set up the same categories that you have set on your budget sheet.

Or, just keep receipts and at the end of your budget period, add up the totals for each category and fill those into the “Actual” columns for the budget sheet.

One thing I've baked right into this budget sheet is a concept I like to call “Paycheck Blocking”.

I don't know about you, but visuals for me are very helpful. Just to see how much, in one quick glimpse, that I've spent out of a paycheck or from our monthly cash flow helps me to understand how much we've got left and how well we're doing.

Paycheck Blocking is a way to track how much of your paycheck (or income for a period of time) has been spent already, and how much you've got left.

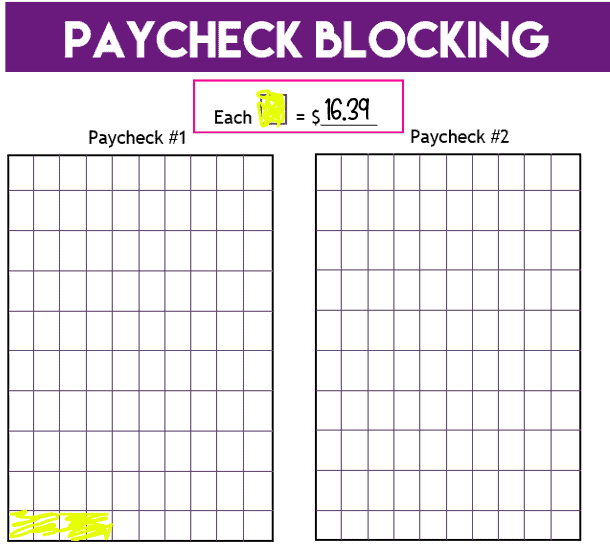

There are 100 blocks total in each of the two big paycheck blocks.

You can use the Paycheck Blocking area of the budget sheet in a few different ways:

#1. Track Paycheck #1 and Paycheck #2

For each paycheck, divide the total take-home pay by 100 to get the value for each square. For example, if your take-home paycheck is $1,639, you would divide that by 100 and find that each square or block is worth $16.39. Fill in enough squares to track the amount of the paycheck you've used along the way.

In the example below, Jill and Ryan color in 4 blocks, worth $16.39 each, after spending around $65.56 at the grocery store.

#2. Budgeted Vs. Actual

You can use these two blocks to look at budgeted vs. actual, with color coding.

- Color code each of your categories of spending (food would get its own color, gas would get its own color, etc.).

- Fill in the Paycheck Block on the left with how your income for the budget period you chose is budgeted to be spent for each category.

- Fill in the one on the right with how you've actually spent and used all your money, at the end of your budget period.

#3: By Week, or Bi-weekly

You could print out two of these sheets, and then use one block for each week of the month.

You could also just keep one sheet for the month, and each Paycheck Block area is for income/paychecks for two weeks of the month.

Play around with this, and let me know how you use it!

8. Reflect on How You Did – Fill in Actuals

Here's one of the most educational parts of this entire process – filling in what actually happened during your budget period.

This will be eye-opening!

You'll go back through and fill in the “Actual” column for each of the categories. This includes your income earned (maybe you earned more than you thought! Or less…), for bills paid, for spending, savings, and for extra debt payments.

How did you do? Did you overspend in some areas? Did you spend less than you thought in other areas?

Even better, make sure to fill in your “Actual” percentages with how things went down for the week, two weeks, or month.

Reflect on this. It'll help you make better budgets and better money decisions moving forward.

9. Repeat the Process

You've now reached the end of the process.

Time to start a new budget, for your next budget period!

Depending on how you did with this one, you could just copy/paste some of the same info moving forward (especially if you have a consistent income and your bills, which tend to stay around the same).

Lots of information – I get that. BUT, I hope I've given you a really good, free resource to help with how to fill out a budget sheet in the months and weeks to come. Just use it a few times, and you'll get really good at things. Not only that, but your money decisions are going to get even better moving forward (especially if you can avoid these 12 common budgeting mistakes)!