Use one of these free monthly bill pay checklist PDFs to keep track of your bill due dates, which ones you’ve paid, and the amount.

Keeping track of bills every single month can feel like one big chaotic mess.

I mean, you’ve likely got some bills that are paid automatically, some that come in the mail, some that are paperless (but that you manually hit “pay” on, online), some with varying monthly amounts, etc.

And they all seem to be due on different dates, right?

A monthly bill pay checklist PDF can change everything for you. Taking a nasty mess and making it predictable, calm, and (dare I say) gratifying.

Just print out one of these bill pay checklists below, keep it front-and-center (like in your budget binder, or bill paying station area), and you’ll be tracking your bills in just minutes a week.

Sound good?

Let me show you how.

Monthly Bill Pay Checklist PDFs

Bills come in two varieties:

- Shelf-Stable Bills: These types of bills are the same amount each month, no matter what. These can include mortgage or rent payments, car payments, monthly condo fees, etc.

- Variable Bills: These types of bills change from month-to-month, or from season-to-season. For example, your December electric bill is going to look very different from your July electric bill. Other ones include natural gas bill, cable/internet bill (where you have a 6-month contract and the rate changes after that – usually in the upward direction, amiright?),

There are a bunch of different features with free printable bill pay checklists, and you’ll want to pay attention to ones that work for your bills.

Such as:

- Filling in how much you pay for each bill, per month over a whole year (good for varying bill payments, like electricity)

- Writing in bill due dates in a visual, calendar format

- Dividing up your bills by your paycheck and their due dates

- Etc.

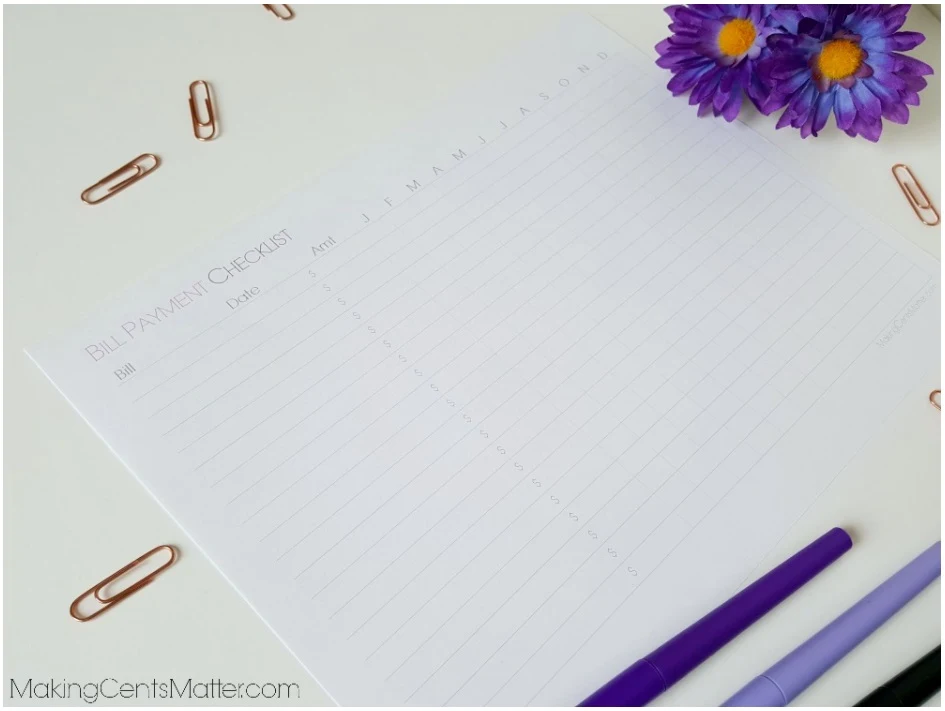

I’m going to give you options for each of these, starting with my number one pick: an annual bill pay checklist, on one sheet, that also lets you record the monthly amounts.

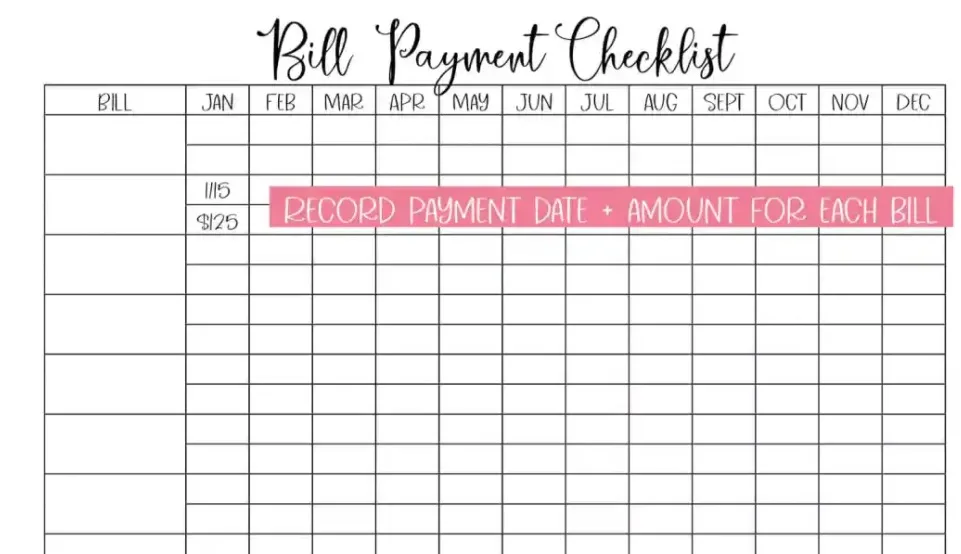

1. Annual Bill Pay with Monthly Amounts

I think this very simple, but very powerful bill pay checklist is the best of all worlds.

You’ll be able to:

- Write in your payment date (if I were you, I would split that first box into two and put the deadline, and then when it was paid)

- Track a whole year for each of your bills, in one sheet

- Track what each month costs for each of your bills (great for bills that vary month-to-month)

The only bummer? There’s space for 9 bills. SO, if you have more than 9 monthly bills, you’ll need to print out two sheets.

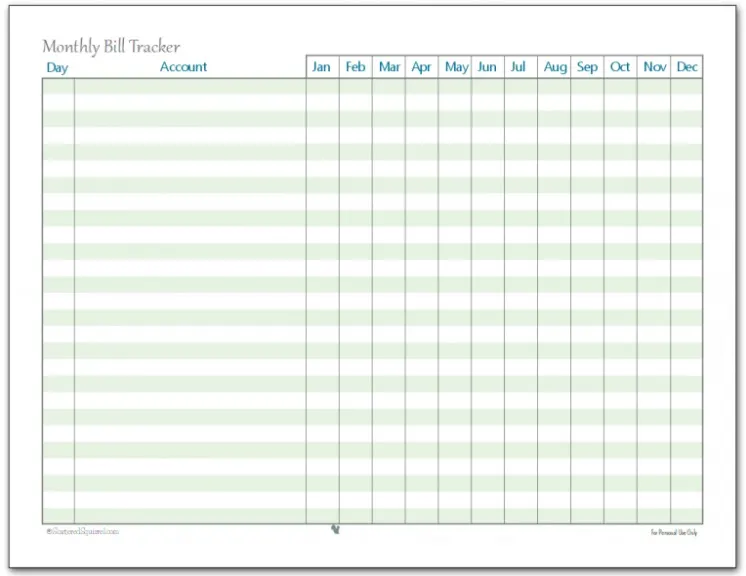

2. Annual Bill Pay with Monthly Amounts #2

This one-page sheet also allows you to track the amount you paid each month, as you pay it.

You fill in the deadline day of the month in the “Day” column, then when you pay the bill, you fill in the amount you paid (that’s the “check”).

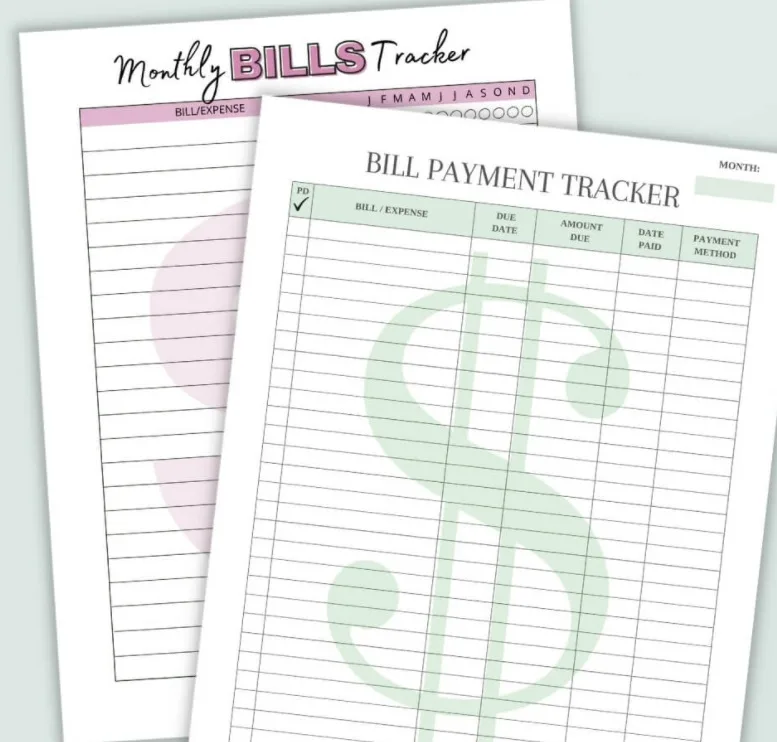

3. Bi-Weekly Paycheck Bill Payment Tracker

Would you like to track your bills by the paycheck in which you’ll pay them, and you get paid bi-weekly?

Great. You might want to use this free paycheck bill payment tracker.

You’ll fill in each bill you’ll pay/is due from your first paycheck, and each bill you’ll pay/is due after your second paycheck.

4. One-Year (One Sheet) Bill Tracker

Would you like to track all of your bills in just one sheet?

While this bill pay checklist doesn’t allow you to enter varying amounts, it does allow you to track all 12 months on one sheet of paper.

Simply:

- fill out your bills one time

- fill in the estimate due date (I say estimate because this date could change by a day or two, depending on how many days long the month is)

- check off each month as you pay it

5. Simple Bill Pay Tracker

Here’s a simple bill pay tracker.

Just print out one for each month of this year, and input each of your bills as a line item plus its due date.

As the bill comes in or is automatically paid, enter the amount paid, the payment method (by check, by credit card, automatic withdrawal, etc.) and check it off.

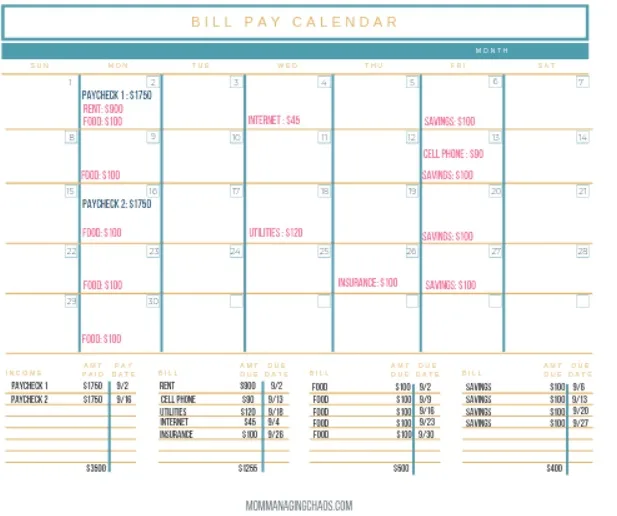

6. Bill Pay Calendars

Check out this monthly bill free printable bill payment calendar. You can print out 12 of these, put them in a binder, and use one for each month of the year.

This is great if you’re looking for something more visual – sometimes it’s nice to see things written on a calendar.

Hint: I personally would use another checklist together with this bill-pay calendar, so that you can check it off cleanly, but then see, visually, when each bill is due.

7. Classy Bill Pay Checklist

Here’s one last simple Bill Pay PDF, where you fill in the bill amount, and then check off each month that you pay it (until you finish out the year).

Next up, let me walk you through how to use these monthly bill pay checklist PDFs.

How to Use a Monthly Bill Pay Checklist

I want to see the stress melt off your shoulders, so let me give you a quick tutorial on how to put your new bill-tracking-system into practice.

Step #1: Download and Print Out Your Bill Pay Checklist

Choose the free printable bill pay checklist you’re going to use, and print out enough to last one whole year (12 months).

Then, decide where you’re going to house it. Is it in your budget binder (yes, this can be the first page in yours if you’re just starting to track money on paper). Is it on a bulletin board above your bill pay station? Hanging on the fridge? Just choose.

Step #2: Gather All Your Bills

Go into your checking account, and scroll down for the last two or three months. Each time you see a new bill, write it in a name you’ll recognize on a blank sheet of paper (I’ll show you why in a minute).

Step #3: Gather Your Due Dates

Even though a bill’s due date will change by a day or two each month, it’s in your favor to know an approximate date of when you can expect the bill.

You can either proactively gather due dates right now, by logging into each service provider or looking up past bills and making a note of their last due date throughout the month. OR, you can wait until the actual set of bills from this month comes in and record each one as you go.

Hint: for bills that only get paid every few months or every six months, or once a year, simply color in/black out the months when the bill is not due. Then, pay it each of the other months.

Step #4: Write them on the Bill Pay Checklist in Chronological Order

Now’s where we start getting your system down.

Order those bills from the earliest due date to the latest.

This will help you to know when a bill got lost in the mail, and how much money you’ll need to set aside soon to get a bill paid.

Step #5: Mark them Off as You Go

Wait until you next whole month, and start using the system.

As a bill comes in, or once a week (you choose), open the bill, write in the amount due and the due date, and then write in the date you paid the bill as you pay them.

The checklist you chose will prompt you with what info to fill out.

Step #6: Repeat + Reflect

Each month, you’re going to go through the same process. Not only will this ensure that you get your bills paid on time, but it will help you to know when a bill has been lost (because your chronological list prompts you to look out for it) and to see patterns in costs as the year goes on.

Next year, you’ll know that, for example, you need to save up an extra $600 to pay for winter heating costs, and that you can do this because your spring electricity bills are very low (a great time to sock away that extra $600).

Perhaps you’ll also sign up some bills for autopay, to make things more convenient. I hope I’ve shown you that using a monthly bill pay checklist is your ticket to not only keeping up with bill pay, but also in keeping better track of your service use. Looking over a full years’ worth of bill-pay data can really help you gain perspective you’re probably not getting when you wing it and pay each bill a la carte. And that, my friend, is priceless information! Use it to do things like negotiate for lower rates, use less of the product/service, and save up money for when you know your bills are going to be heavier than “normal”.

Amanda L Grossman

Latest posts by Amanda L Grossman (see all)

- 5 Simple Dessert Salads for Thanksgiving (a Lighter Ending to a Big Meal) - June 25, 2024

- 9 Easy DIY Dollar Tree Gift Boxes (Super Affordable) - May 22, 2024

- How Can I Get a Discount at Starbucks? (11 Starbucks Discounts) - April 18, 2024