How to achieve savings goals? These tools and resources will have you achieving your goals in less time than you thought.

There’s no secret to saving money.

You earn money, you spend less than what you earn, then you deposit the savings.

Yet so many people fumble along the way when figuring out how to achieve savings goals.

Perhaps your cost of living is too high, you don’t make enough income for the lifestyle you lead, large expenses creep up for which you are not prepared or are underinsured, you have crippling student loan debt, etc.

Suddenly, that savings goal you were STOKED about now feels like an anchor around your neck.

How to actually achieve savings goals when life just seems to spring up out of nowhere with a host of other problems to throw your money at?

How to Achieve Savings Goals – Tips & Tricks

What steps can you take to reach your monthly savings goal?

I’m glad you asked. Follow these savings goals tips and tricks, and your goal will be in the bag.

1. Get Ridiculously Clear on What You Want

Most savings goals are too vague.

Like, you know you want to pay cash for your next vacation, take on no debt this holiday season, or pay for your child’s tuition at that private school or other cool things to save up for.

But you don’t take the time to write it in a specific and measurable way.

Make it easier on yourself – to both figure out if you’re on track to reach your goal, plus what you’re targeting – by getting laser-clear on the type of financial goal you’re going after, and then writing it using one of these free S.M.A.R.T. financial goal worksheets.

Then, move on to the next step.

Psst: Here are 27 financial new year's resolutions, and 6 inspiring saving goals examples from real life. Got more than one goal? How to save up for multiple goals at once.

2. Set Up Your Tracking from the Beginning

Once you get laser-clear on the specific amount of money you’ll need, and your deadline, you can set up a savings tracker.

This will help you measure whether or not you’re on track to meet your goal.

But I don’t want you to track your savings goal the “normal” way. Instead, I want you to clearly see how on target or off target you are each week or month to hit your deadline.

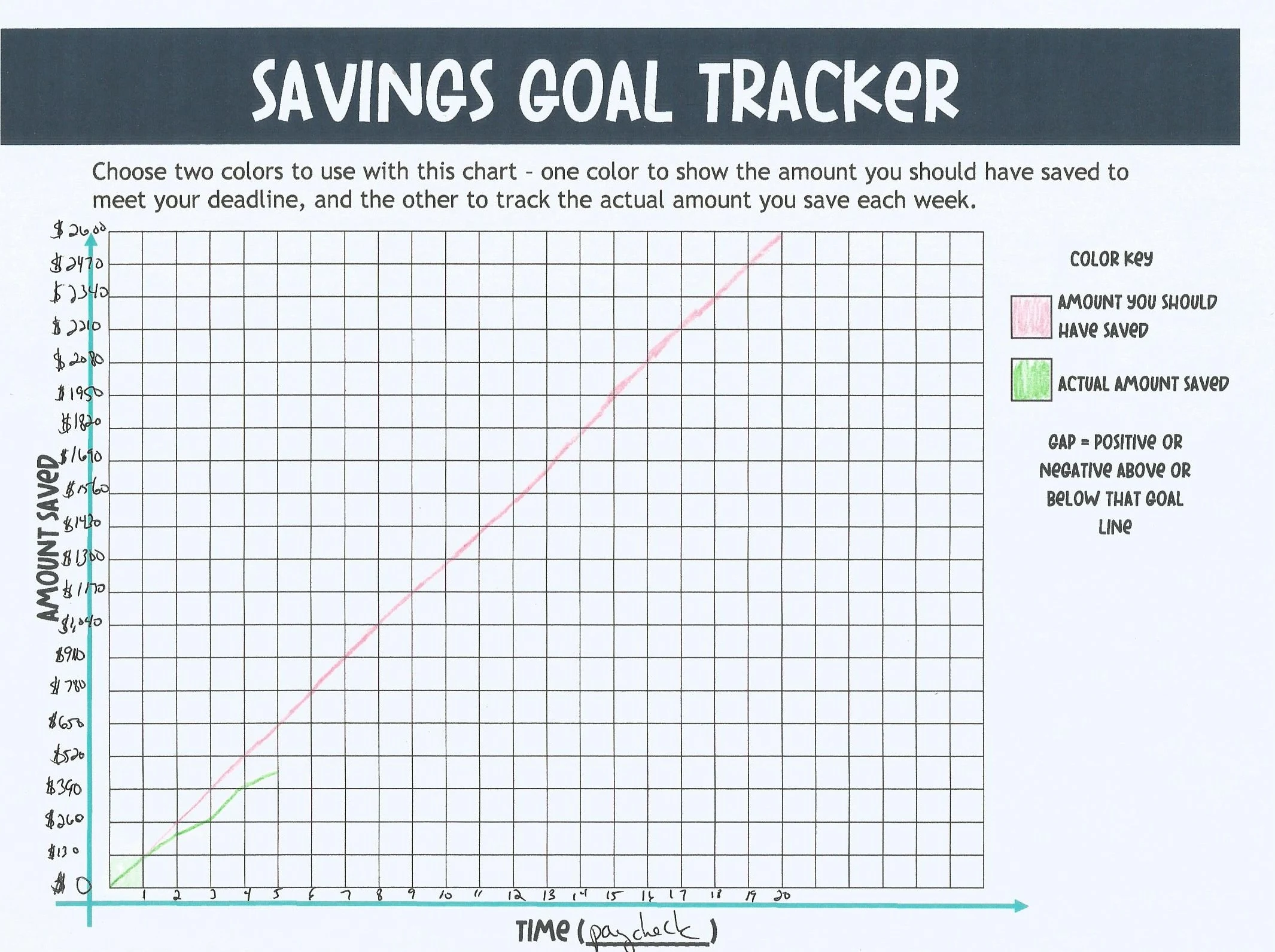

That’s why I created this free money-saving goal tracker, where you use one color to represent how much you should have saved by a specific time, and then another color to track how much you actually save each week, paycheck, month (or however you want to track it).

Here’s a picture of an example savings goal tracker:

It’s a great motivation savings trick, and I highly recommend you set it up on Day #0.

Also, here are 8 other free money-saving goal trackers.

3. Tap all the Resources You Can – Including Free Ones

Sometimes you can’t meet a savings goal without a “Hail Mary” – a huge, desperate attempt at using the resources you’ve got to go as far as you can.

Going down that line of thinking, I want to point out that there are actually ways to get matched savings toward your savings goals.

See if you qualify for any of these matched savings programs (many qualify for at least one!).

4. Chunk it Down into Mini-Savings Goals with Treats

There’s nothing less motivating than setting a savings goal you can’t possibly hit.

Instead of scaling back the entire goal, add in mini-pit stops.

Each mini-pit stop that you hit? You get a mini-reward.

It’s like mini-saving challenges or daily saving challenges built into your overall goal, and as long as you keep hitting them, you’ll eventually get there!

Psst: here’s how to reward yourself for $5 or less.

5. Give Yourself a 24-hour Cooling Off Period

When you shop, do voices play a soccer match inside your head?

You know, Team Live for Now says, “Yes, YES! You need that High-Speed Blender with Dual-Stage Technology right now (in fact, how have you made it through life so far without it?!?).”

Not long afterward, Team Adulting pipes in with, “Shouldn't you be saving for your goal?”

Institute a shopping rule where anything you really want to buy that’s not on your list, can’t be bought for 24 hours.

Meaning, you’ll have to drag yourself back to the store a day later if you really, really want it.

Just this one shopping filter can help you weed out nice-to-have’s from your really-want-to-have’s – leading to less clutter in your life, and more money to put towards your savings goal priority.

6. Play into Your Competitive Nature

Are you a little competitive?

I am. And if I use that to my advantage, then I always get better results.

It makes things interesting to me. Juicy, even.

For example, I used to love calculating my Personal Savings Rate (PSR) and then seeing how it compares to the national PSR.

Personal Saving Rate (PSR): the ratio of personal saving to disposable personal income (expressed as a percentage).

Could I outcompete the national average for saving money?

When I started doing this in 2008 how to increase savings fast, right before the market collapsed, the rate was just 3.5% of income. Then in the fourth quarter of 2008, it “shot up” to over 5%.

In case you’re wondering how to do this yourself?

Personal Savings Rate calculation = [Personal Spending/(Personal Income – Personal Taxes)]

Here’s a snippet from a 2010 blog post I wrote about this:

“On Friday I whipped out my calculator, added up our income from all of our tax documents, added up the amount we put into our savings accounts and retirement accounts for 2010, and then plugged everything into an equation. Drum roll please….we managed to put 42.9% of our after-tax income into a variety of short and long-term savings last year!”

We didn’t keep all of that 42.9% in savings, because some of the money was for specific savings goals. Once we met those goals, we withdrew the cash and paid for the purchases.

Specifically for that year, we paid for our wedding, our honeymoon to Austria, and our new Central A/C and Heater.

Still, we managed to permanently set aside 29.8% of our 2010 income. Which was WAY more than the national PSR.

Then, we set the savings goal of a 50% PSR rate for 2011.

Ultimately what happened was, well…life! We had several large purchases that we made with cash that would have gone to our savings account. These include a foundation repair, a second (beater) vehicle after ours broke down, and pre-paying for the cruise portion of our Alaska trip for 2012 earlier than expected.

The great news about all of this is that we were able to preserve most of our savings by paying cash for these items. So, while we did not meet our goal, being able to preserve and add to savings despite large expenses is a big accomplishment for me. In fact, if we added in the large purchases we had, our PSR would have been 46.9%.

7. Play a Savings Game for Adults

Have you ever played a saving money game?

It’s an excellent way to save far more money than you thought you could, and have some fun while doing it. One of my favorite savings challenge ideas.

In fact, here’s my 52-Card Pickup Savings Challenge:

Here are 10 more saving money games for adults.

Psst: doing this goal with a partner? These 5 money saving challenges for couples could help.

8. Make Your Savings Goal Bigger Than Yourself

If you want to catapult your own money goals + life goals + even those small day-to-day goals you're trying to improve upon, then make it about something bigger than yourself.

Here are some ways for you to do this:

- Put a Charitable Contribution on the Line: You can choose a charity tack your goal progress with it (i.e., you'll donate $200 to the charity that runs deep in your heart once you reach your target savings goal to go on vacation).

- Bring in the Whole Family On It: Make your goal bigger than itself by involving your whole family in it. Instead of just trying to save $XXXX amount of dollars for something, or trying to keep yourself pumped up about paying off two credit cards by December, let your spouse and/or kids get pumped up with you.

- Write Out What Your Life Looks Like Post-Goal: Once you reach that money-promised land post-goal, what is your life going to look like? What is the life of your loved ones going to look like? Write this down. This can cement the bigger vision in your head, which will give you something to focus on when the going gets tough and you'd rather get the kids in the car and go through the Starbucks drive-thru for the 3rd time this week (..that might just be me talking now).

9. Don’t Lock Your Money Up

This is more about prevention, or about getting out of an unsustainable financial situation if you’re in it.

But hear me out.

One of the ways we have a consistently high Personal Savings Rate (PSR)? IS because we haven’t locked our money up into monthly payments that don’t allow much wiggle room.

A perfect example of this is staying away from being house-poor. We didn’t purchase a home that we could “afford” according to a bank’s pre-approved loan amount. We purchased one well below that and within our comfort zone.

And since our home mortgage, insurance, association fee, and property taxes were 17% of our overall income – not the 30% that many financial experts and institutions advise – we have more room to save money.

Whenever possible, do not lock yourself into a tight financial situation. Do that? And you’ll more easily achieve your savings goal.

10. Get Super Serious by Involving HR

If you want to really achieve your savings goal?

Get dead serious about it.

That means taking these two actions:

- Open up a savings account dedicated to this savings goal

- Name that savings account something super-motivational

- Talk to HR to set up a split direct deposit between your checking and this new savings account

BOOM.

11. Increase the Gap Between Your Pay and Your Expenses

This might sound rudimentary, but sometimes it’s best to start from the beginning.

In order to increase your savings, you must widen the gap between your earnings and your spending.

Period.

I told you how to do this in my article on 250 money-saving tips.

Definitely check that out.

And for now? Here are a few of my favorites:

- Stay out of stores more often by grocery shopping every other week. This one tip alone shaved $150 off of our monthly grocery budget!

- Does work offer a free driving class? Take it, then submit your certificate to your auto insurance company for a discount.

- Negotiate lower rent with these 9 tested strategies.

12. Work on Your Mindset around Saving Money

How to achieve your saving goal is not all about “do this, not that”.

It’s about changing your money mindset as well.

Too many times, we think of saving money as important, but not urgent.

The money mindset shift that you need to make can be summed up like this: stop putting the act of saving money in the “Important, but Not Urgent” Quadrant of the Eisenhower matrix, and instead, put it where it belongs: in the “Important and Urgent” Quadrant.

Give saving money towards your savings goal its proper priority, and your savings might just explode.

Use these tips and tricks well, and instead of wondering how to achieve savings goals, you'll be wondering what savings goal to go after next!

Amanda L Grossman

Latest posts by Amanda L Grossman (see all)

- 9 Yummy Summer Snacks for Pool Parties (You Can Make Ahead) - July 23, 2024

- 9 Financial Goals for Married Couples to Conquer Together - July 17, 2024

- 5 Simple Dessert Salads for Thanksgiving (a Lighter Ending to a Big Meal) - June 25, 2024