How much more money do you think you could save if you played saving money games? How to make saving money fun with games about saving money for adults, including money-saving challenges.

Alright. You’re an adult, and you want to make saving money actually…fun.

I hear you! I think we should definitely infuse more fun into personal finance.

In fact, I have a sneaking suspicion (but can’t seem to find any stats to back this up) that if you make saving money FUN? You’ll actually increase the amount that you save.

You can be my guinea pig for this theory!

Not only do I have tons of fun saving money games for adults below, but you better believe I’ll be playing along WITH you (the Rainbow Savings Game has my name all over it!).

Saving Money Games for Adults – How to Make Saving Money Fun

I’ve got loads of saving money games for adults that will help you boost your savings account UP.

Choose one or two of these to play over the next month? And you’ll be amazed at the progress you can make.

Psst: not quite sure what savings goal to have? Definitely check out my article on 47 COOL things to save up for.

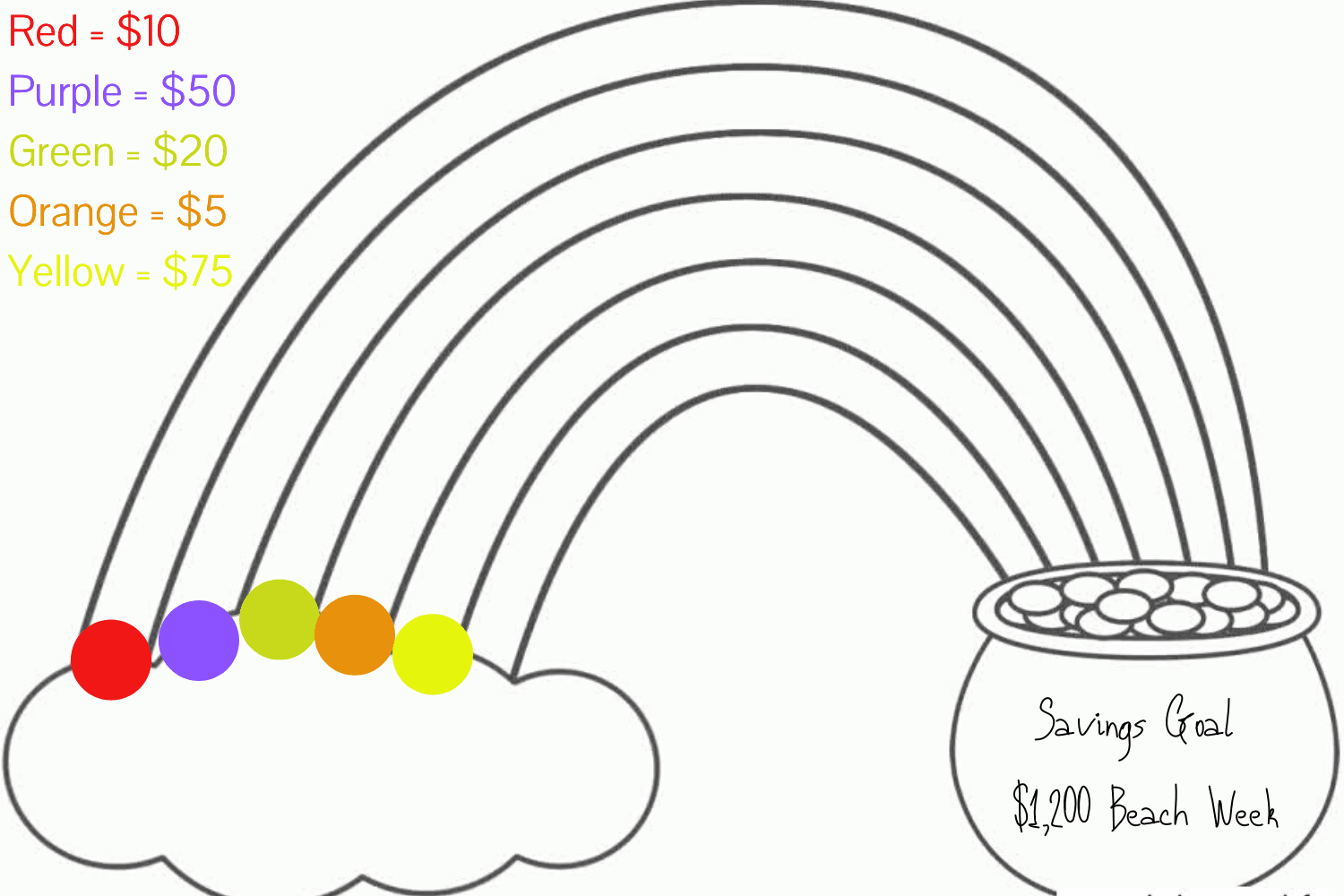

1. Play the Rainbow Savings Game

Grab a bag of Skittles (or other multi-colored candy), and put them in a mason jar, cereal bowl, or whatever else you already own.

Then grab this free rainbow printout (you’ll need to download it first – no opt-in required – and then you can print it). Fill your savings goal into the Pot of Gold box. Designate a color for each of the rainbow strips, and assign a money amount to each color.

I’ll give you example amounts:

- Red = $10

- Purple = $50

- Green = $20

- Orange = $5

- Yellow = $75

Each week, close your eyes and pick out a Skittle. That is the amount of money you’ve got to figure out how to put into savings for that specific savings goal this week.

Start it on Sunday night, and give yourself the deadline of reaching this goal by next Sunday night (say, 5:00 p.m.).

If you reach your goal? Then you get to draw a circle to represent the candy, in the corresponding color on the rainbow (then, of course, eat that candy!).

You’re literally building a bridge toward the savings goal you want to reach!

Psst: another great way to do this? Get some cheap Bingo daubers in various colors that go along with Skittles. Then just “dot” your way to coloring in the rainbow as you meet each challenge you’ve been given!

2. Play the 40% Savings Head Game with Yourself

I do this thing when I run. I commit to running a certain distance (say, 1 mile), and then when I approach that 1 mile, I think just one more quarter lap (one more light pole if I’m outside).

When I get that quarter lap done (or to the next light pole) …then I go one more. I usually do this 3-4 times and end up going about 25% further than I thought I could.

Navy Seal David Goggins actually calls this the 40% rule, meaning whenever we do something, we’re only living up to 40% of our capability. We actually have 60% still left in us, waiting to be unleashed!

Push yourself past what you think you can save.

Practical Application: Take your savings goal, and add 60% to it. How does that feel? For example, if your goal is to save $5,000, then an extra 60% would bring your actual savings goal to $8,000. Wowza! Trying to save up $500? Your actual savings goal after applying the 40% rule should be $800.

Psst: looking for how to save money AND have fun in other areas of your life? Definitely check out my articles on 74 things to do with friends without spending money, and 365 ways to reward yourself for $5 or less.

3. Map Out a Cookie Crumb Trail

I coined this phrase about 6 years ago for a debt course I created, and it can be used as a saving money game, too.

Simply take a sheet of paper, and build yourself a game board (great as a bullet journal savings idea, too). Each block becomes worth a certain amount of money that you have to save before you can move to it.

Here’s the key – create milestones within the board game and a reward that you get for completing each milestone.

In my example, you would follow the cookie crumbs to each cookie piece, and eventually, to the big-kahuna cookie itself!

And your rewards? Well, they don’t need to knock you off your savings goal course. That’s right – I’ve got 365 ways to reward yourself for $5 or less.

A few of my faves to give you a taste:

- Five minutes at a chair massage place (typically $1 a minute).

- Go to the artisan soap area of your local department store, and pick out something for under $5. (Bonus: actually use it by taking a bath tonight!)

- Find a community or donation-only yoga class and attend.

Saving Money Challenges

I love some healthy competition – I’m competitive by nature. And if I can challenge myself with something? Then I’m way more likely to actually meet the goal.

That’s why I’m including a whole section on saving money challenges (don't have much money? You'll definitely want to check out these 9 mini-saving challenges or daily money-saving challenges for small budgets). Because for many of us adults, these add a BIG element of fun to managing our money!

Hint: here's a resource post on how to start a money saving challenge, plus 9 awesome savings challenge ideas to kick yours up a notch (and make it easier).

4. 52-Card Pickup Weekly Savings Challenge

Ready to use a deck of cards to boost your savings over the next 52 weeks?

I'm soooo excited to unveil my new twist on the 52-week savings challenge trend: the 52-Card Pickup Weekly Savings Challenge!

Grab your free printables below, and a deck of cards.

You’re in control of how much you save over the next 52 weeks by simply giving a monetary value to each type of card in the deck. As you save that amount of money, you cross it off of the handy-dandy checklist. After 52 weeks? You will have reached your savings goal!

Psst: here are more 12-month savings challenges to try.

5. Take the End-of-Receipt Savings Challenge (aka, BANK IT!)

I came up with this several years ago when I finally realized that the “savings” stores tell you you have at the bottom of receipts actually aren’t real savings in the sense of the word.

I mean, when you go to CVS and see that you saved $15.36 at the bottom of the receipt…are you actually $15.36 richer? Nope. Not unless you “Bank It”.

In this Bank It game, for every receipt you get where you have savings at the bottom of it – through manufacturer coupons, store coupons, store sales, etc. – you have to Bank It.

Meaning, that you actually put that amount from your checking into your savings account.

So, in this example, I would put $0.63 into my savings jar or account (…I might just round that up to $1.00):

This is actually quite fun! Because you start associating your couponing and other efforts to real money back into your own pocket.

Not only that, but it helps you to “zero out” your budget. Meaning, that instead of “saving” a lot of money on purchases and then going out and just spending it elsewhere, you instead keep the same original budget but siphon that money into your savings.

6. Take the One Percent Savings Challenge

Paula from Afford Anything challenges you to save just 1% more of your income than you’re currently doing. And then, each month, you add an additional 1% of your income to that savings.

How high can you go? Wouldn’t you like to find out?

7. Take the Matched Savings Challenge

You know how some employers give employees a matching contribution for retirement savings (like in a 401(k))?

Well, do this for yourself. Give yourself a $0.50, or $1.00 matching contribution for each dollar that you save. OR, put a matching percentage/amount into savings for each dollar that you spend out of your discretionary spending (you know, the spending that just sort of “happens” throughout the month, like an unexpected trip to the movies or hitting up the drive-thru).

8. Take the 10%-of-Your-Salary Challenge

We’ve all heard the “rule” that you’re supposed to save 10% of your salary each year…but how many are actually doing it?

Take the time to figure out what percent of your salary you’re saving every year. Is it less than 10%? Then, I challenge you, my friend, to increase it so that it’s at least 10%.

Is it already 10% or more? Then go back to the 1% challenge from above and start with that.

OR, did you find you’re saving 10% of your take-home pay, but not your gross pay? Then bump it to 10% of your gross pay (meaning, your salary before anything is deducted from it).

9. Challenge Yourself to Go Twice the Distance…in Half the Time

Make your savings goal TOUGH, and URGENT. Seriously.

What I like to do? Is cut my timeline in half. Just right off the bat. I’m always surprised by how quickly I can reach something or do something just because I suddenly decided to devote less time to it (called expandable consumption).

You want to take this up even another notch? Go for double the target amount of savings, in half the time. BOOM.

Practical Application: Take your savings goal, and double it. Take the time you want to reach it, and halve that. What does your goal look like now?

Psst: not sure how to set a savings goal? Here’s an example we did – our honeymoon savings goal.

10. Take the Jerry Seinfeld Challenge for Saving Money

Writing for a living is notoriously challenging (nods head in agreement while I write this article).

Jerry Seinfeld came up with a great, simple system to challenge himself to write every single day of the year: he simply has a calendar on his wall and gets to put an “X” through each day that he writes.

He says the motivation to keep a chain of “X’s” going for as long as possible is pretty great.

Can you do the same for saving money?

Let’s adapt this a bit – pick the one that speaks to you:

- X-Out Each Day You Try a New Savings Strategy: Can you go one whole month of trying out one of my 250 money-saving tips each day, for 30 days?

- X-Out Each Day You Don’t Spend Money: I have an epic, free guide on how to set up a no-spend challenge here that would pair nicely with this calendar trick.

- X-Out Each Day You Move $5 into Savings: Or $10, or $1. The amount is completely up to you and your current financial situation.

- X-Out Each Day You Find a Substitute to Spending: Think about all the times you and I find a substitute that we already own, or something free to do, etc. in place of a spending occasion.

You get the idea – make this savings challenge your own!

Money Board Games for Adults – Games about Saving Money

Maybe you’re not able to save the type of money you’d like to in real life (*raises hand*). Or, maybe you just love games about money.

Either way, another category of saving money games for adults is found in financial board games for adults.

Here, you can play out your saving-money fantasies and become the money boss you were meant to be.

Savings Board Game #1: Cashflow Board Game for Adults

Robert Kiyosaki, author of Rich Dad, Poor Dad (an excellent read, by the way), came up with the Cashflow board game.

It’s a fun way for adults to understand the value of not only saving money but then to invest that money so that you increase your assets and decrease your liabilities.

There are two different boards: The Rate Race board, and the Fast Track board. Hint: you want to get on the Fast Track😊).

FYI: Cashflow actually does encourage you to use debt, in a way that will invest in your future. Definitely a different perspective than I’ve taken, that’s for sure!

Savings Board Game #2: Acquire

Another FUN, this money board game for adults was actually created in the 1960s.

It’s the game Acquire, and it involves you both developing and then merging major hotel chains. You then earn money when own hotels you build are acquired. Stocks are liquidated at the end, and the player with the most money wins.

Again, while the focus is not exactly on saving money, you certainly can’t win the game without saving some of the green stuff.

Saving money doesn't have to be a drag…especially if you choose one of these saving-money games and money-saving challenges. Go ahead – I dare you!

Emily Bradford

Sunday 16th of January 2022

I love these ideas. I am always looking for ways to save the most money throughout the year. I am saving for lots of things, a new vehicle, a new house, etc. Thank you so much