The five types of financial goals, plus how to write your own. Filled with plenty of examples of each type of financial goal.

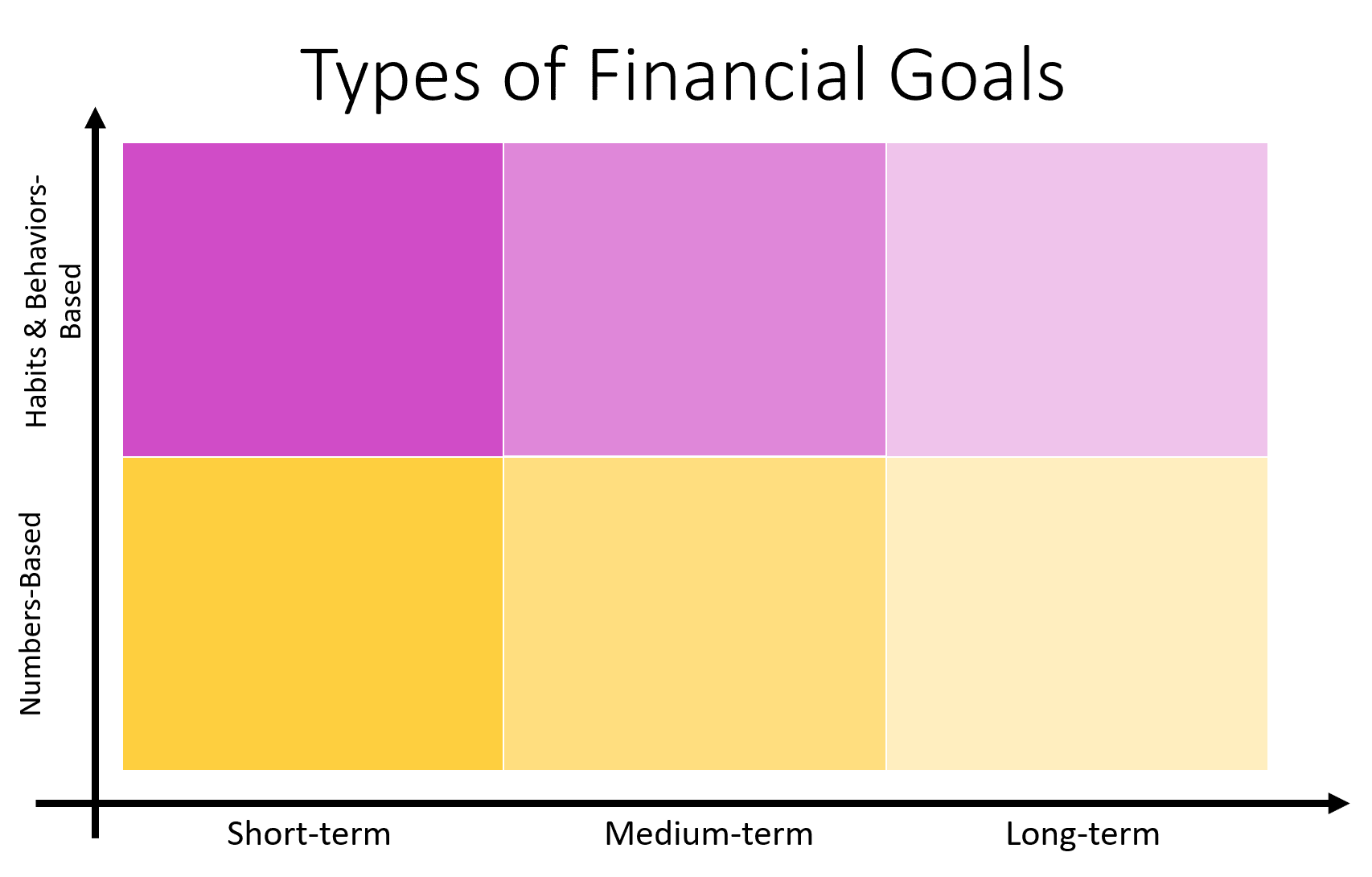

Most people list out the types of financial goals by the amount of time it will take to achieve them: short-term, medium-term, or long-term.

But, they’re missing a key part of categorizing financial goals. And that’s whether or not your financial goal is: numbers-based, or habits & behaviors-based.

Setting a numbers-based financial goal – like we did back in 2011 when we resolved to save 50% of our take-home pay – is mighty different from setting a habit & behavior-based goal.

In fact, if you want to achieve a numbers-based goal, you’ll likely have to change habits and financial behaviors to do it. The reverse can be said, too – if you change your habits and behaviors, then you’ll love the numbers you see, too.

I’m getting a little ahead of myself.

Let’s first look at what a financial goal is, the different types, and then specific examples you can use.

Financial Goals Definition

Just so we're all on the same page, I'll briefly tell you my financial goal definition (in everyday language).

A financial goal is:

an end result you're intentionally going to work to get because it will make your finances (and your life) better.

Now, let's go over the types of financial goals.

Types of Financial Goals

Financial goals can be categorized by the length of time they will take to achieve, or by the type of goal that they are.

Traditionally, the three types of financial goals are:

- Short-term financial goals

- Medium-term financial goals

- Long-term financial goals

And I want to take it a step further because there’s a further difference in financial goals.

Your financial goal is categorized as either a:

- Habits and behaviors-based financial goal

- Numbers and digits-based financial goal

For example, you might have a financial goal to save up to $5,000 by the end of this year. That is a numbers financial goal.

OR, you might set a financial goal to set up your bill-paying system by the summer. That is a habits and behaviors-based financial goal.

See the difference?

Both the type of financial goal and the category play together, too. So, you can have a short-term numbers-based financial goal, and a long-term, habits-based financial goal. Or any other number of combinations.

Maybe you don't have a financial goal right now, and you're looking for a list of financial goals to kick-start your own.

You're in the right place!

List of Habits and Behaviors-Based Financial Goals

Here are some cool habits and behavior-based financial goals for you to work towards (each of which will set you up for a better financial future):

- Pay for all vacations in cash (or by credit card for the reward points – that is then paid off before the grace period is up)

- Keep a buffer in your checking account so that you can stop juggling between paychecks

- Pay off the credit card every single month, entirely, before the grace period is up

- Start tithing X% at church, and increase that by 1% each year until you reach the full 10%

- Start investing. Period.

- Sign up for your employer's 401(k) and increase your contributions by 1% each year until you reach the maximum matching contribution

- Pay off your credit card, and use it only for emergencies from here on out

- Meet a financial incentive from your employer's health insurance wellness program

- Start a 529 plan for your child's education

List of Numbers-Based Financial Goals

Next up, let’s look at numbers-based financial goals you can snag and make your own:

- Pay for your annual vacation week in cash

- Maximize your IRA contributions this year ($6,000/person)

- Get out of student loan debt before your child starts school

- Fund your emergency fund to $3,000

- Fund your emergency fund to $6,000

- Fund your emergency fund to $10,000

- Pay for your child's tuition at a school/daycare/preschool you want them to attend

- Pay off one of your debts, entirely

- Pay off your entire mortgage before retirement

- Save up enough money so that you can live for one year from it if need be

- Come up with a retirement plan

- Find an extra $150/month by cutting out expenses

- Get a raise

- Donate a percentage of income to a charity you're passionate about, on autopilot

- Save up for a lush, 10-year anniversary trip to Italy

Psst: find more saving goals examples in these 27 financial new year's resolutions.

What is an example of a Financial Goal

I’m going to give you two examples of our personal financial goals over the years.

1. Decrease our Grocery Spending

A very recent habits and behaviors-based goal I had late last year was to decrease our grocery spending.

It seemed like it had exploded out of control, and I felt like we weren’t being good stewards of our money (and by that, I mean MYSELF, since I’m mainly in charge of grocery and household goods spending).

I didn’t have a particular number (which, is not the best way to write a financial goal – more on that later).

Rather, I wanted to change my behaviors and habits around spending on grocery shopping day so that I could get our spending back down to a level I felt comfortable with.

Here are the behaviors and habits I changed:

- Started Earning Cashback on Groceries: I finally, finally, finally took the time to sign up for a grocery cashback app (I’d been meaning to for quite some time). I use ibotta, fetch, and receiptpal (yes – all three, for each receipt).

- Overhauled my Meal Planning System: My meal planning system from my 20s (writing down recipes I wanted to keep in a carryable caddy) was no longer serving me. SO, I took the time to really think through a new system, convert to the new system, and set everything up. This made a HUGE difference. You can get my full meal planning and how-to organize recipes in a binder here, with free printables.

- Went into the Recesses of Our Pantry: I started planning from the BACK of our freezer and pantries, rather than quickly checking if we had the most common things we normally purchase. That means using up half-bottle things by remaking the same recipe again that I bought the ingredient for, finding a decent amount of duplicate ingredients, and restacking them from the must-use-first (with soonest expiration date) to can-wait-to-use, etc.

- Cut Down on Wasted Food: I feel like we’re purchasing less overall now because I have a better grasp on what we’ll cook for the week (again, look at that article on my recipe binder and meal planning system – it’s a Godsend!). Since I have clear meals we’ll be making, it’s cut down not only on time but on the extra spending I was doing at the store.

These moves have saved us $150-$200 each month since. These new habits and behaviors are really increasing our bottom line!

2. Pay Off the Remaining $25,000 of Combined Debts

When my husband and I first got engaged, I had us sit down and talk about our finances.

He was less-than-thrilled, by the way. But it ended up being a super important meeting for us. Because we figured out that together, we were $25,000 in debt (from his car, the engagement ring, and the rest of my student loans).

And then we determined that we would work together to get it all paid off before we went down the aisle (just 10 months later).

Not only that, but we wanted to:

- Pay cash for our wedding (we paid for most of it)

- Make a sizable down payment on a home

- Pay cash for an extensive honeymoon to Austria (11 days)

WOWZA. Those were all numbers-based goals. And you know what? We reached them. Not by the wedding, but by just 5 months after that (and in the same year that we got married – 2010).

You can read the whole story of how we did this here.

How Do You Write a Financial Goal?

Now it’s time to actually write out your financial goal.

We’re going to use a plug n’ play formula for you.

I’m going to financial goal by date/deadline so that I can results/outcomes. To do this, I’ll need to change these financial habits and stop doing these financial habits and behaviors. The first step I need to take is first action step, that takes less than 1 hour.

Here’s an example of what it will look like:

I’m going to start investing in my company’s 401(k) plan, by the next pay cycle. So that I can immediately get paid more (through the company match), and eventually build a more secure retirement for me and my family. To do this, I’ll need to change how I think about my paycheck since it will be less, and stop eating out so much. The first step I need to take is to talk to HR to get the paperwork to fill out.

In order to write your own, you’ve got to answer these questions:

- What do I want to change or achieve?

- What will doing this change about my life? What are the results and outcomes I’m looking for?

- What are the behaviors and spending habits I will need to get rid of in order to reach this financial goal?

- What behaviors and habits will I need to adopt in order to reach this financial goal?

- What’s the very first, small, step I’ll need to take to get this done (this should take 1 hour or less)?

You can also check out this article on free SMART financial goals worksheets for more help writing yours out (and is it a savings goal? Here's how to keep your saving money motivation to see it through, plus free savings goal tracker printables).

After reading through all of this, have you decided which of the types of financial goals you want to go after next? Will it take a short-term, medium-term, or long-term amount of time? Share your goal below if you'd like some accountability.