Forget paying holiday bills in January. Learn my holiday budgeting tips and tricks for a stress-free holiday season.

The holidays and end-of-year time can bring about big changes in your monthly cash flow needs.

Things seem pretty predictable budget-wise the rest of the year.

And then the end of the year creeps up.

Suddenly there's:

- Extra spending on travel to see family

- Extra spending on gifts and social events

- Extra spending on pumpkin cheesecake, egg nog, and a tree your cat likes to climb (oh, I think I'm talking about myself here…)

So what are some ways to deal with these big changes in your cash flow needs (you know, before the actual end of the year gets here)?

Holiday Budgeting Tips

I'm about to share with you my best tips, tricks, and strategies to help you budget for the holidays ahead of time, and to make that holiday budget get you through the whole season.

1. Do a Bit of Planning First (the Earlier, the Better)

The earlier in the year that you can plan for your holiday season, the better.

Seriously – you can't get too early on this one!

You'll need to know about how much money you'd like to spend on your holiday season. And then, you'll want to start saving it. Finally, you'll need to track where you are during the holiday season itself.

Use these free printables to help:

- 9 Free Printable Christmas Gift List Organizers

- 9 Best Christmas Budget Worksheets

- 8 Best 52-Week Christmas Savings Plan Printables

- 11 Cute Printable Budget Worksheets

2. Scan Your Shopping Receipts and Save that Up

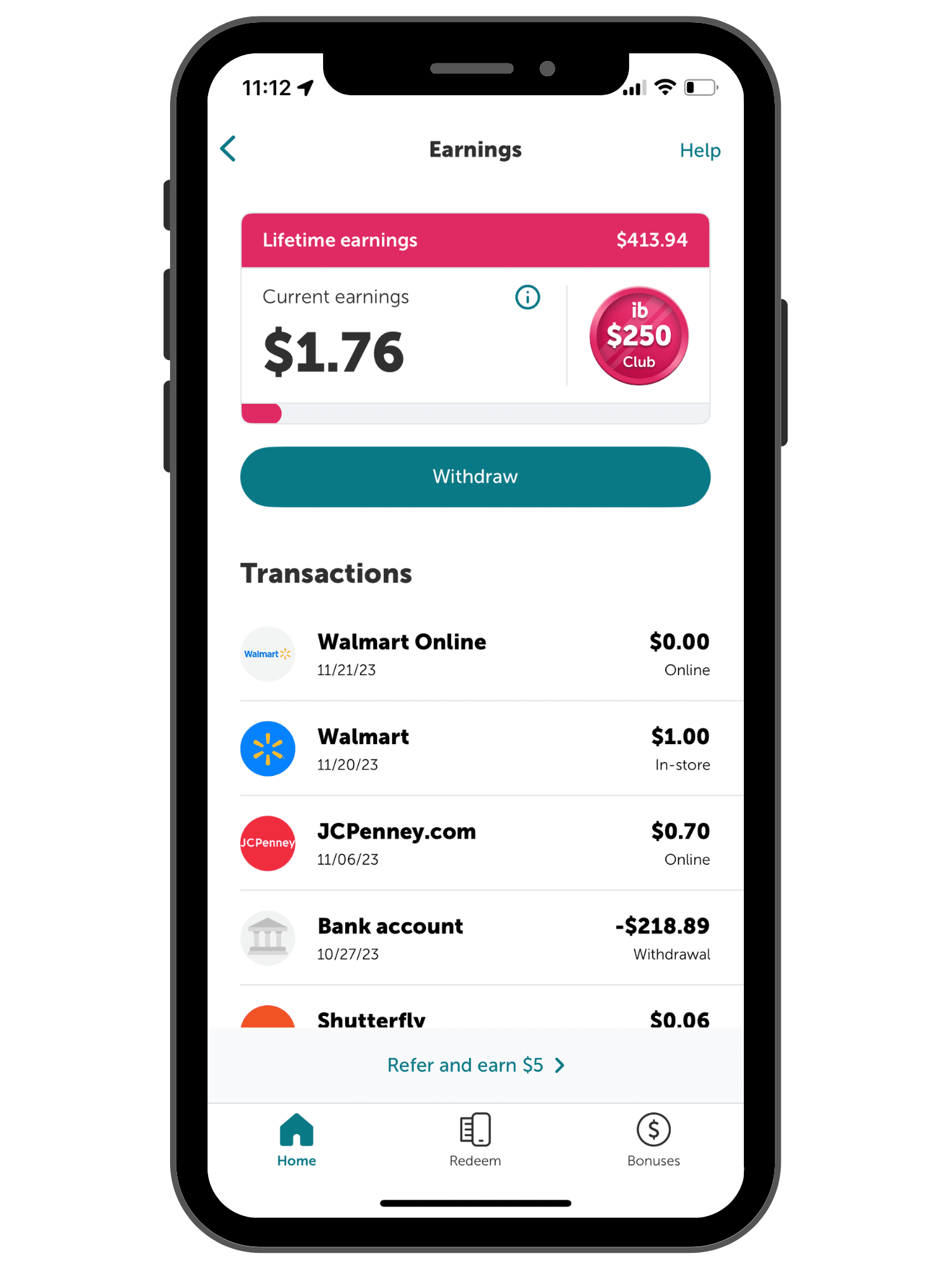

I scan all of my receipts, all year long, into these two cashback apps: iBotta, and Fetch.

I keep the cash and points tallying all year long, then cash out around the end of the year to put towards my holiday budget.

Last year, I withdrew $218.89 in actual cash from iBotta alone in October!

3. Do the Retirement Savings Shuffle

Max out retirement savings in 10 or 11 months instead of 12.

Two months without contributing to retirement will definitely give you breathing room (hint: don't forget to turn automatic retirement savings back on in January. No cheating!).

Psst: this decreases your dollar cost averaging over the full year…but it can REALLY help out in those expensive two months of the year, November and December. I've used this strategy for several years now, and LOVE it.

4. Introduce New (ahem, More Realistic) Gift-Giving Traditions

At the end of this holiday season, or perhaps in the Fall of next year, talk to your family and friends about new gift-giving traditions that will be easier on everyone's wallets.

For example, the adults in the family could exchange names and only buy one gift at an agreed-upon limit instead of everyone buying everyone a gift.

You could have a “Buy Nothing” Christmas where everyone exchanges homemade gifts, or take a thrift store challenge where you and your friends hunt for the best gift possible under $10 (this one is pretty fun!).

You could do a white elephant gift exchange at the holiday party. OR, choose to purchase something for each other in the after-holiday clearance sales (how fun!).

5. Start a Gift Cabinet

I have a gift cabinet in my home. It ties in perfectly with my Christmas shopping strategy: shop all year round, starting as early as the mind-boggling, after-Christmas sales in January.

By shopping all year round I have ample time to find that perfect present for each person on my list – alleviating my holiday stress – I can wait until a coupon and/or sale comes through my door, and my December and January budgets are not decimated because I’ve spread the purchases out, and I avoid the mad dash that can make holidays so stressful.

Come Christmas season – if I've used this method all year round – then I just have a few gifts to finish up with and the whole gift-shopping experience is leisurely and wonderful.

Psst: here's free printable Christmas gift list organizers to help you get even more organized this holiday season.

Not only does this method save me a lot of money, but it increases my dollar’s purchasing power and I end up being able to purchase nicer gifts for everyone than if I had purchased all of my gifts at the same time for full retail price.

I also can take advantage of the clearance sales at the end of three seasons (winter, spring, and summer) which can really add to my bottom line.

Who knows how much money you could save from shopping all year round for the holidays? Penny from the Saved Quarter was able to spend just $100 on Christmas last year because she shopped all year round using many frugal strategies we’ve discussed here.

Could you knock off 40-60% of what you typically spend? I am sure of it.

6. Open A “Stress-Free Holidays” Savings Account

Designate a savings account for the Holidays/End of the Year, and drip feed it $30-$50 per month throughout the year (more tips on how to save up extra cash throughout the year, to come).

Psst: I've got loads more simple budgeting tips you can use year round.

7. Borrow from Categories for Extra Spending Elsewhere

Especially with the holidays approaching, you're probably already borrowing from Peter (aka, the grocery budget) to pay Paul (aka, the kid-needs-shoes budget) and then some between gift-buying, social events, and getting ready.

It's a great strategy and keeps your total monthly spending within your total spending category limits anyway. I'd like to add a few tips to squeeze a few more bucks out for you:

- If you have lots of social events around the holidays you'll be going to (with food), then purchase less than a grocery store trip to uncover some cash for other things.

- Traveling for the holidays? Put your water heater on “vacation” mode, and turn your thermostats way down/up to save some money there. Leading up to the trip, do an “eat-from-your-cupboards” challenge instead of buying groceries for that week and being tempted to overbuy. Your bell peppers and milk will probably not get fully used before you leave anyway.

How to Set Yourself Up for a More Even-Flowed Holiday Season Next Year

So, you're here, and it is what it is. While this year you might only be able to band-aid the issue, I'd like to show you how to set yourself up for a financially blissful + less stressful holiday season next year.

8. Shop at the Dollar Tree for Christmas Gifts

One of my favorite holiday budgeting tips? Is to spend less. And a surefire way of doing that is to do some of your shopping at Dollar Tree.

Hear me out on this one – because the Dollar Store we grew up with is not the same one of now.

Dollar Tree is killin' it, and I just couldn't help but create tons of great Christmas gift ideas from there.

Like these:

- 11 Dollar Tree Christmas Gift Ideas

- 11 Dollar Tree Gift Ideas for Him

- 14 Dollar Tree Gifts for Mom

- 17 Dollar Store Stocking Stuffers for Adults

9. Buy Discounted Gift Cards to Shop with

How would you like a small discount on everything you purchase during the holiday season?

Many people sell gift cards that they do not want, or cannot use. You can purchase these gift cards at a discount all year round on sites like Raise.com and GiftCardGranny.com.

10. Buy Products to Use for the Next Holiday Season

Stocking up on decorations and products for the next holiday season at 75% off or higher is a no-brainer.

You can gauge how big your child will be next Halloween season, and snag a costume right now at a huge discount. What about a fancy pumpkin carving kit?

Decorations are a great choice as well; perhaps you want to deck your lawn out with white reindeer and enough lights to put Clark Griswold's house to shame, but you don’t have the several hundred dollars to pay for it this year. Wait until after Christmas and take advantage of 75%-90% off!

Go ahead and stock up on festive napkins, bulbs, cornucopias, and spiderwebs.

11. Use Post-Holiday Sales Throughout the Year

Another way to fill that gift cabinet? Shop post-holiday sales throughout the whole year.

- Halloween

- Purchase candy (with non-specific candy wrappings) to stuff into stockings for Christmas time.

- Votive candles and small candles generally used for lighting pumpkins can be used throughout the year in candle sconces, fireplaces, etc.

- Pumpkins that you used for decoration (but did not carve) can be cooked, pureed, and frozen to use for recipes.

- Dry out gourds and use them for Thanksgiving centerpieces.

- Purchase Hershey’s Kisses to use in cookie recipes for Christmas and beyond, such as Peanut Blossoms (my favorite!).

- Thanksgiving

- Before and after Thanksgiving you can find coupons and sales for many food items that can be used for the next year (or until they expire), such as canned pumpkin, cranberry sauce, turkeys (freeze), stuffing, etc.

- Paper products, such as paper plates and napkins, go on sale around this holiday and there are usually coupons that come out as well. Stock up now to use for birthday parties, barbecues, housewarmings, etc. Also, aluminum foil sales abound.

- Christmas

- Think baking supplies: stockpile butter (you can freeze), chocolate chips, sweetened condensed milk/evaporated milk, sugar, flour, etc.

- Ham goes on sale before and after the holidays; purchase an extra one or two and put it in your freezer.

- After the Christmas season, purchase red wrapping paper and ribbons to use for Valentine’s Day or birthdays, and other neutral wrapping paper colors for events throughout the year.

- Candles

- Parchment/wax paper

- Tape

- Batteries

- Peppermint-flavored candy/hot chocolate, and Andes Mints (two of my favorites)

- New Year’s

- This is a great tip I got from Bridal Bargains: purchase champagne when it goes on sale before/after New Year’s Day and use it for special occasions throughout the year (particularly if you are getting married!)

- Birthday Gifts

- Shopping after Christmas is a super-easy way to save on birthday gifts throughout the year.

There are many, many ways you can use the items you purchase at 70%+ off to help you save BIG all next year long.

12. Use a “Surprise” Savings Tool

In past years, I've stressed in November and December with how we're going to come up with airfare + enough money for gifts + finish maxing out our two Roth IRAs for the year (a girl has to have her priorities, right?).

Then I found this cool Savings Tool.

Oportun is a company that monitors your checking account and then makes small withdrawals of money from it straight into a savings account for you.

When I ran across them, I thought it could be icing on a decently healthy savings cake.

Like I said earlier, we already have automatic withdrawals to both our Roth IRA accounts, plus to regular savings. And things are pretty tight with our built-in savings model. So I was curious as heck to see if this little savings engine could really do anything significant for us with what's left.

That $509.97 that this savings tool set aside for us? It all came in just the past two months − between August 25th and October 24th to be exact – with an average of $18.21 taken out on each withdrawal.

Psst: And that was including us withdrawing $150 during that time period.

In other words, this free tool solved a problem for us. Now that's worth talking about!

Here are a few more facts for you:

- No-Overdraft Guarantee: Do you feel like this might take things out of your control? Check out Oportun's No-Overdraft Guarantee on their FAQs page.

- Savings Bonuses in Lieu of Interest: A con to using Oportun? You won't earn any interest on your savings kept in their account. That's their business model − they save it for you automatically, and they earn the interest. However, they do give you Savings Bonuses. Every three months you earn a little bit ($0.05/$100 saved, based on the average Digit balance over the last three months) for keeping your money with them. Pro Tip: A workaround? Whenever you get a “significant” amount saved up, you can always move it back to checking and transfer it to your high-interest savings account.

- FDIC-Insured: Yes, your savings account with Digit is FDIC-insured up to $250,000.

13. Proportion Out Surpluses Ahead of Time

You might not know if you are getting a bonus, a cash/gift card gift, or any sort of surplus at the end of the year.

But it's a good idea (and kinda fun) to figure out how you'd dole it out in case you do (and how it would work with your holiday budget).

Here's what to do:

- Remember that a portion of it may go to taxes (particularly if it's a work bonus) and that those taxes may or may not have been taken out prior to you receiving the money.

- Identify a percentage that you are going to lop into savings, right from the start. Start at 50%, sit with that number, and then ease it up until you feel too much like Scrooge. Make sure the percentage/number you end up with is a stretch outside of your comfort zone.

- Identify any spending needs in your life that the rest of the money could go for. How could it be used to get the most satisfaction + needs met for you and your family?

14. Use Cash from Your Health Insurance Wellness Program

Have you ever heard of an insurance wellness program?

These are incentive-based programs to get you to take healthy actions throughout the year. Insurance companies are willing to pay you to do this because overall, it lowers their costs as a company.

I signed up for my husband's after learning that we could EACH earn $450/year just by recording things about our health (heck, one health survey alone was worth $75!).

And guess we? We pocketed that $900 at the end of the year, in the form of a check from the health insurance company.

SCORE.

Have you picked up on my number one tip for preventing holiday stress? Hint: it's all about prevention. Use these holiday budgeting tips to get ahead of the holiday season. You'll thank yourself all winter long.