You need some NEW tricks and surprising ways to cut household costs, right? Cut everyday expenses with these 5 actionable tips.

Tired of the same-old, same-old articles and tips circulating the internet about “surprising” ways to cut household costs (that aren't all that surprising)?

Me, too!

That’s why I’ve set out to give you 5 FRESH ideas that are so actionable, you can’t help but cut your household costs.

Psst: hang around until the end, as there's a bonus tip just for renters that I'm really excited about sharing!

5 Surprising Ways to Cut Household Costs

Instead of me lopping 250 money-saving tips your way, I’m going to give you just 5 surprising and highly actionable ways to cut everyday expenses in your household.

These are great ways to spend less money!

1. Make One Meal Per Week from the Dollar Tree (At Least)

A meal from the DOLLAR TREE?

That would've been my response to this spend-less-trick a year ago, as well.

But then I started looking at the groceries available for $1.25 each at Dollar Tree.

And when I realized that many of them we were paying full retail price for at the grocery store, OR, were products that had the same ingredients (gotta look at those nutrition labels!)…

I challenged myself to create real meals from Dollar Tree.

And I was blown away by:

- The tastiness

- The variety of ingredients

- The food savings

Personal favorites of my husband's (pictured below), include the $6.25 Broccoli, Sausage, Potato Hash (with Homemade Cheese Sauce), the $6.25 Sausage-Stuffed Garlic Bread (with Peppers & Onions), and the $6.25 Texas Caviar Frito Pie.

Find these, and many more recipes + ingredients list:

- $37.50 Weekly Dollar Tree Meal Plan for 2 (No Beans & Rice!)

- 7 Dollar Tree Dinner Ideas ($42.50/Week for 2-3 People)

- 7 Dollar Tree Lunch Ideas ($18.75 for the Week!)

Not only that, but our family loves lots of the snacks available at Dollar Tree – the same ones (brand, size, and variety) we'd pay full price on at the grocery store.

Ready to try it out? I dare you!

Psst: surprised by the Dollar Tree Meals? You might also be surprised by these Dollar Store Date Night Ideas, too.

2. Take Your Health Insurance Company's Surveys

Have you checked with your health insurance company, or on their website lately?

The last three health insurance companies we've had (over the last decade, including our current one) offer some serious cash via Visa Prepaid Gift Cards for completing surveys about our health.

Like, we currently get $75 each to spend on medical costs (doctor co-pays, supplements/prescriptions, etc.) just for filling out an online survey of our health once a year.

And if we want to track things like our water intake, exercise, and eating on their dashboard? They'd give us each up to $450.

That's some serious cash savings on overall medical costs! Go find out what your own insurance company might offer as financial incentives for taking care of your health.

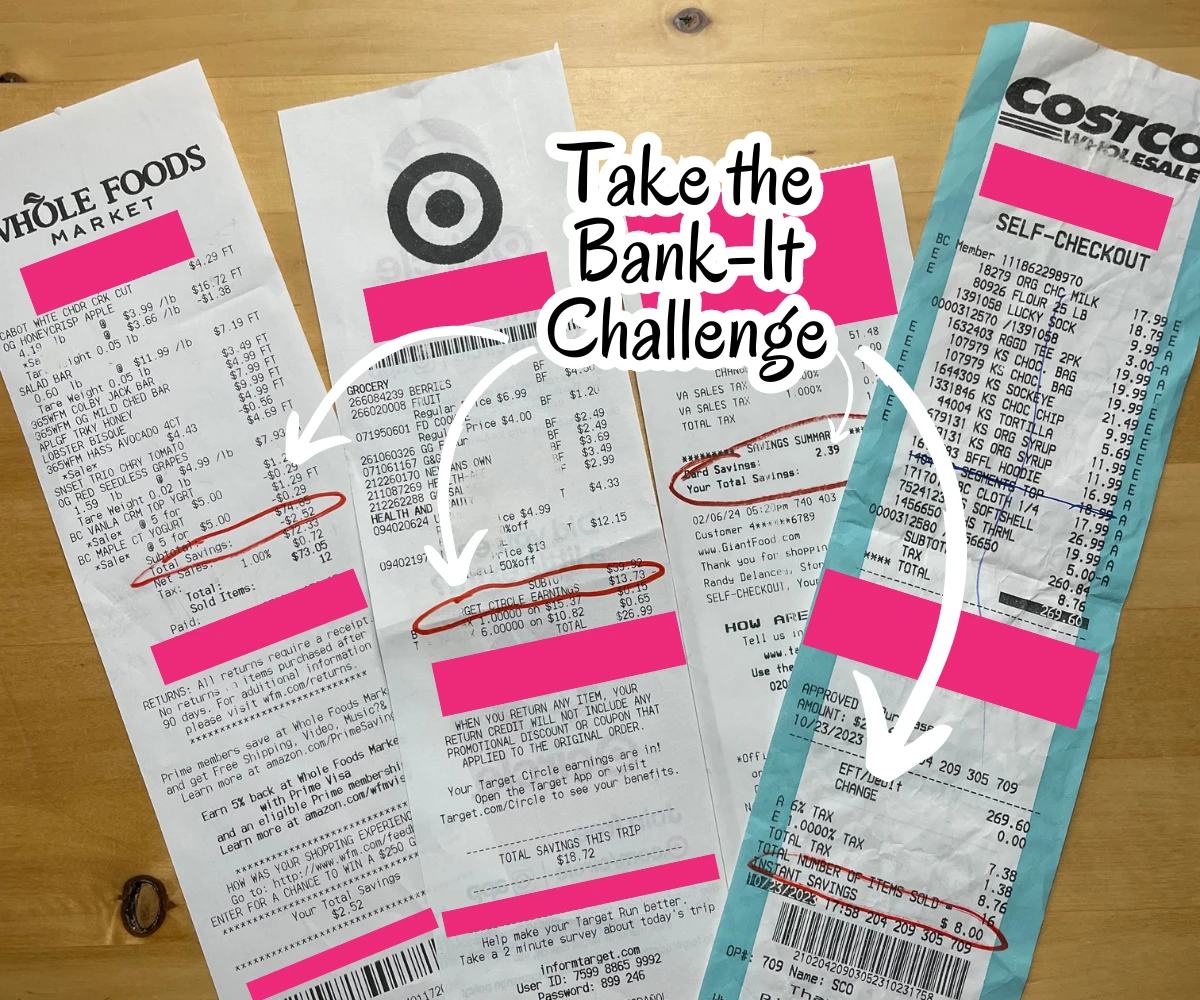

3. Take the “Bank It!” Challenge

I’ve got a fun money challenge for you that will cut your household costs and add to your savings, all at the same time.

It’s called the “Bank It” Challenge, and even though I created it years ago, not many people know about it.

We all get a rush when we see how much money we’ve “saved” at the bottom of our receipts, right? Like, your CVS receipt might say you saved $6.54, and your Kroger receipt might say you saved $3.56.

My challenge to you is:

- Get more savings on the bottom of those receipts

- *Actually* move that amount of money into your savings account each week/month

That’s right – I want you to keep your receipts, add up the “saved” amount on the bottom, and then actually move that amount over to your savings account.

Pssst: check out my article on 49 ways to drastically cut expenses.

4. Set Up a New Toy and Clothing Rotation (to Shop Your Closet Year-Round)

One of the reasons why we spend extra on things, or why your kids nag for you to buy them new stuff at the store, is because everyone wants that rush from getting something new.

You can create that “new rush” by using your own belongings just by storing them away and “rediscovering” them every six months or so.

This works beautifully for young kids – I stash at least 70% of the toys and books my little guy gets for birthdays and Christmas in a specific closet in our home. As he tires of some toys and books, or when he asks me to buy something new, we instead “shop” the closet.

He is mesmerized by this closet, by the way, and knows he’s not allowed in it!

Hint: because of this nifty little system, my preschooler actually requests to go to the “toy closet” instead of to the store! Can I get an “amen”?

Then we put his older toys into the closet, and rotate out a few new ones.

In 6 months or a year, getting his old toys back seems like such a sweet surprise to him, too, that he calls himself a “lucky boy”!

You can do the same with your clothes. Forcefully store different seasons out of sight, so that when that season rolls around, it’ll feel like you’ve just gone shopping when you get all your favorites back.

5. Pick just One Habit or Routine and Audit it

When you think about cutting household costs and attempting to do 5 different things at once, it can get overwhelming really fast.

Not only that, but saving just $1.25 here with a coupon, and $0.50 there off of gas, seems like it’s not adding up for the amount of new effort you’re putting forth.

Which can cause you to lose motivation and choose more convenient options.

Instead, I invite you to choose ONE habit or routine at a time, and fully audit it until you build it into a new habit/routine that costs much less (and is more satisfying, anyway).

To do this, you need to really break the audit down:

- Figure out what it is that you like about the habit or routine – what keeps you coming back for more?

- Figure out what you want to change about it – you may want to not spend as much, but what else do you want to change? Make it healthier? Make it more convenient?

- Figure out how to still get what you need and want moving forward AND to pay less for it.

Let me give you just one example where I’ve successfully done this.

Habit Audit #1: My Starbucks Drive-Thru Habit

It became a routine for me to zip through Starbucks’ drive-thru when my little guy was a baby, then a toddler…and then a preschooler.

Granted, I enjoyed it for a while there – I wouldn’t have given this habit a second thought (and you could not have pried it from my new Mommy's hands) when he was an infant.

But gradually, I started feeling guilt instead of joy when doing it.

It wasn’t tasting as good to me anymore. It was costing a small fortune (at least it felt like it).

Yet…I just kept doing it.

This easily cost us $120 per month. True, we had the money to spend. But I just felt like it was not using our resources in the best way – especially since I was just doing it and not really enjoying it anymore.

SO, I audited my habit.

I broke it down into why I was doing it, and what I needed from a substitute to not feel deprived by giving it up.

I was doing it out of convenience + habit (“because that’s what I always do”), and what I needed to substitute in its place was:

- A hot breakfast that had some protein in it

- Something iced with caffeine, without the chemicals of a Starbucks drink

- Much cheaper than what I was spending

- So convenient to make, that I’d spend 5 minutes or less in the kitchen each morning

Tall order, right?

Here are the two alternatives I came up with:

Hint: Not only did I come up with these, but I’ve actually stuck with these for 8 months now – in fact, breakfast has become my favorite meal of the day!

- Chike’s Iced Protein Coffee + 1 Cinnamon-Raisin Bagel: This was awesome for a while – helped break the drive-thru habit. I was using just a half-scoop of the Chikes for each serving, so one bag lasted me a few months. It’s quite delicious!

- Iced Cold Brew Latte + ½ Everything Bagel with Lox: I get wild-caught salmon from Costco at a great price, plus two sleeves of Everything Bagels for $7.99 (so 12 bagels in total, and I only eat half each day). My husband, Paul, makes me a batch of cold brew once a week, and I make a batch of simple vanilla syrup (this recipe, plus I add in a teaspoon of cinnamon). I make my own iced vanilla latte each morning by adding ½ cup of vanilla almond milk (unsweetened), ¼ cup cold brew, 1 tbsp. vanilla cinnamon syrup, and lots of ice with a reusable tumbler I got from a conference years ago, then I put it in my reusable Java Sok sleeve, and the ice literally stays until late afternoon (amazing! I have the medium-sized one). While that’s going, I’m toasting my ½ bagel, then I add cream cheese and salmon to it.

Each morning, I create a healthier, yummier breakfast that (dare I say) is more delicious than my previous one from Starbucks, for a fraction of the cost (and in under 5 minutes!).

Do you realize how much money this one habit makeover has saved my household?

An estimate – after taking into account the cost of the ingredients and subtracting that from the cost of what I’d spend on “my order” from Starbucks – is $800 over the last 8 months.

Even better than that? I don’t feel deprived at all.

In fact, I’m eating something healthier (less chemicals), and saving gas/time of sitting through the drive-thru.

Win, and win.

You’ll pick a habit or routine to work on, answer the questions above, and then break it down into its parts to audit/give it a makeover.

After you successfully solidify the new habit or routine? You simply move on to the next one.

Pssst: you’ll definitely want to check out our 17 powerful daily frugal habits we’re using right now in our own household for more ideas.

5. Fight Your Property Tax Bill

You’re reading the blog of a woman who successfully fought her property taxes, winning an extra $612+ in our household budget over the course of several years.

Meaning, it can be done!

And without hiring someone to fight them for you (though, that is an option, if you’re okay with splitting any cost savings reaped).

Here are the 3 specific times when you should fight your property taxes:

- You hear a neighbor had their property tax lowered

- There was a major disaster near your home

- Your home has a good chance of already being over-assessed

Hint: you might get lucky, like I did, and they won’t increase your taxes from the decreased amount for several years! If nothing else, by winning a property tax appeal you’ll be paying less each year than if you hadn’t fought it because most states and cities have a cap on the increase they can make to property tax each year.

Bonus: Negotiate Rent (Even After You’ve Signed a Lease)

Absolutely.

In fact, I have an article where I interviewed and dished on 9 different strategies used by myself and several other people to negotiate their rent down.

I've even done it, myself!

You definitely want to check it out.

Which of these 5 surprising ways to cut household costs were you most surprised by? Let me know in the comments below how it goes when you take action.

Amanda L Grossman

Latest posts by Amanda L Grossman (see all)

- 9 Easy DIY Dollar Tree Gift Boxes (Super Affordable) - May 22, 2024

- How Can I Get a Discount at Starbucks? (11 Starbucks Discounts) - April 18, 2024

- 5 Surprising Ways to Cut Household Costs (Saved us over $1,412!) - March 11, 2024

Alanna @ Work Online Sites

Monday 16th of November 2020

You have some great tips here. I remember using the rotation of toys method when my kids were younger. It was the best feeling to see the excited looks on their faces when I brought out a "new" toy that had been put away for a few months. That was a great way to save money at that time instead of going out and buying new toys. I had forgotten all about that until I just read this now. Thanks so much for sharing!