What to do after being scammed? Learn how to report a scammer whether you've been scammed on the phone, by text message, or by email.

Have you been scammed, and you're wondering what to do after being scammed so that you can get help, maybe recoup some of your money, and save others from getting duped in the future?

You are not alone – money scammers are lurking everywhere on the internet, and it's only going to get worse.

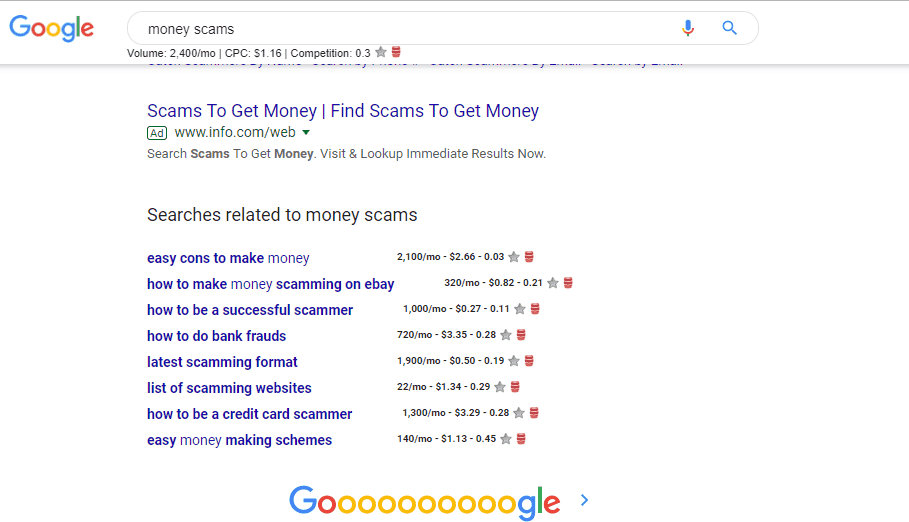

There is a dark side to all of the information and accessibility to information available on the internet, and part of that dark side is information on how to commit money scams.

Not only that, but I was SHOCKED to find out just how many people are actually SEARCHING for how to commit money scams.

Just look at these searches being done on Google, and the number of searches per month:

- easy cons to make money (2,100 searches/month)

- how to be a credit card scammer (1,300 searches/month)

- how to be a successful scammer (1,000 searches/month)

- how to do bank frauds (720 searches/month)

- easy money-making schemes (140 searches/month)

I could go on…but those are depressing enough.

Next up, let's look at what to do after being scammed and how to report a scammer.

How Do You Report a Scammer? What to Do After Being Scammed

Look, scams and financial frauds are not going to go away. In 2017, the Better Business Bureau added 45,401 scams to its scam tracker list. And in 2018? That number ballooned to 47,567.

You need to know what to look for when dealing with money to make sure you don't fall for a scam, AND, you need to know how to report fraudulent activity so that others can be warned off, in the event that you are a victim.

Psst: here's a way to check if your email or phone has been part of a data breach.

Resources to report a scammer:

- How to Report a Scammer to the Police: According to USA.gov, your first line of defense is to report the scammer and/or the fraud to your local police department. From there, you can report to your state's consumer protection agency, and then to federal agencies using the links below.

- Report to Your State's Consumer Protection Agency: You can search here and find your state's consumer protection agency. They can help with things like vehicle wrap scams).

- How do I report a phone scammer?: Phone scammers try to offer free grants, lotteries, product samples/trials, and ask you to invest your money, and they can come in the form of actual people calling you or robocalls and even text messages. If they ask for your credit card information or social security information, then you're likely dealing with a scam. You'll want to report these by submitting a complaint to the FTC. To protect yourself for the future, place your phone number on the national DoNotCall list. Then, if you receive marketing calls still, you can submit a claim through the DoNotCall.gov site (these are different from scams, though. They might just be people trying to sell you something, which is not a scam).

- FBI Scammers List: You can look through the FBI Scammers List here (this is the Cyber's Most Wanted list), and keep yourself informed or do a search any time you think you're dealing with a money scammer. Chances are, you're probably dealing with a fake name though. So, there are better ways to take care of the issue listed here. Here's an FBI list of ongoing internet fraud.

- How do I report a Suspicious Email:

- Did you receive unsolicited e-mail offers or spam? Forward your messages to the Federal Trade Commission at [email protected]. You'll also want to file an official complaint with the FBI's Internet Crime Complaint Center (ITC3). They'll process them, and may or may not refer the complaint to federal, state, local, or even international law enforcement agencies for investigation.

- How to Report Identity Theft: Visit Identitytheft.gov to both report identity theft, as well as to get help with overcoming it.

- How do I Report an International Scam?: You can report international scams through econsumer.gov, which partners with 35 consumer protection agencies across the globe to protect consumers from scams.

- Report on TruthinAdvertising.org: Another place to report a scam is this site, which publishes scams so that others can be warned.

After you've reported all this, you might want to consider filing a class action lawsuit (if you think there are many other victims out there), or even getting your case heard on court television shows.

One way to keep you all (and myself) from falling for money scams is by continuing to write articles and show word-for-word scam emails, scam text messages (how to stop text spam), scam checks, etc. here on my blog.

Just look at how this has helped others over the years.

Fraud Examples that Have Helped Others by Being Published, Word-for-Word

Over two years ago I published a post detailing how someone tried to scam us out of money on Craigslist. We had listed an item for sale and were approached by a buyer who was going to have their freight company pick it up for shipment to New Hampshire.

Psst: here's how to identify a craigslist scammer.

This person sent a fake email from PayPal saying that $900USD (the item had been listed for $500) had been sent to our account but was temporarily placed on hold.

We were advised to go to the nearest Western Union Office and send $400USD (the cost of the buyer’s shipper’s pick-up fees) to the Transport Agent (a man in Maryland). PayPal would release the funds to our account once they received a scanned copy of the Western Union receipt.

We knew that receiving this money was about as likely as receiving that US$65,000,000 I have coming to me from a wire transfer from the Nigerian government (yes that scam is still alive, and in the last email I received it was being run by a Mr. Bonnet Wealth).

However, I played it out through emails so that I could write about it to warn others. I am very glad I did this, as over the last two years I have received numerous emails and comments from people saying that they had almost fallen victim to this very scam, except that they decided to google certain parts of it, found my article, and knew to not send any money.

HT commented,

“Thank you for your post and warning about Mary. I posted furniture for sale last night and by this morning had VERBATIM the same messages you described above from MARY. Only exception is the first message came from: [email protected] and then it was followed by the one from Mary at Mary Rose Wright [email protected]…Had it not been for the “spidey senses tingling” and finding your post, I may have gone down the same path you did. I hope others find this as well. The scam must be working, or they wouldn’t still be doing it.”

IW commented,

“Well, over a year later this scam is still alive! I posted an ad to craigslist, furniture, $500. Thanks, HT, for posting the email addys, as that’s how I found this article. My first email came from Stephen McIntyre [email protected] asking “for how long have you been using it?” Second from Mary Rose Wright [email protected] with the verbatim message as above. As HT said, my spidey sense was tingling! Thanks, Amanda, for posting this article!”

This article, and others, have literally saved others thousands of dollars!

Fraud List – Watch Out for These Money Scams

Because of that, I think it’s time for another article about the current money scams out there. While I have not fallen for any of these and so have no experience with them, I’ve included as much detail as possible from others who have.

- Timeshare Buyback Scam: Times have been tough for people over the last several years, and the logical response has been to offload debts and liquidate assets in order to increase monthly cash flow. With the rise in people trying to sell their timeshare obligations has come a rise in timeshare buyback scams. The way this scam usually works is the con artist tells the timeshare owner that they have a buyer lined up for their property. Then the seller is asked to make a deposit or payment for any number of reasons, typically more than $1,000. Of course, after they make this deposit the scam is over as the con artist moves on to the next victim. It should be noted that some of these con artists own companies, making them sound even more legitimate. (Psst: here is what is a timeshare and how does it work).

- Social Media Money Scams: Old scams with new faces show up on each online platform that is invented, especially with social media. A woman in El Paso was almost scammed out of $2,800 when someone perused her Facebook profile and updates in order to glean information and gain her trust. The con artist accurately imitated her grandson during a phone call, and said he was in jail and needed money. Unfortunately, she sent it. However, she quickly realized what had happened after calling her real grandson to confirm that it had not been him. She was able to cancel the transaction.

- Vacant Home and Foreclosure Rental Scam: This particular scam was carried out by a licensed real estate agent, though others have done this as well. Basically, people are claiming title to properties that were left vacant during the recession, and then renting them out on informal sites like Craigslist. The homes are actually owned by banks who foreclosed on homeowners. Another form of this rental scam is by homeowners themselves who rent out a house that their mortgage company is in the process of foreclosing on. Tenants generally have 90 days to get out after the formal foreclosure occurs but were never aware that the previous homeowners were in formal proceedings with their bank.

- Ransomware Allegedly from the Department of Homeland Security (DHS): The FBI has recently reported a new scam where ransomware uses the name of DHS to accuse victims of violating various U.S. laws. At the same time, the ransomware locks their computer. To unlock their computers and “avoid legal issues”, victims are told they must pay a $300 fine via a prepaid money card.

Next up, I'm going to share with you our own experiences with being scammed.

Credit Card Fraud – Our Own Money Scam Experience

I can imagine someone walking around Brooklyn, New York right now with new shoes, new clothes, furniture, and a small appliance or two.

They're probably smiling after all of these purchases, smugly satisfied with the good fortune and booty that has come their way. I’m not really certain of what $851.42 can buy a person in a department store as I have never spent this much of my own money on one before, let alone somebody else’s money.

But someone else sure had the audacity to do so using Paul’s identity and our credit.

It started about a month ago when I received some mysterious 800-number phone calls on my cell phone. I don’t like to answer my cell phone and specifically never answer it from a number I don’t recognize. The test I usually do is if the unrecognizable number leaves a voicemail, then they were calling for a reason. If they don’t leave a voicemail, then there was no reason for them to have called in the first place or for me to pick up the phone the next time they dialed my number.

This time it was a 1-800 number that left a voicemail, and it turned out to be our credit card company’s fraud department.

There had been two purchases made at an undisclosed department store in the amount of over $400. Since this is not typical purchasing behavior for us, they rightly called to verify that we had, in fact, not made these purchases.

The card was in our possession, which meant that the credit card numbers had clearly been compromised.

The only problem? Paul had already left for a business trip and his credit card was the only form of payment for him (coincidentally the magnetic strip was not working on his debit card anymore; he had ordered a new one right before he left).

Over the next week while Paul was in Dallas he was declined on every single purchase he made – gas, restaurants, hotel charges, etc.

To be fair, the credit card company was protecting themselves; so long as the card stayed open, someone else was making out pretty well on either the store or the credit card’s dime.

After another $851.42 in purchases in a Brooklyn department store, we finally talked the credit card company into sending Paul a new credit card overnight to his hotel so that they could close the account. It was a bad situation for all of us, but I felt really bad for the credit card company/department store that was on the hook for the charges.

The $851.42 showed up on our statement. We had to fill out an affidavit to attest to the charges that were fraudulent, and then fax/mail this in within 5 days. When it came time to pay our credit card for the month, I subtracted the fraudulent charges from what was ours.

Unfortunately, this resulted in us getting charged interest of $28.99. Another call into the credit card company and they took the interest charges off. They were still processing the fraudulent claim at the time, but in the end, they ended up subtracting this from what we owed.

Unfortunately, again, there was another statement issued. So we had to call in again for the interest charges to be taken off of the account.

In the meantime, we also had to call the companies that automatically were paid from this credit card and change the card with each of them – a real hassle.

In a nutshell, the whole thing was a big headache. We were fortunate in that our credit card company was vigilant over our account enough to see that there were fraudulent charges being made. Our credit was not hurt, our identity was not stolen, and we now have the new credit up and running.

I hope I've shown you not only that financial fraud and money scams are alive and well, but how you can report a scammer, whether you've been scammed by phone, text message, or email.

Have you ever fallen victim to a scam? Are there any scams that have recently come across your inbox or into your life? I've opened up commenting on this article so that you can please warn others below.

Amanda L Grossman

Latest posts by Amanda L Grossman (see all)

- 5 Simple No-Bake Thanksgiving Desserts (They’ll Ask for the Recipe!) - September 16, 2024

- 9 Yummy Summer Snacks for Pool Parties (You Can Make Ahead) - July 23, 2024

- 9 Financial Goals for Married Couples to Conquer Together - July 17, 2024

Sue Fairweather

Monday 19th of June 2023

Losing money can be awful. It has a tendency to send you into a downward spiral of despair, which is exactly what happened to me. I invested money in a platform, and everything seemed legitimate up to the point when I realized I had been deceived. I was depressed for days before a friend mentioned that he knew of a platform that could help. I gave them a chance despite my reluctance, and it ended up being the best choice I've ever made. My money was promptly returned. Please exercise caution and make sure you are aware of what you are investing in.

Michele Perez

Wednesday 13th of April 2016

I had the exact scam happen to me thes last few days I am looking at the check but it really doesn't look real any bank can tell you that but , the whole story sounds fishy to me so here I am looking at the FBI fraud page with u guys so what do I do with their fake check, from which I don't think any bank would deposit because it looks so fake, tear it up give t to the bank call the FBI this check is 2,990,00. Crazy shit I think they thinking get you to deposit the check you send real money to them in oh and they want to to black out you account number because u send them their 1,2000 then do it again using money gram, mmmmm, then u keep 300.00 for your self but really when the check become found out t a fraud you pay back all the money you sent to them right.

Jane cavallisan

Wednesday 3rd of June 2015

i waS forwarded an email to have my car wrapped from my boyfriend. Perrier was the company this time who would pay me $300 a week to allow them to advertise a new spa ruling water in the U.S. and Canada market. They wanted a pic of my car, sent me the same cashier check from a Mr.Fuller and put me in touch w/ the company that would do the work in my area. I was going t o open a separate account to deposit the check. I understand then you are on the hook for international wire transfEr charges to the tune of. $1800. Or so. I decided to contact Perrier. All the email like sites that looked legit had non working sites. 1. The check did arrive. I was to deposit it and let them know when I received it. Then they wanted a pic. Of my car. Any huge company is very careful with their advertising. There had been no paperwork. They emailed me a form to fill out and fax back with my signature in agreement. 2. Then they said they has received the acknowledgment. Wrong! I had not sent it. I had never spoken to them on the phone. Odd too. I called the police fraud unit. The receptionist didn't know and suggested I call back and speak with someone from the squad. Today I got 3 calls from him with a strong African accent asking to speak with me using my first name. I dodged. Last night I googled car scam and saw this was the latest. Ironically after I got their offer, I got another from a beer co. Out of San Diego for the same service but offering to pay me $400. A week. When I inquired, asking for more info. I never heard back! Saved by a questioning mind just in time! The company would have contacted you more directly. In my case there was an email from a woman @ Perrier introducing me. The email bounced back, no domain name...clue # 4. Beware!

Marissa@Financetriggers

Sunday 15th of September 2013

These are awful awful scams! I hope everyone will be more vigilant and do their research first before acting up on anything out of the ordinary. Hats off to you and for writing that article before. I'm sure you have saved so many people from terrible scammers!

Crystal @ Prairie Ecothrifter

Thursday 12th of September 2013

Whenever we list a room for rent, we get at least 3 scammers offering to wire us like 6 months of rent if we would send cash to their moving company. I have found that you can avoid almost all of those type of scammers by operating cash-only in most circumstances...

FruGal

Friday 13th of September 2013

That's good you guys know what to look for because it's the same scam that keeps popping up.