These 13 simple strategies will help with how to hide money from yourself so that you can stop spending on unnecessary things.

Are you having trouble saving money because it's just there, in front of you, begging to be spent?

That's one of the many reasons why you might be wondering how to hide money from yourself.

We'll go over others, too.

But first up, let me quickly share how to hide money from yourself.

Where can I hide money so I don't spend it?

Saving money is important because life can throw you some sucky financial situations.

But if you're not able to do it, then you might need to figure out how to hide money from yourself.

Any roadblock you can put between yourself and your money makes it more likely that you won't spend it.

We're going to call these “money roadblocks”.

Money roadblocks could be something that physically hides the money from yourself, or it could mean putting into place things that make it a bit more difficult or annoying to access your funds so that you're less tempted to overspend.

Psst: did you know that you can train yourself to not spend money?

Ways you can “hide” money from yourself with a money roadblock:

- Opt out of your bank's overdraft feature so that you physically cannot spend more than you have

- Stash extra money in a savings account at a different bank than your checking account so that it will take between 3-4 days to transfer (versus 24 hours for the same financial institution)

- Once you've overspent in between paydays, freeze your debit card and credit cards in a block of water in your freezer until your next check (for real – people actually do this!)

- Remove your debit cards, credit cards, and bank account information as a payment method on all online store accounts (great way to help you stop spending money online)

- Buy Certificates of Deposits (CDs) with some of your cash, where there's both a time delay and a penalty to cash out

- Move more money into your savings account, since you can only make a certain number of withdrawals from these accounts per month

Ways you can physically hide money from yourself:

- Overpay on your taxes (you won't be able to access the money until you file your taxes the following year)

- Automatically deposit one person's paycheck into a savings account, so that you don't even see the money come into your house

- Use an automated savings app, like Oportun, where they stash money for you from checking to savings without your input (using an algorithm that analyzes your spending and bills)

- Split your direct deposits for your paycheck (many employers allow this) and automatically send some of your money directly to your savings account

Pssst: were you looking to physically hide money from yourself in your home? Here's my article on creating homemade diversion safes.

Why You Would Want to Hide Money from Yourself

My husband, Paul, and I are all too aware of the type of sticky financial situations life can throw at you.

In the summer of 2008, Paul was laid off from his position. Just two weeks later while he was visiting me in Florida with the extra time on his hands, I came home early from work with a box of my cubicle belongings, and a tissue in hand.

You guessed it – I was laid off, too.

I also watched both sets of my parents go through bankruptcy, which was after they each went through the financial and emotional upheaval of divorce.

All of this has left me slightly fearful when it comes to money.

Maybe not “fearful”, but certainly respectful of it.

Even though money might be coming in one day, it’s not necessarily going to continue flowing in the next, so we should not spend all of our take-home pay.

Other reasons to save money (and hide it from yourself, if you're not good at saving money)?

- Who is to say that we won’t experience a medical situation?

- What if one of us cannot work one day?

- What if social security continues going downhill and there is nothing left for us when we retire at the future retirement age of 85 (looks like it’s heading that way, right)?

Even if you're not overspending, frequently experiencing buyer's remorse, eating out too much, stuck in bad spending habits, or in debt, if you were to spend money as if you're going to continue at your current income level, then you could actually find yourself in a pickle rather quickly.

I am not a doom and gloom conspiracy theorist by any means, but I have a healthy respect for the future and an even healthier respect for the unknown. This is why I am such a diligent saver. Savings are not an option for me but a necessity.

While some of the situations I have mentioned were self-induced, others were not.

Whether self-induced or not, having a cushion of savings will make any situation much more palatable. It is much more digestible to place money restraints on yourself than to have them placed on you.

And by choosing to place money restraints on yourself and living below your means, you will put yourself and your family in a much better financial situation for when life decides to throw that curve ball.

The reason is twofold:

Money restraints equal extra savings in the bank, and also teach you to live on a lower income, thus making the transition to one income much more smoothly.

Here are several ideas for “how to hide money from myself” that will help you to jump-start your savings, and deflate your lifestyle (11 examples of where your lifestyle may have inflated).

Hint: While “deflating your lifestyle” really doesn’t sound like fun at all, what will be fun is watching the balance in your savings account grow at a much faster pace.

Strategies to Hide Money from Yourself

Now, let's dive into each of these strategies to help you “hide” money from yourself.

1. Opt Out of Overdraft Protection

When you opt-in to your bank's overdraft protection, it means you will allow yourself to spend money that's not in your checking account. And on top of that, to get dinged with a fee for each over-withdrawn charge.

That can add up quickly!

Call your bank, and submit the paperwork necessary to opt out of this “convenience”.

2. Get a Savings Account at a Different Bank

While most people try to keep bank accounts at the same bank for convenience, it's best for you to keep your checking account at a different bank than your savings.

Why?

Because if you do, then it'll take 3-4 days to transfer money from savings to checking (instead of around 24 hours if it's at the same banking institution).

Consider that 3-4 days a self-imposed, “cooling off” period.

3. Freeze Your Debit and Credit Cards in-Between Paydays

Do you spend all of your paycheck well before your next payday comes around?

An easy way to keep from spending any other money – a money roadblock – is to physically freeze your debit and credit cards in a block of ice in your freezer.

Seriously!

I don't know who came up with this idea first, but people have been using it for a long time.

4. Empty Your Online Payment Methods Out

Go into each of your online shopping hangouts (Amazon, J. Crew, JCPenny, and anywhere else), and delete all of your payment methods (your bank account, your credit card, your debit card, etc.).

Don't forget to remove your payment method information from your browser, such as from Google Chrome.

This will give you an added inconvenience before buying something online – a moment to rethink your purchase, if you will.

5. Absorb Your Extra Cash into Certificates of Deposits (CDs)

Not only will you earn interest (more than from a savings account) by buying CDs with your money, but if you were to cash them out early, then you'd:

- Pay a penalty

- Have to physically go into the bank to make the transaction

6. Move Your Money into an Account with Withdrawal Limits

Did you know that you can only withdraw money from a savings account up to 6 times per month? It's a federal law. By moving more of your money into a savings account, you can stop yourself from tapping it so much.

(Hopefully, you wouldn't even get close to 6 withdrawals from savings each month).

7. Overpay Your Taxes

Hardly anyone wants to overpay their taxes. But it's definitely a way to ensure that you're “saving” money (until it comes back to you next April when you file your return).

Here's more info on overpaying your taxes each paycheck so that you can save up for a refund. Hopefully, you'll then put that refund into a savings account!

8. Live on One Paycheck in a Two-Paycheck Household

If you are a two-income household, you can choose to live on one person’s paycheck only.

And the way to make this work is to directly deposit the other person's check into a savings account so that you're less tempted to spend it.

This could act like a simulation for the future in case one of you loses a job, wants to start your own business, or wants to stay home to raise children, or it could be used as a strategy to boost your savings dramatically.

Paul and I currently do this; we live on his income and use my income for savings for both short-term and long-term goals.

Granted, he makes a sizable amount more than I do, so to ensure that we could still survive on my income alone, I have an Excel sheet budget where I calculate our costs and living expenses.

We can do this with either one of our incomes, but it would be super tight on mine (sounds like a fun savings challenge to me!).

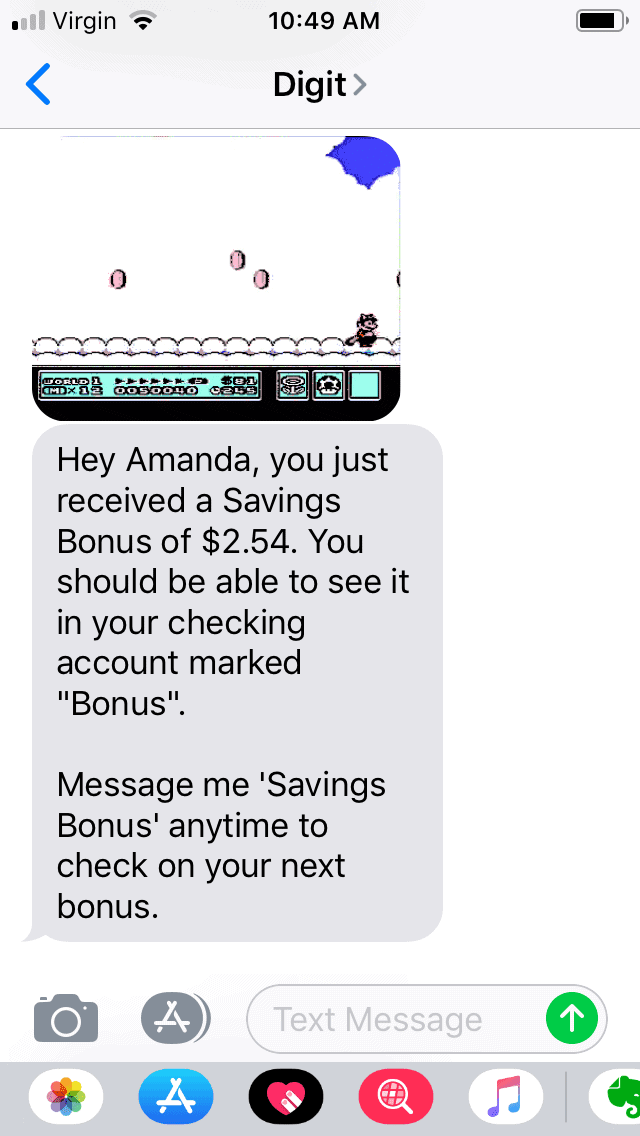

9. Use an Automated Savings App

Did you know that there are savings apps out there that use an algorithm to figure out your spending, and then automatically pick small deposits to swipe from your checking account to your savings account?

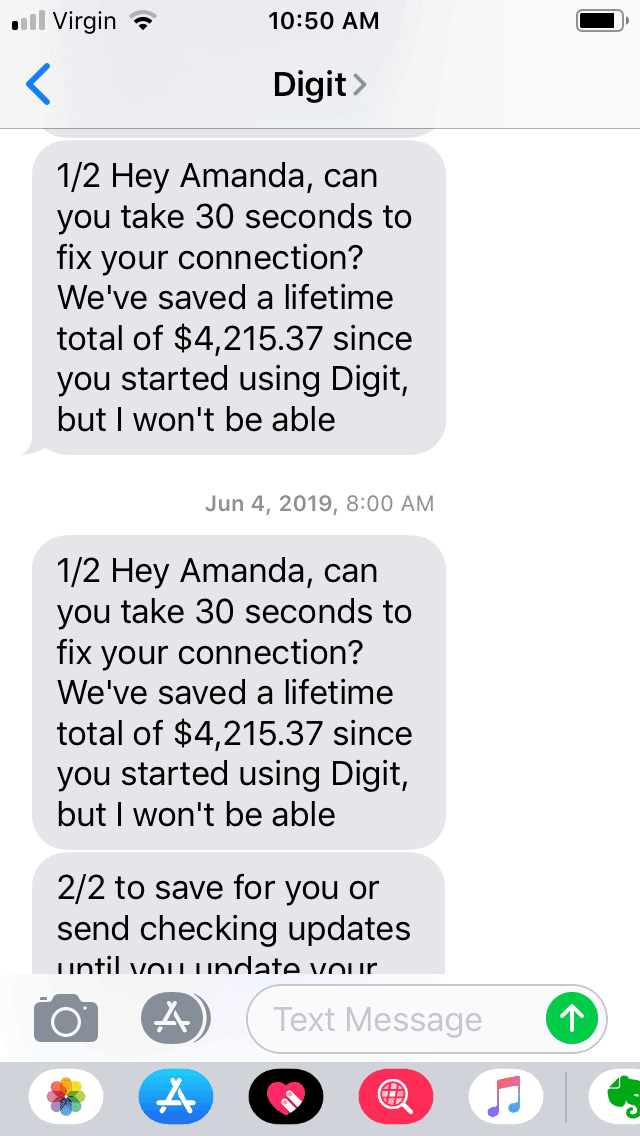

I used Digit.co for a while (now Oportun) and actually managed to save over $4,000 with them without paying much attention to it (over a few years). That was pretty sweet!

They also will pay you a bonus for having your money with them (like an interest rate).

10. Split Your Direct Deposits

It didn't occur to me that I could split my direct deposits from my paycheck into both my checking and savings accounts. In fact, many employers now offer this option.

Instead of putting all of your money directly into checking each payday, choose a percentage to put directly into your savings. You won't even miss it (after a while).

11. Pay a Pretend Mortgage

Many financial gurus give this advice: if you want to purchase a home, begin “paying” a mortgage into your savings account to see if you truly can afford one.

Fortunately, homes in Texas are much cheaper than where I am from (the Northeast), so you can actually find one that is close to what you would pay in rent anyway.

What would be a good exercise is to take the mortgage that the bank feels you can handle (and the bank will balloon this figure), and pay this every month into a savings account. Not only will you build up money towards a down payment, but you will get to determine what monthly mortgage payment you are comfortable with, and not the one the bank thinks you can afford.

Paul and I ensured that our mortgage payment could be paid by either his salary or my salary alone, along with all of our other monthly expenses. That means we took the paycheck with the least amount in it (mine!) and based our comfort level on that.

12. Live on Last Year’s Pay

Though you may not have received a pay increase in the last few years due to the recession, you can always go back to living on the income you made from an earlier time period, such as when you graduated college and got your first job or three pay increases ago.

Look up an old pay statement, or look in the archive of your bank account, and figure out what that amount used to be.

Adjust your spending accordingly, and have the extra pay automatically withdrawn into your savings account.

You used to be able to live on this amount, so chances are good that you can still do so (unless you have suffered from considerable ‘lifestyle inflation’, added to your family, etc.).

13. Execute Your Emergency Financial Plan

Do you have an emergency financial plan?

This is your plan for when you lose a job, or have another small financial catastrophe hit. What bills can you give up (cancel cable, internet, cell phone plans, etc.)? Are there debts (mortgage, student loans, credit card debt, etc.) that you are overpaying on that you can go back down to the minimum requirements to increase your cash flow?

Perhaps you can defer your student loan payments (if you have them), or even temporarily suspend your car insurance if you are no longer driving it around.

With my insurance company, I was able to do this while traveling abroad. For $10 per month, we could keep insurance, but have it temporarily suspended, thus keeping any discounts we receive for tenure.

While you may not want to do some of these things while just pretending, execute a few of them and reap the savings to build up your emergency fund. If you don’t wish to do any of these, it is still a good idea to take this time to write up an “I lost my job” budget in Excel.

Remember that Limits Breed Creativity, NOT Deprivation

It may seem like putting limits on yourself financially – such as incorporating a budget, and setting up automatic withdrawals to your savings each month – is limiting your life.

But I challenge you to think differently about this.

I am a budgeter at heart, but even I feel limited sometimes by my self-imposed boundaries.

If I sit around and brood about all of the things I cannot purchase, or how I am nearing my spending limit and it’s only three-quarters of the way through the month, then I would miss out on all of the great opportunities out there.

For one, I never would have learned the Drugstore Game, which led me to write six columns called “Frugal Confessions” and start this blog!

Having unlimited money would have caused me to spend more of it (necessity is the mother of invention, not abundance) as I never would have discovered great tools like Craigslist, followed many of the blogs that I do with people dedicated to saving me money, learned how to invest my precious resources, save for retirement, etc.

Having limits in my life has only served me, not caused me deprivation.

Have you taken advantage of yours?

Do you place financial restraints on your household in order to save more money? I’d love to hear about it!

spiffi

Wednesday 9th of September 2020

I remember one May, after the end of my first year at college, my friend and I were talking. She had just started her summer job - she was making good money and was already seeing that it was going to slip out of her fingers. The way she put it, when she would go to the ATM and go to take cash out, just SEEING that healthy balance from her paycheque, made her "feel" rich - and she would take out (and spend!) more money than she should - since she was supposed to be saving money to pay for the upcoming school year. When I suggested that she open a second bank account, and either deposit her cheques into that account, or move money into it immediately after her pay hit the account, so that she wouldn't *see* that money - she looked at me, shocked - she had never even thought about having a *second* bank account! Not only did she open a second account, but she opened it at a totally different bank, and didn't allow herself to have a debit card on that account :D She would deposit her paycheque into that "secret" account, and then withdraw only the amount of cash she was allowed to spend - and then put that into her account that had access via ATM. These days I do the same thing, tricking myself, using online banks and automatic withdrawals scheduled to hit my primary account immediately after payday - by the time I look at my bank balance, there's nothing to see - all the money has been shifted around to the various accounts.

Amanda L Grossman

Monday 14th of September 2020

So amazing that you helped your friend out like that, spiffi! It obviously made a difference to her finances - being able to "hide" money from herself like that. Thanks so much for taking the time to comment with your own money hiding experiences.

valleycat1

Friday 4th of February 2011

Excellent article. Tip 1 is the advice my grandad (who was in banking & insurance) gave my parents when they married & they have passed along to all the kids. He specifically advised buying a house you can comfortably afford on one income.

We also pay a 'pretend' car payment since we paid ours off a few years ago, so by the time we're ready to buy again we should have the money to pay cash.

FruGal

Friday 4th of February 2011

valleycat1: Hello! Thank you. That is great advice he passed down, and also a great idea on the car payment!

krantcents

Wednesday 2nd of February 2011

Mine is rather simple, I set up a payroll deduction to max ($22,000) my 403B. I bank an additional amount ($12,000) for our IRA and Roth IRA. Then we live on what is left.

FruGal

Thursday 3rd of February 2011

Great job krantcents! Thank you for sharing your strategy.

Squirrelers

Wednesday 2nd of February 2011

You're clearly speaking from wisdom here, and I totally agree with the notion that the money might be coming in today, but it could stop at some point. Things happen - they will happen, it's just realistic. Might not be job loss, but could be other financial losses. It's good to arrange one's financial life with eyes wide open, and plan savings accordingly.

Sustainable PF

Wednesday 2nd of February 2011

You really do need to plan aggressively. Since we bought our new (old) house we've sunk $10,000 into it for energy retrofits, our washing machine got a golf ball size hole in the drum, our cat needed $600 worth of vet work, our house was broken into and $1500 worth of stuff stolen. Christmas happened (as usual), we finally got life insurance (and paid for the year up front). Some other things too.

If we hadn't been financially prepared to deal with the planned and unplanned we would be up to our eyeballs in debt.

Amanda L Grossman

Wednesday 2nd of February 2011

I am still so sorry to hear about the break-in. And yes....homes have a way of sucking money out of you:). Last year we had to replace our Central A/C and heater for the downstairs--yipes!