Here’s a roundup of the best FREE debt payoff challenges to help whip your debt payment plans into shape. Onwards and upwards!

You’ve got debt you want to lose, like yesterday.

And guess what? As someone who has paid off $59,496 in debt a full ten years earlier than my creditors wanted me to, I can tell you that there are faster ways to pay off your debt than what you’re currently doing.

One of them is taking a debt payoff challenge.

Debt-free challenges really should be part of your debt-free plan, because they’ll help turbo-boost your results.

Both by motivating you to keep going and keep finding more ways to throw money at your creditors, and also by teaching you a trick or two that will help pay your credit cards and other loans down faster.

I’ve taken the time to collect the BEST and FUNNEST (when possible) debt payoff challenges around the internet.

They’re all free for you to take, and I guarantee that they will help you pay off your debt faster than if you didn’t take them at all.

So, check out the debt payoff challenges below and get started with one.

My Favorite Debt Payoff Challenges

Here you’ll find my absolute favorite debt payoff challenges – these are the ones you want to try out first to get you living that debt-free lifestyle, ASAP.

Debt Payoff Challenge #1: The Debt Bustin’ Challenge

How can I not start off with my very own free debt payoff challenge?

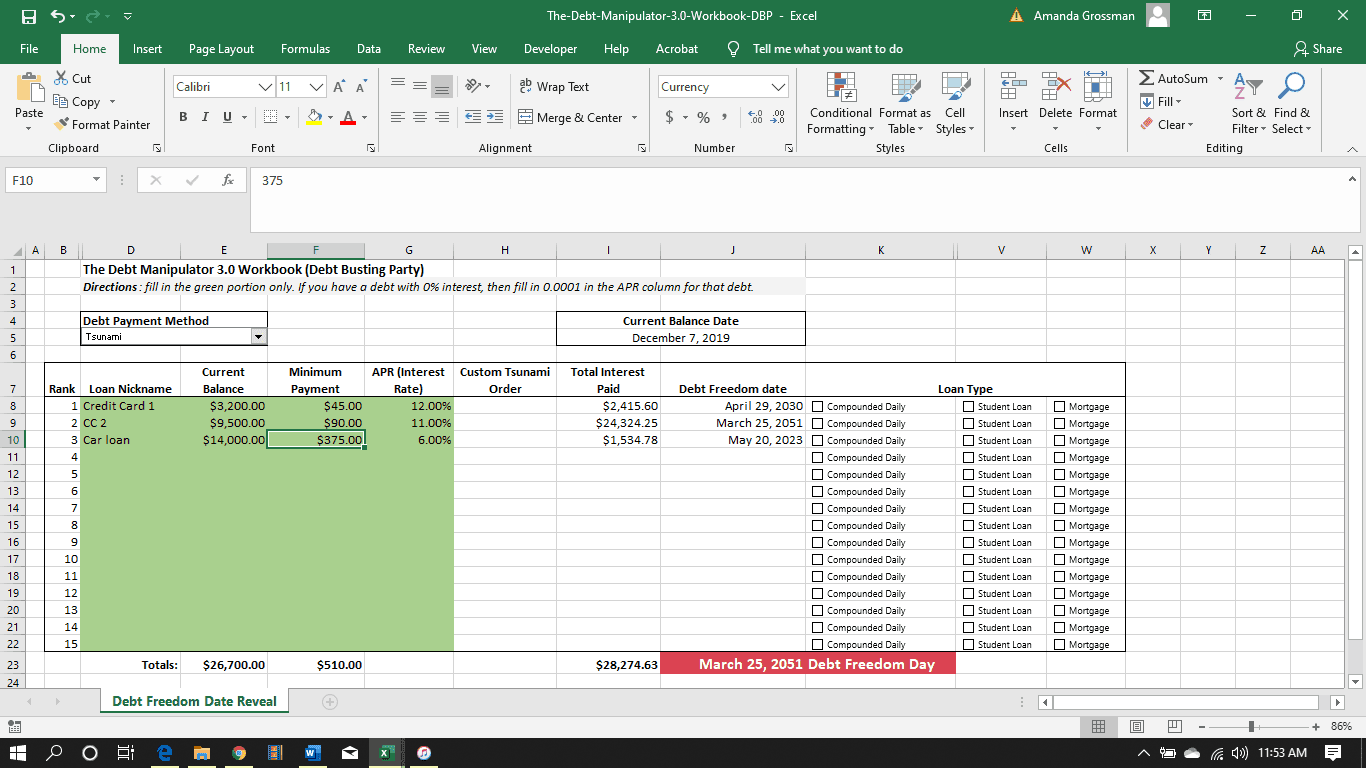

It’s called The Debt Busting’ Challenge, and I created it as a lead into the old debt payoff course I used to sell called The Debt Manipulator 3.0.

While I no longer sell the course, the mini-challenge is one smart way to get your debts in order and see them for what they are.

Take this debt challenge to:

- Get all your debts organized in an Excel sheet by interest rates and balances

- Find out which debt payoff method you should use by running a few simulations in the Excel sheet (it’ll actually tell you WHICH debt payoff method – snowball, avalanche, or tsunami – will cost you the most and the least in interest)

- Get your *actual* debt payoff debt, based on the stats you input into the debt payoff calculator (again, all in the Excel sheet)

- Get ideas for how to boost your cash flow in order to actually pay your debt off faster

Click here to take this challenge for free.

Psst: need some examples of others who have gone before you in a quest to pay off debt quicker? Here's examples of how to get “gazelle intense”, and gazelle intense meaning.

Debt Payoff Challenge #2: Debt Free in a Year Challenge

Here’s my personal challenge for you – what would it take for you to get completely debt-free in one year?

I actually sat down with the numbers and did this once to see what we would need to pay each month in order to pay off our mortgage in just one year.

It was EYE-OPENING.

Psst: Here's my whole walk through on how to pay off debt in one year.

Not because it felt way out of reach, but the exact opposite. You see, once you sit down with actual numbers in front of you, your brain can start thinking about the “how” instead of the “here-are-107-reasons-why-we-can’t-do-this” that it usually works on.

Here’s a debt payoff calculator where you can input the date that you want to be out of debt. SO, fill in all your info about your debts, then change the date to one year from today.

What do you get? How much would you have to pay each month to reach that goal?

Start brainstorming around that.

Chances are, you might not reach your goal. But when do you KNOW the numbers? You’ll get closer than if you just keep blindly sending in your minimum monthly payments.

Debt Payoff Challenge #3: 52-Week Debt Payoff Challenge

You’ve likely heard of those 52-week Savings Challenges (like these 52-week Christmas savings challenges). Well, if you’re in debt-payoff mode, then they don’t exactly fit your situation.

SO, instead of doing a 52-week challenge that lets you save up a certain amount of money, use it to challenge yourself to send the designated amount to your creditors each week for the next 52 weeks.

Above and beyond your minimum payments.

You can use any of these free printables, and then just cross off “savings” and write in “debt”:

- Send an extra $1,378 to debt in the next 52 weeks

- Send an extra $1,000 to debt with this money savings chart (pick and choose)

- Go all in by sending an extra 10,000 over the next 52 weeks to debtors

Debt Payoff Challenge #4: 3-Month (90 Days) Debt Snowflake Challenge

Have you heard of the debt snowflake method to pay off your debts?

Hint: it's not the only debt payoff method. Here is my article on Suze Orman vs. Dave Ramsey, as well as what is the best strategy for paying off debt.

It basically means you gather up all small amounts of extra cash you have on hand and put it towards your smallest debt payment first (a psychological win). So, extra birthday cash, or a refund on something, or a rebate, etc.

The debt snowflake challenge I have for you is to *actually* keep this going for 3 whole months.

Because if you can keep this going for 3 months (90 days)? Then you’ll likely keep going with it until you get to your juicy, debt-free date.

How should you track this sort of debt payoff challenge?

Glad you asked!

You could either:

- Use a page from a Mandala coloring book (here are some free Mandala coloring pages you can download)

- Get a blank sheet of paper and create one new line on a snowflake for each payment that you make (start from the middle, and move out from there)

- Print out one of these 7 visual debt payoff charts

That’s right – I said for each payment, not for a specific amount you send in.

Since this challenge is all about micro-payments, you get to fill in one part of this snowflake for every payment you send in (whether it be large, or small).

But here’s the catch: ONLY for the payments that are above and beyond the minimum amounts. You want to reward yourself for paying extra – anything extra, even very small payments – on your loans, not for just paying the minimum that was due anyway.

Psst: here’s a really cool site about progress mapping, where you can read about filling in a visual tracker for your micro-movements towards any goal!

More Debt-Free Challenges

I’ve got even more debt-free challenges for you. I’ve put these in a separate category because I haven’t personally gone through them.

Debt Challenge #1: 7-Day Debt-Free Challenge

In this free 7-day debt challenge, you’ll learn ways to gather $500 in extra debt payment fast, understand your spending better, and get committed to the overall debt journey.

I haven’t personally gone through this free mini-course, so if you do, let me know in the comments below what you think.

Debt Challenge #2: Debt Elimination Plan Challenge

Cash University has a module on creating an Emergency Elimination Plan.

It’s something that you should use if you are in a bad way – so deep in a hole that you might have to declare bankruptcy.

Basically, it’s a quick walk-through of how to create your own debt repayment plan based on what you can actually afford. This means you’ll have to individually negotiate with your creditors on both interest rates and repayment plans (that’s the challenge).

Debt Payoff Challenge #3: 30-Day Debt Loss Challenge

Credit Karma’s got a 30-Day Debt Loss Challenge where they challenge you to one new thing to do each day, for 30 days, in order to send more money into your debt repayment.

Think things like going without Starbucks for 27 days, and negotiating your cable bill.

Psst: are your debts in collections? Here’s my article on how to deal with a debt collections agent.

Debt payoff challenges should definitely be part of your overall debt-free plan. So, choose from above, and give your debt a swift kick out the door!