Debt Payoff can take years. Stay motivated with instant gratification debt payoff trackers and visuals.

Let’s be honest: debt payoff can take years (even if you’re getting gazelle-intense). How are you supposed to sustain your motivation to stay the course until you get to that sweet, debt-free future?

That’s where visual motivators and progress bars – like the kind used during a middle school fundraiser assembly – come in.

They can really help with any type of financial goal, especially with your debt payoff.

Free debt payoff worksheet PDFs are just one way to do this – we’ll offer those as well – so let me give you a continuum starting with the nerdy, numbers examples on one side and ending with what inspired this entire post by its sheer coolness.

Psst: you'll definitely want to pair these with a debt payoff challenge.

Free Printable Debt Payoff Worksheet PDFs

We'll start off with some free printable debt payoff worksheets – the kind that'll get you excited to work on your debt journey.

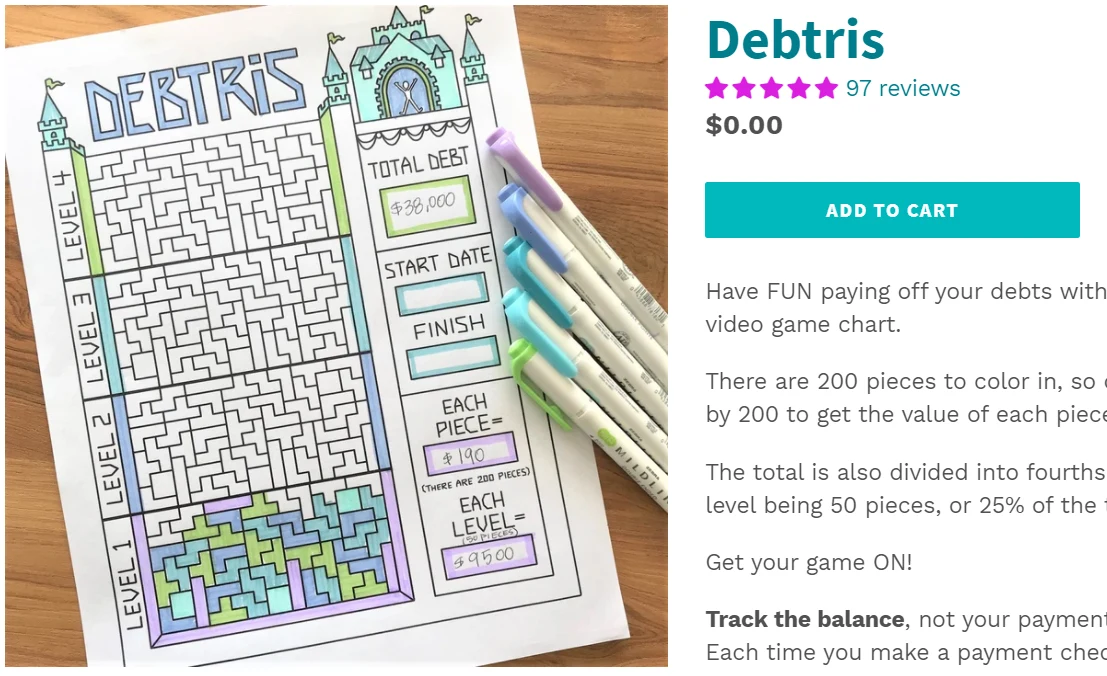

1. Free Debtris Payoff Chart

Debt Free Charts offers up a really cool visual debt payoff chart (pdf) in the form of Tetris!

Here's how you use it:

- Divide the debt you want to pay off by 200 (that's the total number of pieces to color in). This is how much each piece is worth.

- Add up how much each level is worth, so that you can visually get a snapshot of how you've paid off as you advance through the “game”.

- Each time you make a debt payment, color in the number of pieces that represent what you did.

- When you color in your last piece? Well…you will have paid off all of your debt!

2. Free Percentage-Based Debt Payoff Printables

Wow, check out these five free debt payoff printables where debt paytoff is tracked by percentage paid down.

These would be great for credit card debt payoff, student loan payoff, or any other type you might have.

I just LOVE the color scheme.

And there's another color scheme (blue and green) you can download, too!

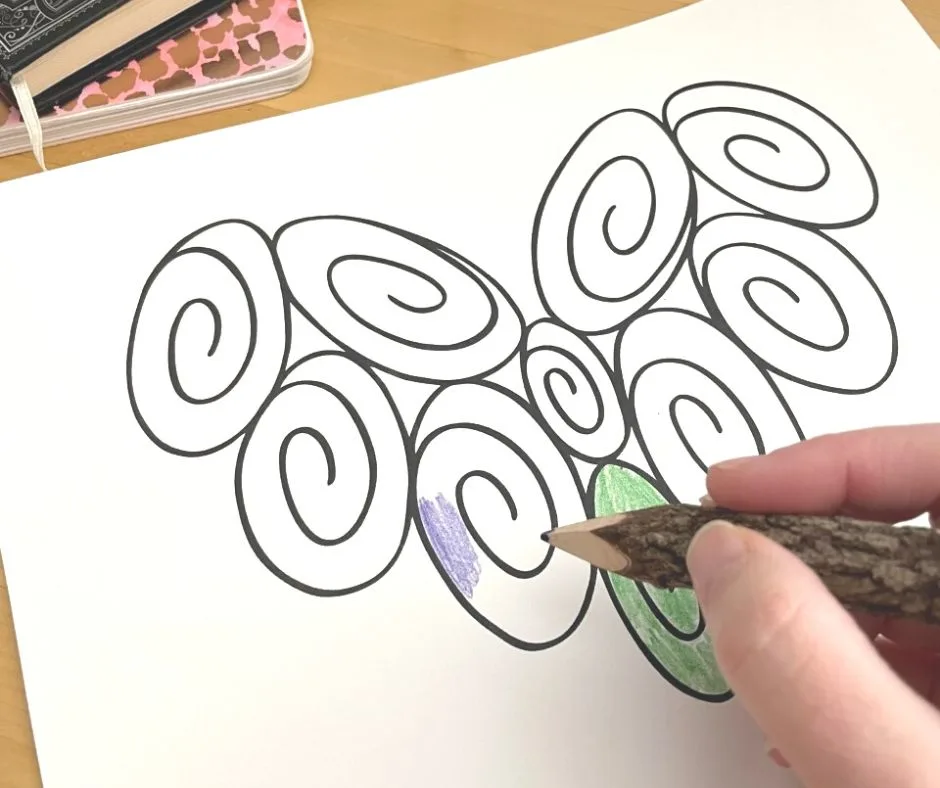

3. Create a Work of Art with this Visual Debt Payoff Chart

Sure, there are all kinds of online tools you can use to keep track of your progress, but if you’re anything like me, a little visual instant gratification that you physically get to fill in (re: color) doesn't hurt either.

Creating a work of art as you pay off those pesky debts is precisely what one woman did when she paid off more than $26,000.

Her work of art garnered so many “oohs” and “aahs“, that she then created a business out of it (how's that for ways debt can be a rewarding motivator?)!

Unfortunately, I think these prints are no longer available. However, you can create your own Progress Map to color in like the photo above, or in her article here.

Draw the outline of your own version of a work of art, slap it up on your wall, grab your favorite colors, and start visually mapping your progress. It'll be as cool and fun as it was in first grade.

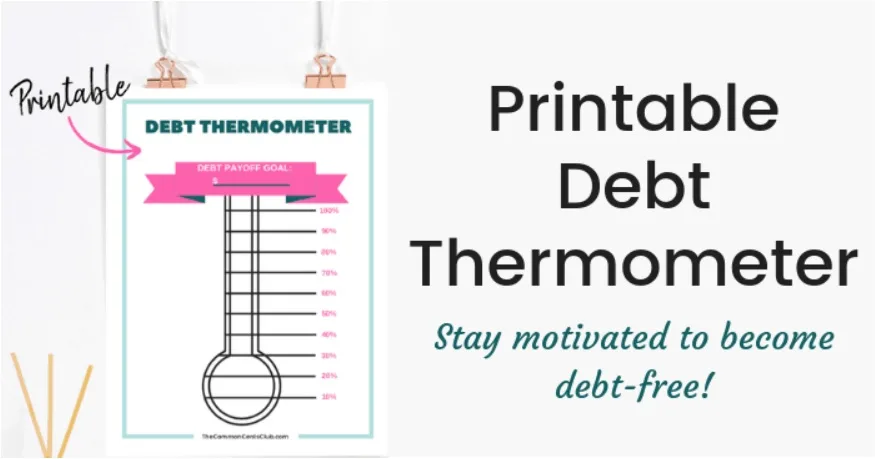

4. Debt-Free Thermometer Template

These are self-created debt payoff thermometer templates by people who have gone through the debt payoff process themselves:

Ashley from BloggingAwayDebt.com created her own paper debt thermometer to keep her motivated in completely paying off her $7,700 Wells Fargo credit card debt.

She had the idea to make them for one debt at a time – the one that she’s hyper-focused on at the moment – so that she could really see some progress. Have six fingers when it comes to crafts? Here’s a free printable thermometer you can use to achieve your goal.

And here’s a bunch of free, very specific payoff charts you can print and color in as you go (scroll down on the page to see them).

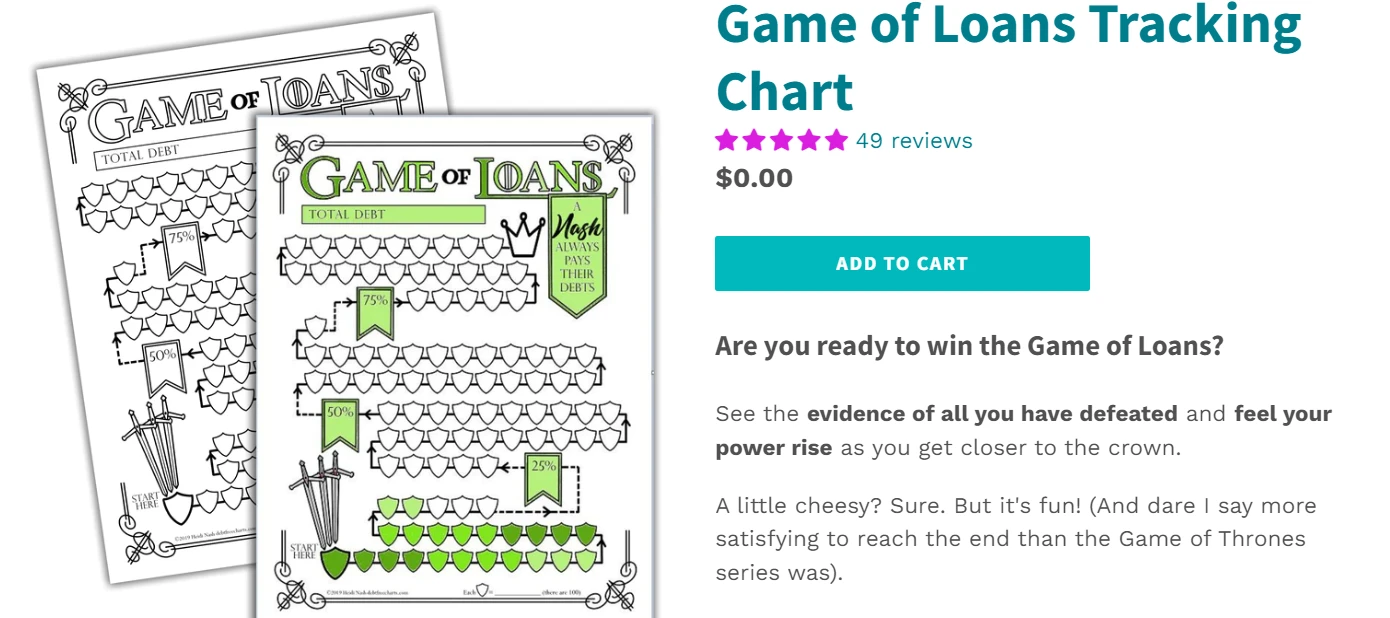

5. Game of Loans Debt Free Tracker

This printable is SO fun. Did I mention, it's completely free?

You get to put your surname in the box “A _____ always pays their debts”. There are 100 spaces in total, and you would divide your total debt into 1/4s so that you know when your balance is down to 75%, 50%, 25%, then 0%.

Hint: she's got loads more free debt-free charts, as well as some cool paid ones.

More Debt Payoff Visual Aids

Guess what? Printable debt payoff charts aren't the only visual aids you can use in your debt payoff journey.

Let me show you what I mean.

1. Debt Paper Chain Link

I lurrrrvvvvveee this idea from commenter crazypumpkin,

“I made a paper chain link, just like the ones we all made in elementary school. Each link is worth $100. I hung that nice long chain across a picture in my bedroom so that I see it every morning when I'm getting dressed. I see it every night when I'm getting ready for bed. I see it every time I walk into my room. Every time I get below the amount on a link, I get to cut it off. Talk about visual and satisfying! It's really helped keep me on track and remind me what I'm working for: no more credit card debt.”

I think this would also be a great family project if you’d like to get the kids onboard + excited about your financial efforts.

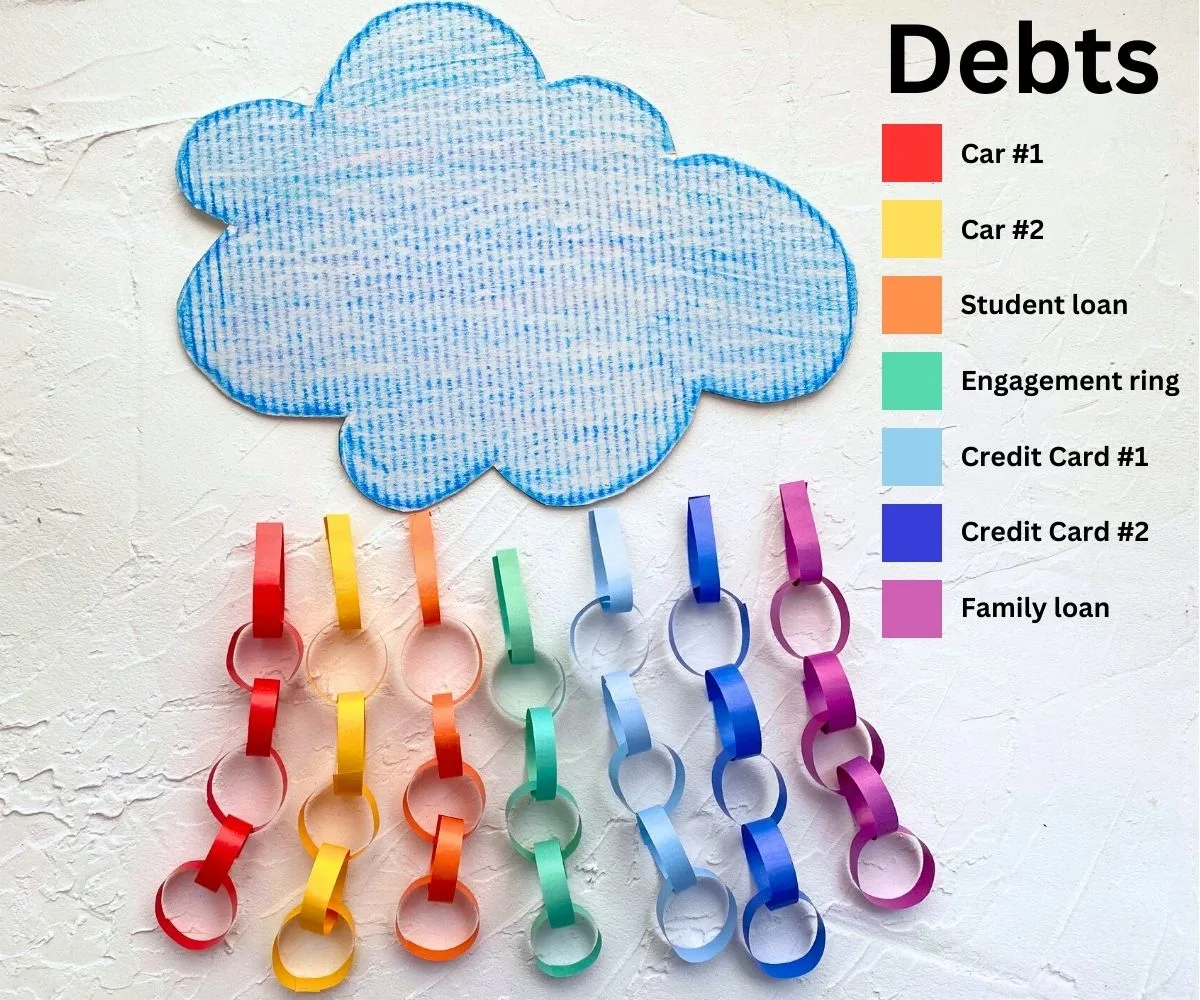

2. Rainbow Rain Cloud of Debt

Building on that paper chain idea, why not create a cloud (this one is colored cardboard), and assign one color to each of your debts.

As you pay off an amount of debt, you add a paper chain link. Could be for every $100, $500, $1,000, or whatever is meaningful to you.

What a fun visual to pay down your debt!

3. Move Your Way UP to Zero, Excel Style

Do you enjoy a good Excel sheet?

The thing is, it's kind of defeating when you’re working down towards zero ($0).

I mean yes, at the end you will have paid off your debt (and there’s nothing defeating about that!).

But the end of your debt payoff journey can feel like starting from absolute scratch instead of truly acknowledging the amazing work you've put in.

There’s a psychological benefit to seeing a line headed up in a positive direction versus simply headed down toward zero.

So what you can do to reap this benefit is set up a Google Spreadsheet or Excel sheet with your various debts – ours were a student loan, a car loan, and an engagement ring. Then put your totals in the first column, except add a negative sign to them (for example, -$14,366).

Add each new payment you make to that debt's total (as a positive number).

For a more visual option, add the new totals to a different column (with the dates along another axis) and create a chart to show you visually moving upwards towards zero.

4. Use Online Wealth Trackers (Yes, Paying Off Debt is Adding to Your Wealth)

Here's the funny thing about net worth trackers: they work whether you are working your way back to zero (from being in debt), or whether you're working on building positive net worth.

There are several free net worth trackers available to help you visually get back to zero (and then move up, up, up!).

I use Empower, which I highly recommend as it automatically keeps track of some crucial investment data (like how many fees you’re paying overall, across all funds, each year).

Though not an online wealth tracker, I’ll discuss the online Chrome Extension “Momentum” tool here as well. I use it in my biz to remind me of the most important of my daily tasks (hello semi-recovering, 20-windows-open-at-the-same-time).

Instead of using it for that, each day when it asks you what your main focus is, you can type in your financial goal. Then every time you open a new window, this gorgeous backdrop with your goal + an inspiring quote opens up as an aspiring reminder of what you want to be focused on.

5. Debt Payoff App (Strategy + Tracker)

Need some quick calculations and strategy done on your behalf automatically through an app?

You input your debts and debt stats, and then go to the Plan Summary section to see how your debt payoff is affected by using various strategies (Snowball, Avalanche, etc.).

There's a debt visualization section so that you can quickly see your total debt picture, and there are visuals of debt payoff timelines. Sweet!

Available for iOS and Android.

Bonus: Advice When Using Your Debt Payoff Visual Aid

After you choose a debt payoff visual aid from above, it's time to make the most use out of it.

I recommend consistently updating your tracker – no matter if you've paid off $5, or $1,500. Pick how often you'd like to update your tracker from the beginning and stick to it.

You could choose to do so every other week, every week, or once a month. You could also do it after each payment, even if you send in multiple payments each month.

And if you have a family? Get everyone involved. The motivation and excitement will be multiplied.

How about it – ready to add a little visual progress ticket to your debt payoff goals? If you already do, I’d love to hear what you use in the comments below (it might inspire someone else’s debt payoff journey!).

Marcus

Thursday 21st of January 2016

Great post, I was enjoying reading it. Actually gave me idea to try out my hobby. I was always thinking how to turn my painting talent to some profitable business. You opened my eyes. Thanks for sharing

Amanda L Grossman

Saturday 23rd of January 2016

I'm glad you enjoyed it and found it useful!