This is the guide for MOMs to make your money management quicker and better. The (DIY) free portfolio checkup I’m walking you through? Will blow your mind.

Look, I get it. You’re a Mom. Your days are filled (I prefer to say “filled” instead of “busy”, as it reframes the whole thing…but that’s just me).

On top of meal planning, calling AT&T for the fifth hour-long wait in several months to fix the dang cable (at least, that’s the current battle in our household), and scraping God-knows-what off of your baseboards (good for you, by the way – mine need some work), you’re also the manager of your household’s money.

And you know what? I’m right there with you.

As a Mom of an almost four-year-old and a business owner, I need all the breaks I can get. Even though I LOVE the subject of money, my time that I have for doing real managing of our money? Has been sliced into pieces.

That’s why I’ve had to get SMARTER about how I manage our money. And today? I’m going to walk you through about one of the smartest money moves and financial decisions I’ve ever made for us (and for myself): doing a free portfolio checkup.

Because even though you handle all kinds of things like how much to spend at the grocery store, paying the bills, paying down the debt, and saving all that paperwork for your childcare tax deduction…managing your finances ALSO includes managing your investment portfolio.

Don’t let me scare you off – the whole reason why I’m writing this article is because we Mamas tend to just get the minimum done needed to be able to move onto the next 7 things in our lives.

So, I’m going to show you a few tricks and tools to make this super easy on you – and trust me, you’ll get some great insights to know how to move forward with what your portfolio needs.

Let’s get started!

The Free Tool You Need to Get Your Free Portfolio Check-Up

First things, first. I want to talk about this free tool I’ll be showing you around below. It’s the very thing that’s going to make your life as MOM (family Manager of Money) WAY easier.

Not only easier but more effective.

Because if you don’t have your eye on your OVERALL financial picture? Like if you’re going up or down, and how many investment fees you’re actually paying on all those investment accounts? Then you can’t make the best money decisions on a daily, weekly, and monthly basis.

Back in 2011, I heard about a free stock portfolio tracker + checkup that several of my personal finance blogger buddies had already signed up for. I decided to give it a shot, knowing that I only had an hour or to lose (ha! Wish I had an extra hour or two in my life, now😊).

What I did not know is the vast amount of specific, actionable information I had to gain.

Here’s what Empower does for us:

- Tracks ALL the portfolio investment fees we’re paying, so that I can get both a snapshot PLUS how much we’re paying in fees by account (priceless information, especially when you’ve got, ooohhhhhhh, 9 different investment accounts as we do!)

- Tracks our net worth (why might it be important to track net worth?), automatically (including automatically tracking our home’s value through Zestimate and populating the information)

- Tracks our spending across all accounts (credit cards, debits, etc.)

Did I mention, in the X years that it’s been doing this, we haven’t paid a dime?

Here’s where you can sign up for your own account. Once you do, you’ll need to link each of your financial accounts ONE TIME. Then, all of the information I talked about (and so much more – we’ll get to that) will automatically populate. PLUS, it’ll update each time you sign in.

How awesome is that?

Let’s move on to quick, easy ways to use this for a free investment portfolio checkup. I promise it’ll be worth your time.

Why I Call This an Investment Portfolio Tracker – Your Portfolio Check-Up

Look, if you closely follow Warren Buffet and like to read investment blogs in your spare time, then you might have a bit of heartburn with me calling Empower a stock portfolio tracker (you have no idea how crazy in-depth some of these stock portfolio trackers can get).

But if you’re a MOM – like me? Well, this is about as great of an online stock portfolio tracker as you need.

Here’s what this can do for your portfolio:

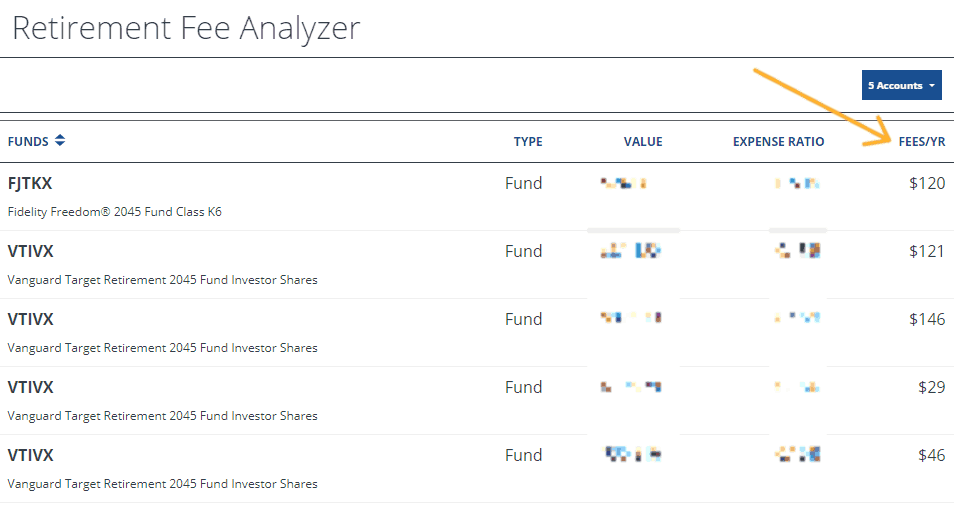

#1: Tracks your investment fees

I’ve been able to see that my husband’s 401(k) account fees are TRIPLE the amount of fees we pay for our Roth IRA retirement accounts at Vanguard. So, each time he’s left a job, I’ve quickly rolled over his 401(k) account to another retirement account with extremely low fees. This, alone, has saved us a bundle over the years.

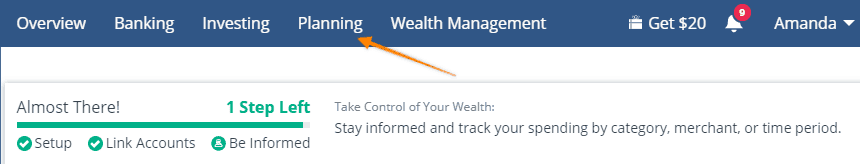

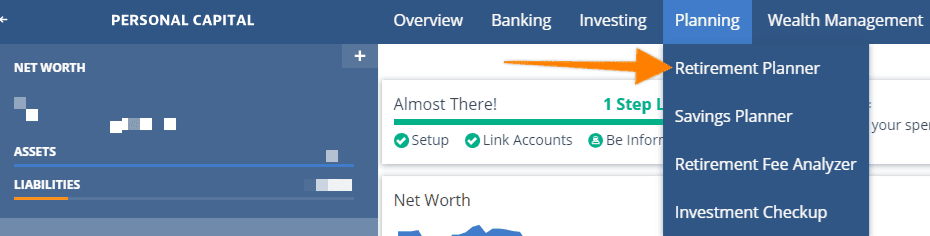

To get your information on investment fees, go to your Dashboard. Under “Planning”, click “Retirement Fee Analyzer”.

This section will tell you both the percentage you’re paying for each retirement account in your portfolio, as well as the SPECIFIC fee amount you pay each year on your investments.

Golden information!

I can’t tell you how difficult figuring out this information can be if you do it account-by-account, across brokerages.

In fact, you normally just get a percentage amount…but not actual numbers.

On top of that? They tell you how much your investment fees are costing you in terms of money over the course of your retirement savings horizon.

Questions to Ask Yourself: Are your overall fees you’re paying less than the recommended amount? Is there one account that is particularly high in fees, and can you roll that over to another investment account or brokerage?

#2: Tracks if You’re On Target to Retire, Automatically

I love how Empower tracks both their estimate – based on your spending – of how much you’ll need each month to spend in retirement (generated from your investments), then compares it with your investments now to see if you’ll meet that need when you plan to retire. Golden information.

To get this information, here’s what you need to do (this assumes you’ve already signed up for your free account, and linked all your financial accounts):

Go to your Dashboard, “Planning” and “Retirement Planning”.

Scroll down to under the chart, on the right, where it says “Retirement Spending Ability”. In this section, Empower has calculated your projected monthly spending amount based on your current investment accounts/fees/etc., and the planned amount of retirement spending (which is the amount they say you’re going to need, based on your current spending level).

They even give you a percentage to tell you how likely it is that you will reach your retirement monthly spending goal (because we all know investments fluctuate over the years). Right now? Ours is 75%.

Does the spending amount not seem real, or does it need to be adjusted?

Simply go to your Dashboard, under “Profile”, and scroll down to “Objectives”. Click “edit”, and you can edit in a monthly spending amount you’d like for retirement. BOOM.

Now, go back to your Retirement Planning chart, under Planning, and see how this changes things (if you edited it).

Questions to ask yourself: Do you need to be adding more to your retirement accounts each month than you are? Perhaps by adding another 1% to your 401(k) contribution? Or are you on target to hit what you want/need? Remember, too, that you can change your risk tolerance and WHAT you’re investing in to potentially hit the target amount you need.

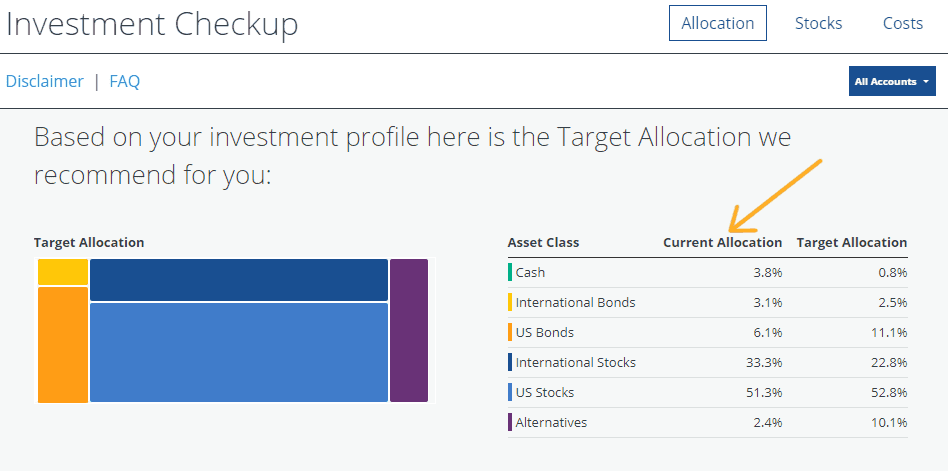

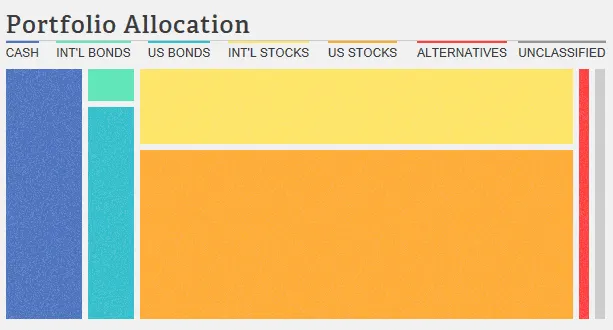

#3: Investment Allocation Check Up

If you’re like us, then you have multiple investment accounts. Like my old pension that I rolled over, my husband’s two 401(k)s from two different jobs, and then our own IRA accounts.

We checked off what allocation/risk level we wanted when we first signed up for each of these accounts…but what about the allocation and target ACROSS all of our accounts?

In other words, are we “unbalanced” (meaning, too much in stocks or too much in bonds, etc.) or balanced across our ENTIRE portfolio?

Again, you and I can turn to Empower for this.

Sign into your account, and go under “Planning”, then “Investment Checkup”. Scroll down, until you see a chart that looks like this.

This chart shows you the target allocation – taking ALL of your investment accounts into consideration – and where your current, total investment portfolio lies.

For example, ours from above shows that with our “moderate” risk tolerance, we should have 11% in U.S. bonds…but we only have 6.3% of our investments in U.S. bonds.

Psst: how cool is it that you can have intelligent conversations like this because you can easily get the info, and can easily understand it? Amazing.

Our U.S. stocks are right around where they should be, and we have more in cash than the experts suggest (this, I’m okay with – I like having a year emergency fund since I’m self-employed).

Questions to Ask Yourself: Is there a category of assets (cash, international investments, bonds, etc.) that is out of whack with your risk tolerance? What account is it from? Maybe give them a call and see how you can reallocate (meaning, buy into a different fund, switch some money from stocks to bonds, or change your target retirement date to add more risk or take away risk).

Now, let’s look at a few fun features that make this a really awesome money management tool.

#4: Investment Performance

Ready to get your hands on your investment performance, by investment type, across all your portfolio at the same time?

In other words, not your performance per retirement account (say, 401(k) versus your target 2045 account at Vanguard), but your performance in ALL U.S. Stocks across ALL your investment accounts?

Awesome – just go to your dashboard, then “Investing”, and then click “Performance”.

I just love how they dissect all these individual stocks and bonds within each of our investment accounts, and then spits out a report so that we can actually understand what’s going on!

Psst: here's 6 ways to get your beginner investment questions answered.

Empower as a Money Management Tool

The investment portfolio tracker is not all you’re going to get with this – this is an amazing tool for managing your overall money.

Which is great, because I seem to collect financial accounts like Carrie Bradshaw collects shoes.

Having so many accounts can be unwieldy to keep track of.

- Benefits of opening so many new accounts = sign-on bonuses and other perks

- Drawbacks of having so many accounts = having to manage each of these accounts as well as manage an unwieldy list of usernames/passwords.

Empower offers a great solution to our serial account problem by aggregating all of our accounts into one account I can access online whenever I’d like.

It can do the same for you!

After you sign up with them and fill out your information for your checking, savings, mortgage, investments, and retirement accounts, a few days later everything will automatically populate and update.

As soon as it does, you’re going to get all kinds of great data in just one place – like your net worth (automatically updated), your total debt across all accounts, your total savings across all accounts…and one place where you can also see each balance of every account.

It’s just an amazing money organization tool.

Other things I love about this as a money management tool?

- If you’re paying off debt, you can slowly watch your net worth climb (yes, even if it’s still in the negative, it can climb back to zero).

- Alerts you to upcoming bills (under “Banking”, and “Bills”).

- Shows you your transactions (spending) across all accounts. It’s easy to just treat each debit card/account/credit card as individual, but when you can see spending across ALL financial accounts, by category? Then you can catch patterns and make some changes.

Lastly, I want to talk about one final perk they have that’s totally optional: a live, free investment portfolio check-up.

Free Investment Portfolio Check-Up with a Live Person

Look – I got all of that information above by just signing up, associating my accounts, and looking in different places in my dashboard.

I say that because there’s tons of info that’s yours without needing to talk to a financial advisor or have a free personal consultation.

But if you want to have a free portfolio check up (we did)? Well, that’s what I’ll be detailing in this section.

Here’s something to know – if your assets are worth $100,000 or more, then you qualify for a free investment portfolio conversation with a live person from Empower.

We had ours, and I’d like to detail out some key information I learned (so that you can get an idea if the hour call is worth your time or not).

I spoke with Michelle over two different phone calls, and she drafted us a personal investment strategy based off of our goals, income, retirement age, kids, risk, age, etc.

The amount of free information gleaned from this consultation was well worth the time to set up our account.

Invaluable Insights from Our Free Portfolio Check-Up

- We are heavily invested in US stocks with not much in emerging markets/growth markets (i.e. Brazil, China, and India)

- We have too much risk in the tech and financial markets (which happened to plummet in the last recession)

- We have very little “alternatives” in our portfolio (i.e. hard assets like gold, other metals, energy, agriculture, etc.)

- There are some tax shield/tax optimization strategies that we could be taking advantage of (this was particularly exciting to discuss with her!)

To be honest, before Empower, I could not have spoken so sharply, or understood much about our investment portfolio. In fact, I wouldn’t have even used the “term” portfolio for the collection of investment accounts we had going. But with this dashboard? I feel like I can have smart conversations about our portfolio, and I can get an Eagle Eye view of our financial picture – the kind that helps me make really smart money decisions for our family.

Amanda L Grossman

Latest posts by Amanda L Grossman (see all)

- How Can I Get a Discount at Starbucks? (11 Starbucks Discounts) - April 18, 2024

- 5 Surprising Ways to Cut Household Costs (Saved us over $1,412!) - March 11, 2024

- The No Spend Challenge Guide (Money Game-Changing Tool) - January 31, 2024

Joe Saul-Sehy

Wednesday 20th of February 2013

All I've heard lately is good stuff about Personal Capital. Impressive write-up. Did you get any sales pitch to keep working with the advisor on a fee basis, or was it strictly a "here's what you need to know" discussion?

FruGal

Thursday 21st of February 2013

Hi Joe!

That was one of the best things about this consultation; there was no hard sell at all. We got to the end of the presentation, and she said "okay, I think you should discuss this with your husband and then get back to us if you think we can help you with this." Pretty good!

Joe

Tuesday 19th of February 2013

I like Personal Capital too and I'm glad you had a productive session. It's great to be able to ask some financial questions to a expert. The lack of hard sell is great too. Will you invest more in emerging market? Vanguard has some low fee funds that might fill the hole.

FruGal

Thursday 21st of February 2013

Hi Joe!

Thank you for sharing your experience with them. I do believe I will be looking into emerging markets, so thanks for mentioning that there are funds available to mitigate some of the risk.

Chris

Tuesday 19th of February 2013

I love the idea of a weekly email telling me that i've made some money, best email in the world!

FruGal

Tuesday 19th of February 2013

Haha--totally:).

Marie at FamilyMoneyValue

Tuesday 19th of February 2013

There are other ways to get a one time review/plan. I once worked for a mutual fund company, one of the perks was development of a financial plan by one of their advisors. It didn't help us much - as we were just starting out, saving every penny we could. The advisor's plan was 'just keep doing what you are doing'.

Another one was from a firm that came to a later employer of mine and taught 'retirement investment' classes. They offered a free plan as well, which also didn't help much. Of course, they also wanted to manage our assets for a fee.

The last opp was with Vanguard. When I moved my retirement assets to an IRA I had enough there for a free financial planner conference. She gave very stock advice about what she recommended I do (and of course had to push Vanguard assets). The advice did not consider my risk tolerance, which apparently was much higher than hers!

I find that self education and management has worked best for us, but yes, it is a pain to do.

FruGal

Tuesday 19th of February 2013

Hello Marie!

Thank you for sharing your experiences.

Something I forgot to mention is you do not have to participate in the personal consultation. You can just use the website for free and have your accounts aggregated in one spot (you can get a lot of information from just this). However, I shared my consultation experience because I was truly impressed with it. It was great to have someone break down my Target Fund, cost/fees, etc., even though yes, I could have done this myself (though it would have taken a lot more work on my part). It was also really neat to hear about possible tax shelters. Overall I've learned a lot from this experience, and wanted to share it with others.

Doctor Stock

Monday 18th of February 2013

I worked in the industry for years as one of those advisors who would prepare these fancy designs... and there is some value. Unfortunately, as much as they may seem "personalized" they are often designed to lead to cross-selling opportunities for the advisor. As you can imagine, these are not always in the best interest of the investor.

FruGal

Tuesday 19th of February 2013

Good morning Doctor Stock!

Yes, they would like the opportunity to manage our portfolio. I inquired about how much (the nice thing is that there was no hard sell at all--I was really happy about that), and it would come to less than 1%.

However, there is a lot of positive and insightful information I got from our conversation. On top of that, I was able to ask all kinds of investment questions I did not understand before, and Michelle was great in explaining in a way I could understand.

Thank you for your perspective, seeing how you used to work in this market.