Feeling like you don't make enough money to live? I've got killer tips on how to save money when living from paycheck to paycheck.

Tired of living paycheck to paycheck?

I'm so glad you're here to get some tips on how to save money when living paycheck to paycheck – because if you're stuck in the paycheck cycle (like up to 78% of Americans are), then saving money is one of the ways you'll get out of it.

You might be wondering, “Am I living paycheck to paycheck?”

Let's dig into that, first.

Am I Living Paycheck to Paycheck? How to Tell.

So, just to make sure we're on the same page – here's the dictionary definition of what living paycheck to paycheck means:

Your next paycheck is almost (or completely) taken up by expenses – all of your paychecks are – plus you have close to no savings to fall back on.

But I want to take it a step further than this. So, I asked 12 real people who are living paycheck to paycheck what it means to THEM.

Here are a few of their responses:

- Lee Silsby says, “Living paycheck to paycheck is a bit like an ongoing nightmare that you can never wake up from. Possibly a little over dramatic but that is what it can feel like at times. There are no treats or dreams of a holiday it is just can I afford to pay for my electricity next month. It can leave you feeling desperate and very alone at times even if you are not alone.”

- Ozella says, “Personally, my definition of living paycheck to paycheck is only having just enough money to cover the main bills and having to get creative when it comes to some of the other expenses such as groceries and gas. There's definitely no money left to pay extra toward debt or contribute to a savings fund.”

Given all of this, how do you know if you are living paycheck to paycheck?

Ask yourself this simple question:

What happens if I don't receive my next paycheck? What if I didn't receive the paycheck after that?

If your answer is ending up on your mother's couch, going further into debt, or anything else of the sort, then you're living and dying by the paycheck cycle.

Living Paycheck to Paycheck, No Savings? Read On.

There are several ways to stop living from pay to pay. And they all work together.

You'll want to:

- Build up savings.

- Decrease your living expenses dramatically (this will increase the gap between your bills and what you earn each month).

- Build up a passive income that earns you money on an ongoing and semi-consistent basis.

We're going to focus on the first one, primarily, in this article.

Pssst: how I stopped living paycheck to paycheck and saved my first $1,000, plus 12 other living paycheck to paycheck stories.

That's because living paycheck to paycheck with no savings means that you're just one emergency away from something bad happening.

Like:

- sleeping on your mother's couch

- borrowing from friends and family

- running up credit card debt

- being unable to pay some of your monthly bills

- etc.

Think about it: if you need your entire paycheck to survive, then how will you pay for the next accident or big expense that surprises you?

I interviewed 12 people who are living paycheck to paycheck. And this kind of question is what keeps them up at night.

One woman, Steffa Mantilla, writes,

“Our fears were that we weren't going to be able to save money for retirement or have money should an emergency pop up. From the outside it looked like we had everything and were well off when in reality we were one expensive event from not being able to pay our bills.”

Ozella adds,

“I'd have to say my biggest fears were not being able to provide for my kids. They are number 1 and the mere thought that money could potentially get in the way of me providing the best life I could was very saddening for me.”

I know, I know – I'm sure I don't have to tell you this. This is the kind of thing that is probably keeping you up at night (and keeps you reading personal finance articles, like this one!).

That's why we're going to cover how to save money in the next sections, even with a paycheck that barely pays the bills.

How Do You Save Money When Living Paycheck to Paycheck?

If you're living paycheck to paycheck, then you know that there is not an ounce of money to spare for your saving account no matter how much you’d like to build up your savings.

However, by not saving money, you are only ensuring that your current, stressful lifestyle will continue.

I want better for you and for your future; I want you to have financial freedom in the future instead of bill cycles and anxiety.

In order to have this, we need to find ways to get your money from your paycheck into your savings account using your current income. Below are some ideas.

Psst: definitely check out my article on 250 ways to save money.

1. Make this Important Money Mindset Shift

First up? Is one of my most important tips that's really a money mindset shift to make.

You need to change your mindset entirely when it comes to your savings account.

This tip is SO important because it sets up the foundation for all of your other savings tips. Don't follow this tip? Then you'll have trouble accumulating money in your savings.

Here it is:

Re-categorize your savings account as a black hole. Money goes into it, but it can't come back out.

This will stop you from tapping your savings account about 90% of the time. And when you no longer see your savings account as an option – instead, getting super creative in how you handle financial problems?

Well, then your savings start to grow.

Something that I like to do is automatically withdraw a budgeted amount from my checking account into my savings account before I pay any bills.

I almost make it into a game – once that money hits my savings account, I would rather cut off my right pinky finger before transferring it back to my checking to cover bills.

The money becomes dead to me.

This makes me creative sometimes in finding solutions or tests my patience as I wait to have things replaced until next month in order to keep that money in my savings account. You may surprise yourself with the ingenious ways you come up with to not touch that money.

And then…it happens!

The next month has already arrived, and that money is now safe and sound, earning interest.

2. See if You Qualify for Any Savings Match Programs

The thing is, you've got to set money aside. But you might be wondering how on earth you can do so when you're living paycheck to paycheck.

There are Savings Match Programs out there sponsored by banking institutions, government-matched savings accounts, nonprofits, your employer, etc. that you can apply for to make the most out of any money you can set aside.

3. Tap Your Tax Resources

Have a tax return coming to you? Instead of earmarking it for stuff, direct deposit it into your savings account, not your checking.

If you are disciplined enough in saving money, work with your HR department to have less money withheld for taxes, leaving you more money each month to put into the bank.

If you own a home or have substantial medical bills and you can take an itemized deduction this year instead of the standard, make sure to clean out your closets and make donations.

You can use the online free service ItsDeductible in order to keep track of the value of what you donate, and then you can get a bigger tax refund.

4. Deposit Your Two Extra Paychecks

Most people on salary are paid on a bi-weekly basis, receiving a total of 26 paychecks, and some are on a weekly basis, receiving a total of 52 paychecks.

That means that for two months out of the year when there are five weeks in that month, you receive three paychecks instead of two (or five paychecks instead of 4 if you are paid weekly)!

Since you are used to living on two paychecks per month, this should feel like winning the lottery (okay, a lottery that you had to work 40+ hours for). Instead of earmarking this golden nugget for a large purchase, or letting it sit in your checking account to be slowly squandered away, deposit it into your savings account pronto.

Without much effort, that equals an entire month’s pay that you will save over the next year.

Note: if you are paid monthly like I used to be, or you are paid two times per month (like the 2nd and 4th Friday), then this scenario will not occur for you.

5. Break Your Expensive Contracts

If you are living paycheck to paycheck, that means you cannot afford your current financial obligations. Look at your contracts for your cell phone, cable, rent, utilities, car lease/payment, etc. Some will be easier to get out of than others.

Because of cancellation costs, some will not be financially worth it to break.

The first step when breaking contracts is to find a better deal for the services that you will still need, like a phone, a car, and utilities.

(Hint: cable is not a necessity. You should be eager to give it up because socking away that extra $60-$100/month can help you get out of your stressful financial situation. An example of people who recently did this is from the show Downsized.

- Cell Phone: You can get out of your contract without paying the $175+ early cancellation fee. Sell your contract to sites such as CellTradeUSA. There are some great pay-as-you-go cell phones available that you can sign onto.

- Utilities: This is geared towards utility markets like the one we have in Houston where there are numerous utility companies that compete against one another. While you may still have to pay a fee to get out of your utility contract, many companies offer $200-$300 to switch electricity companies to their cheaper rates. You can use this money to offset the cost of early termination with your other company.

- Cable/Internet: You will want to call the cancellation department of these companies and tell them that you need to cancel your contract. One of two things will happen: they will offer you a better deal, or they will be able to temporarily suspend your contract to give you a few months off for free until you can pay again. Either is great to boost your savings. Here's a script for how to do this.

- Car Lease/Payment: Is your car payment or lease more like an apartment payment or mortgage? Cars are not a good investment – they lose value as soon as you roll them off the car lot, which is why you should typically buy used and let the first owner take a hit on their investment. Still, you can sometimes get out of these obligations. For an un-leased car, you can attempt to sell it. For cars that are leased, you can use services such as SwapALease.com or WalkAwayLease.com where you can list your car and a buyer who is looking to take on your lease will hopefully find you. Transferring your lease does not ding your credit score, but you cannot do it without your lease company’s consent. Make sure you understand your contract and discuss your options with your lease company.

6. Fight Your Property Taxes

If you own a home, you can shop around for lower home insurance, as well as fight property taxes to see if you can get your tax load lowered.

If you get these lowered and pay into an escrow, have the company where you keep your escrow account reassess and lower your monthly payments – cash you can now put into a savings account.

Psst: definitely check out my 250 money saving tips for even MORE ideas!

7. Take in a Roommate

I have an aunt who lives in a beautiful area of D.C. in a gorgeous, two-story home. How did she afford to live just a few blocks from the metro in our nation’s capital?

At least since I was born, she has taken in roommates. She posts the ads in the newspaper, conducts interviews, gets to know the candidates, and then makes a decision.

A lot of these people are students, people traveling on business for a period of time, and people from foreign countries. She has met a wealth of individuals and made connections to last a lifetime, and each month, she gets to divide up the mortgage, utilities, and all other house expenses by 2-4.

I lived with a roommate during my first year out of college and the savings were dramatic. Even if you have a family, this can be an option for you. Do you have a basement, or a spare bedroom and bathroom? Are you within distance of a major city or a college campus?

Think about the possibilities.

8. Attack Your Variable Expenses

Variable expenses are the ones that are easy to trim, as you are in control of them and typically are not bound by any contracts. These categories include transportation, food, entertainment, clothing, habits/addictions, etc. We will tackle these as individual categories in upcoming articles.

For example, you should stop grocery shopping every week and switch to every-other-week grocery shopping.

Most of us have stockpiles of food, and we need to cash in on them every now and then to reap the benefits.

Bank the extra $100 or $200 from not shopping. Repeat this every six months.

Marissa Sanders is a great example of someone who did this. “I decreased all of my bills by switching companies, negotiating lower prices, asking for discounts, canceling services, and utilizing less energy, water, data, etc. For the new baby, I utilized cloth diapers, co-slept, breastfed, and wore him everywhere so that I could decrease the costs of raising a baby as much as I could. That gave me extra money to start my debt payoff strategy.”

Psst: you'll definitely want to shift your whole thinking around frugal living and give it a shot! Here's 17 powerful daily frugal habits we are using in our own household.

9. Give Your Bills a Summer Break

For summer vacation this year when your kids are home and most hot TV. shows are on hiatus, so get rid of your cable and internet (make sure you will not incur fees for doing this).

Instead, trek to the library (the best way to save on Netflix) to enjoy magazines, books, internet use, and free DVDs.

Also, check out Hulu and purchase a $2-$10 HDMI cord to run from your laptop or computer to your television to see some of your favorite shows for free.

During times of good weather, drop your gym membership (if you had one – which you might want to reconsider since you're living paycheck to paycheck) and run/walk/hop outside instead.

You can always sign back onto these services, and in the meantime, you can bank some extra cash (24-hour fitness has a month-to-month contract, do other gyms).

I Live Paycheck to Paycheck How Can I Save Money?

Saving money – actually depositing money into a bank account that won’t be touched in the short term – happens when both the physical and mental elements are right.

What do I mean by this?

A healthy savings account does not just manifest by itself. If a person makes a decent income but sees no benefit in saving any of it, then savings will not automatically accumulate. Conversely, if a person is a natural-born saver but is struggling to make ends meet, then it will be difficult to accumulate money as well.

You need both an income AND a savings mentality in order to build up your money.

Fortunately, both of these areas can be improved upon, potentially even without securing a second or third job and even without sacrificing many of your wants today. Below are a few tricks that you can use to overcome both barriers – mental and physical – and get more of your hard-earned paycheck into your bank account.

1. Give Your Savings Account a Pet Name

Do you know what your savings means to you?

Yes, it means more money.

But what else? Some possibilities include financial security, financial independence, seed money for a different kind of life, travel, retirement freedom, etc. Online banks generally allow you to give each of your accounts a nickname, so take the opportunity to give it a pet name that invokes some emotions in you.

Say, “Freedom Fund”, “Seed Money”, “Declaration of Independence”, or really anything that makes you want to stash money in it more than the generic “Account: X123456789” will.

2. Challenge Yourself Past What You Thought You Could Save

Running does not come naturally to me. It never has, though after six months of consistently doing it 2-3 times per week, I find myself wanting to do it more.

Because it’s not natural for me, I play a mental trick on myself that has stretched me much farther than I would normally run. When I run, as I get to the end of where I typically stop running, I start egging myself on just a little bit further.

I might tell myself “When I get to that next tree, I’ll stop”.

After I reach that tree, I mentally declare, “When I get to the next light pole I’ll be finished”, then, “I’ve made it this far, might as well go to the end of that bench.”

Adding a little onto the end when I am in the zone already stretches me past where I thought I could go.

Once you have figured out how much you can save each month, challenge yourself to do a little more.

If you have earmarked $100 for savings, why not do $110, or $120? Then as this amount becomes your new norm, stretch yourself again. Make it to $140, or $150.

Once you figure out you still survived without the extra money to spend, saving the higher amount will become a regular habit.

3. Save All of Your Change

Paul and I love to travel. Typically we do not purchase lots of souvenirs (we’d rather spend the money on more travel). However, on our honeymoon to Austria in 2010, I fell in love with a cow piggy bank.

We spent the $20 and traveled all the way from Salzburg back to Houston with it – ceramic ears and tail intact. Ever since then, we’ve put all of our “silver” change into its belly.

A little under three years later we cashed it in for the first time for $93.01 of money we had never missed. Cha-ching!

3. Set Aside Every Dollar Bill that Crosses Your Path

Just like you can save all of your change in a jar, you could also save each $1 bill (or coin) that crosses your path. These may not fit well into a piggy bank, so instead you could take a shoe box and stuff them in there.

Once every six months count it up and take it to the bank (or sooner if you happen to have a lot of dollar bills).

Psst: check out my fun savings challenges for you here, and 9 mini savings challenges for small budgets. Also, here are free savings challenge printables for A6 binders.

4. Skim a Little Off the Top of Work Reimbursements

If your company is as slow as my husband’s in reimbursing you, then chances are you have already found a way to cover the amount spent before the money comes in.

While you may need some of the reimbursement checks to put back into savings or cover your bills, try to skim some off the top to put straight into savings.

This works even better if you use your own vehicle and get reimbursed by the mile, as you will make a small profit. The extra is meant to reimburse you for future car repairs, so it’s a good idea to save this money anyway.

5. Bank Referral Credits by Leveraging Your Social Network

Many of us have a social network online or in person. If there is a service you enjoy using, be sure to tell your family and friends about it. You can look in your account and see if there is a way for you to get credit for referring someone to the service.

Include a link when you post on Facebook, email, or any other form (and tell them upfront that you receive a benefit for them signing up under you).

Many referral links also give the opportunity for the person signing up to get something special as well. For example, ING Direct (now Capital One 360) used to give $25 to the person signing up for a new savings account, and $10 to the referrer. It’s a win-win!

Take your extra referral credits and put them into your savings account. You may need to offset the cost to do this.

As an example, if you receive a credit on your bill for the referral bonus, then put that same amount of money from checking into your savings account.

How Can I Save Money with a Small Paycheck?

I'd like to leave you with one more, often overlooked, tip on how to save money with a small paycheck. And that's to actually increase your earnings.

I'm not telling you to go get another job (although, you can). Rather, I'm trying to give you tips on how to earn cash on the side, without disrupting your whole life.

1. Sign Up for Freebies that Equal Cash

Do you ever wonder if signing up for freebies really makes a financial difference?

I mean, beyond the initial freebie-adrenaline rush?

One of the best things about blogging since 2009 is I've got a well-kept, easily searchable diary of my financial dealings, ideas, and what-ifs.

And guess what? I decided to sift through the last 7ish years of blog posts to see what the financial impact of signing up for freebies has been for our household.

It's all about the numbers, and I'm about to share mine.

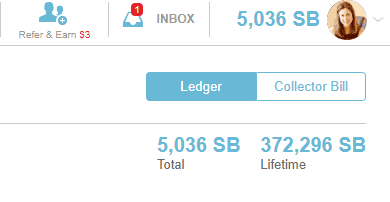

$3,700 in Actual Cash from Swagbucks since 2009

One afternoon − March 14, 2009, to be exact − I decided to give Swagbucks a try. It's an online search engine where you earn Swagbucks (SB) periodically for searches you're doing anyway.

Man, am I glad I did! My lifetime SB earnings since that day have been 372,296. I cash these points in for Paypal cash (5,000 points equals $50), which has yielded me *drum roll please*…$3,700! Just for surfing the internet over the last 7 years.

What I love about this one?

- You (yes, you!) can refer people through your referral link (here's mine), and you then earn some of their SB earnings.

- They allow you to cash out through Paypal, and it doesn't cost more points to get cash like in other reward programs I'm part of (such as my credit card reward points).

- You could do this for several years, and then cash in for something amazing, like an awesome vacation!

2. Check out Ways to Earn Extra Cash from Home

Also, when figuring out how to earn more money (without getting a second or third job), check out my article on ways to earn extra cash from home.

It might seem like a pipe dream to you to build up savings. And you probably feel like you're not making enough money to live. But if you want to get out of this cycle and you're tired of struggling financially? Then the tips above will help you to stop living paycheck to paycheck. Take action, and your life will change in ways you could never imagine − less fear, more control, and more money in the bank.

Amanda L Grossman

Latest posts by Amanda L Grossman (see all)

- 11 Financial Life Hacks (Simple Changes, Big Savings) - November 24, 2025

- Switch to Twigby Mobile Smartphone Plan to Save Money ($47.28/Month) - November 21, 2025

- 9 Cozy Winter Date Nights At Home (Reconnect for Cheap!) - November 19, 2025

Alz Smith

Friday 1st of January 2021

Awesome tips on how to stop living paycheck to paycheck !

Shaban

Tuesday 18th of February 2020

Good, all I need now is a job!

Millennial Money

Tuesday 29th of November 2016

Wow, the internet has provided many ways to save and make money. Thank you for listing all of these potential earning opportunities.