Trying to save up an emergency fund? A free emergency fund tracker is the perfect way to keep you motivated.

Building your emergency fund savings up?

It’s going to take a little while to do.

And a free printable emergency fund tracker is the perfect thing to keep you both:

- Motivated to keep going

- In-the-know with how much you’ve done, and how much further you have to go

First up, let’s make sure you know how to use these cool printable emergency fund trackers below.

How to Use a Free Printable Emergency Fund Tracker

Here’s a quick refresher for how to use a savings tracker.

Step #1: Figure Out Your Emergency Fund Amount

How much of an emergency fund are you saving up?

Here’s a few ways to choose:

- Dave Ramsey Baby Step Method: If you’re following Dave Ramsey and looking to pay down your debt gazelle-fast, then you’ll want a tracker that saves up $1,000. And the faster, the better.

- The 3-6 Months Emergency Fund Method: Use the steps in this article to figure out how to calculate what you need to fill a 3-month emergency fund, or a 6-month emergency fund. Choose which one you’d like to do, then choose a blank savings tracker from below so that you can fill in your own amount.

- The One-Month-Ahead Method: Add up all of your bills for just one month (not wants, just the bills and things like groceries), and make that the amount you save up to get one month ahead on your bills. Choose a blank savings tracker from below so that you can fill in your specific amount.

Step #2: Pick Out a Tracker

You’ll want to pick something you’ll like looking at, and even will be proud to display in a space others will see!

Not only that, but one that’s functional for you.

Meaning, if you choose to do a $1,000 emergency savings fund, then choose one of the preformatted ones. If you choose to do a specific amount to your needs, then you should choose one of the blank ones you can fill in yourself.

Step #3: Set the Tracker Up

For the blank savings trackers, you’ll need to calculate how much each space or line is “worth”, so that you know when you can color it in.

To do this, you add up the number of spaces or lines. Take the amount you’d like to save up, then divide by the total number of spaces or lines.

For example, if the tracker has 100 spaces to color in, and you’re looking to save up $3,500, then each space is worth $35 (or $3500/100).

Now, let’s get to those free printables!

Free Printable Emergency Fund Tracker

For each of these free printable emergency fund trackers, you’ll want to figure out how much each space is “worth” (by taking the total you want to save up for your emergency fund, and dividing that by the number of spaces), and then color in the corresponding number of spaces each time you make a deposit to your emergency fund savings account.

For example, if you want to save up $3,500 in your emergency fund, and you chose a tracker with 52 spaces, then you’d:

- Divide the total amount you want to save up, $3,500, by the number of spaces, 52, and get $67.30.

- Down-round, meaning, make each square worth $67 to keep it a bit more simple (or even $65 to keep it even more simple).

- Let’s say you have $200 to deposit into your emergency fund, and each square is worth $65. Then, you’d fill in 3 squares (that extra $5 that isn’t account for? You could write it in pencil on the side of the paper so that you can account for that the next time you make a deposit).

Let’s dive into some great options for you to choose from.

Psst: while you're thinking about building an emergency fund, don't forget about preparing your family for emergencies in a different way with these family emergency finder free printables.

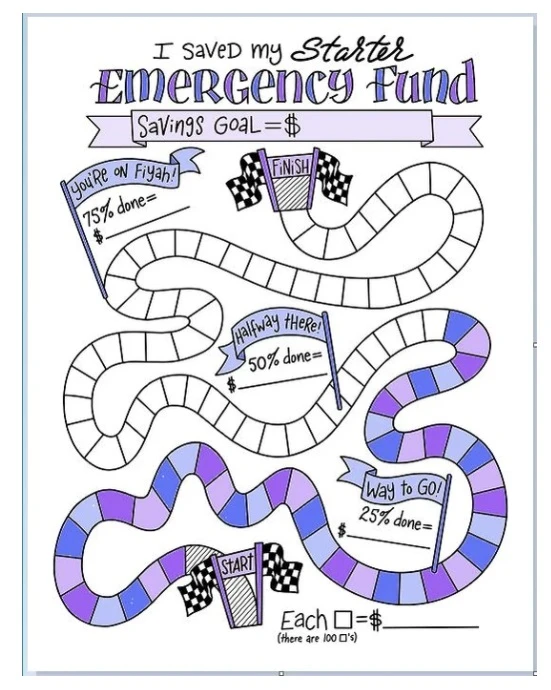

1. Starter Emergency Fund Printable

Check out this super-helpful (and cute) starter emergency fund tracker from Debt Free Charts.

I love how it has spots for mini-milestones, so that you can pause, reflect, and reward yourself for how far you’ve come (at 25%, 50%, and 75% of the way).

2. Blank Savings Log Printable

You get to choose the emergency fund savings goal you have, when your deadline is, and then fill in what each line represents in this savings log.

Hint: There are 15 lines in total, so divide your emergency fund goal by 15 to figure out how much each line is worth. For example, if you want to save up $3,000, you would divide $3,000 by 15 to find that each line is worth $200.

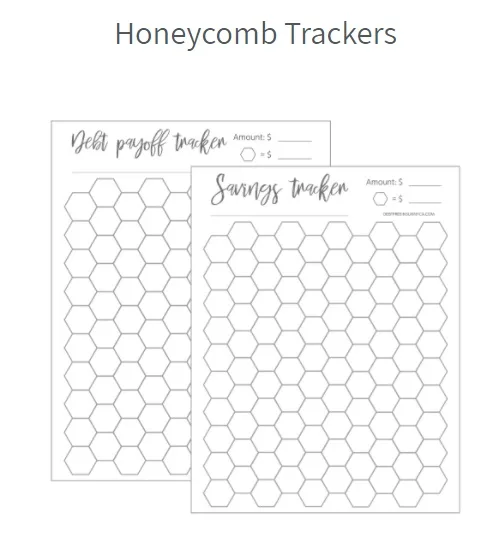

3. Honeycomb Jar Savings Tracker

Use this tracker to save for anything, including the exact amount you’ll need for your emergency fund!

There are 100 hexagons, FYI.

4. Savings Thermometer Tracker

Who doesn’t love a good thermometer to track your goals with?

This one comes blank with lines measuring each 5% gained towards your goal.

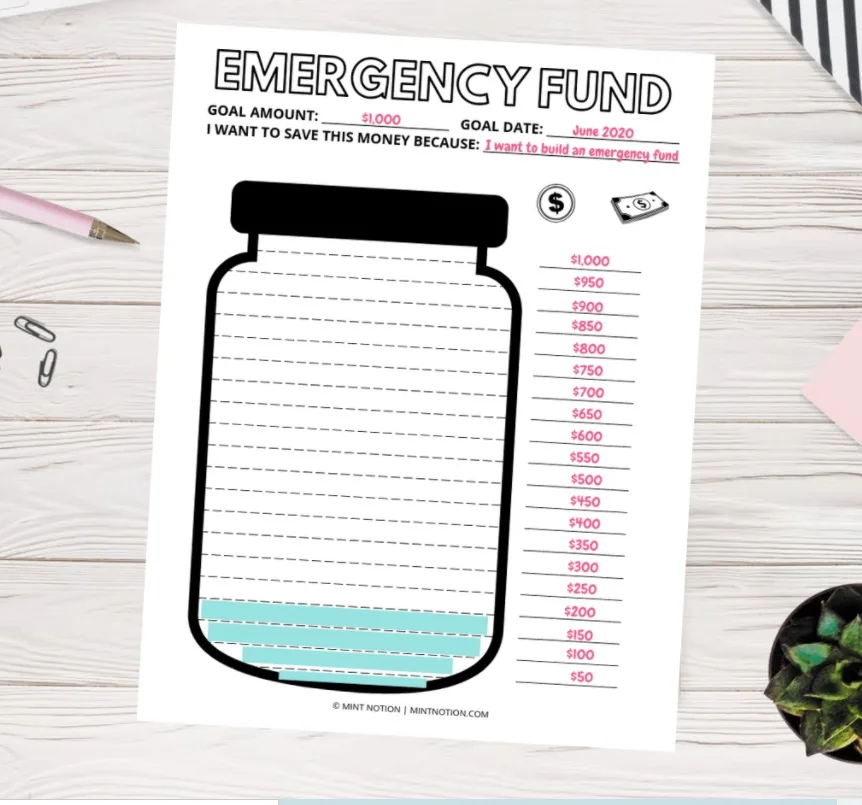

5. Emergency Fund Tracker

This blank savings tracker has 20 different lines, and will help you to see your savings goal progress as you go.

$1000 Emergency Fund Tracker Printable

$1,000 is a popular number for an emergency fund because of Dave Ramsey and his baby steps (not sure who Dave Ramsey is? Here’s my article on Total Money Makeover success stories).

The idea is that you want to save up $1,000 really quickly, and then you go whole-hog into debt-payoff (gazelle intense, he says).

Newsflash: while I love, and have benefitted personally, from Dave Ramsey’s baby steps, only having $1,000 in an emergency fund is definitely taking a risk. Here’s emergency fund examples so that you can make the best decision for your family.

Here are my favorite free $1,000 emergency fund tracker printables.

1. Honeycomb $1,000 Saving Tracker

Each hexagon in this free savings tracker would be worth $10 for a $1,000 savings goal.

Color them all in? And you’ll have that $1,000 emergency fund saved up.

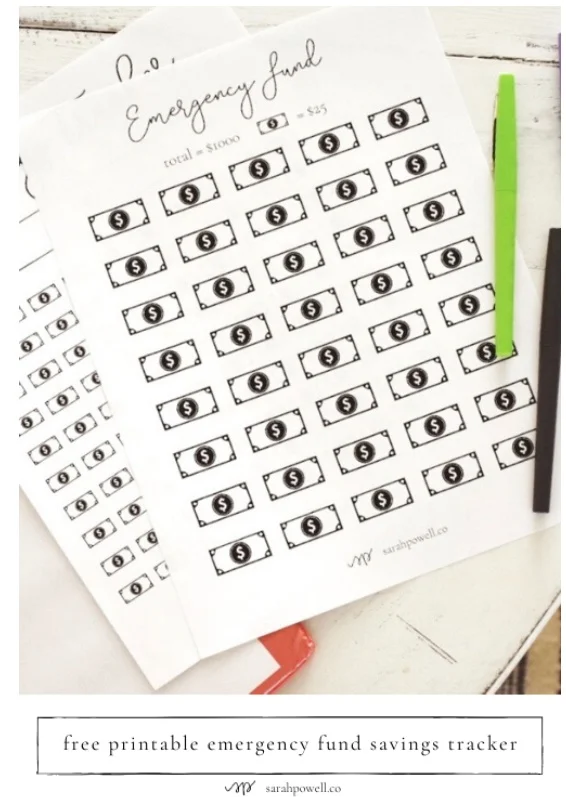

2. $1,000 Tracker with $25-increments

Each space on this tracker is worth $25, and at the end of all of them? Sits $1,000 of your money in a bank account.

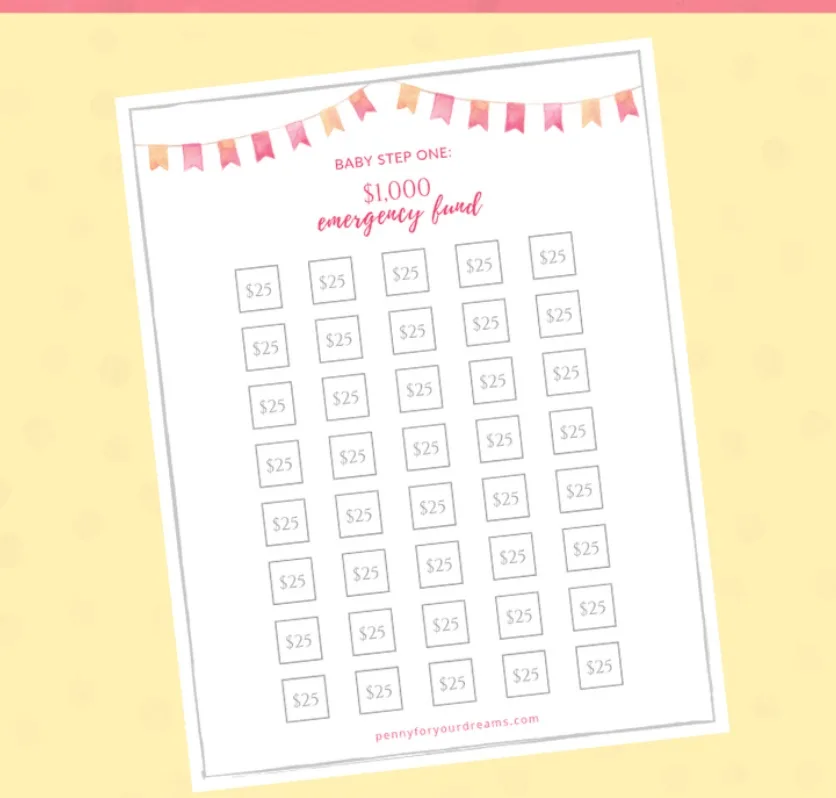

3. Pretty $1,000 Tracker with $25-increments

Here’s another $1,000 emergency fund tracker that uses $25-space-increments. It’s so pretty, too!

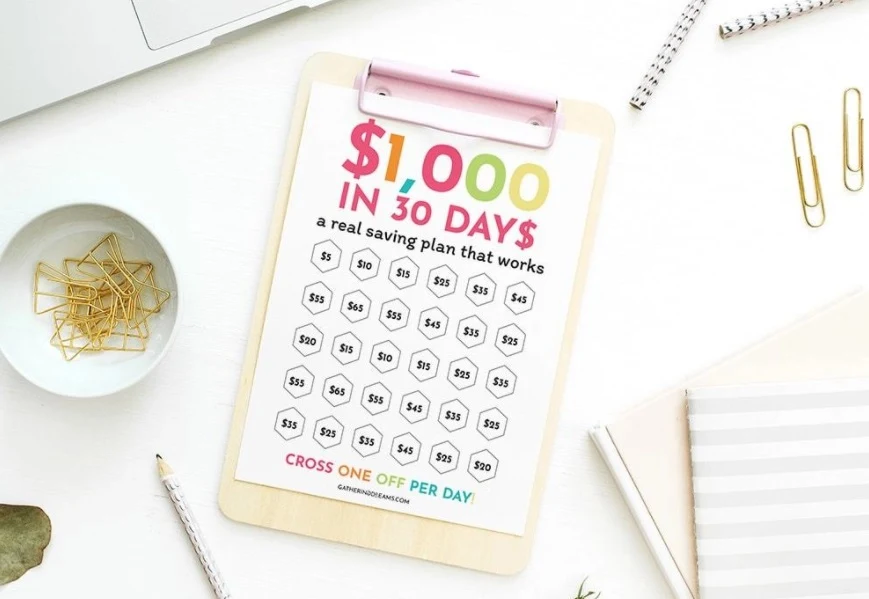

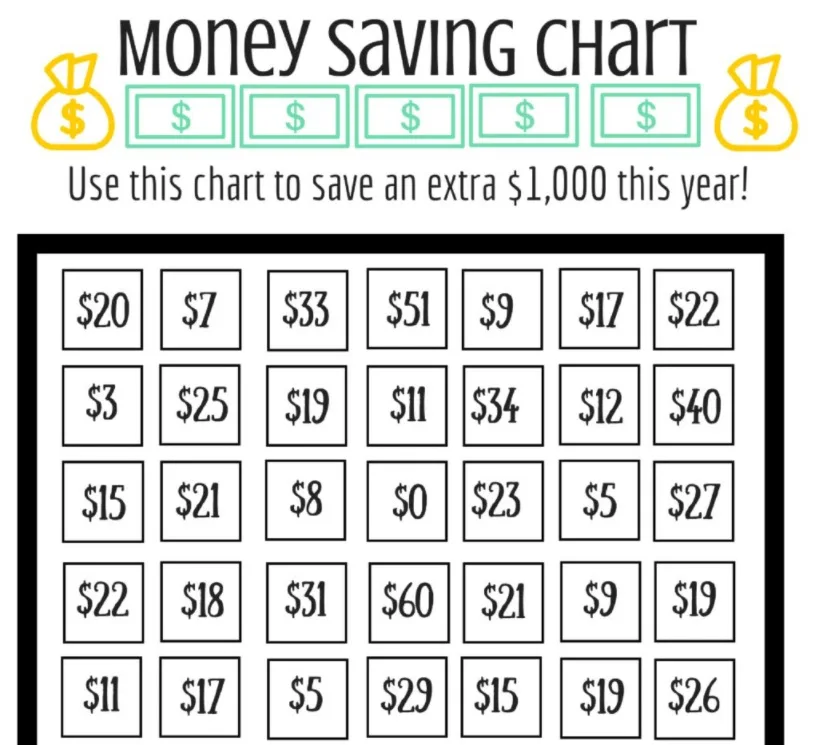

4. 30-Day $1,000 Emergency Fund Tracker

Are you ready to dig in and get this done in just 30 days? This is the tracker for you!

Each day over the next month (or, just start on whatever day of the month you’re on), pick a space and corresponding savings amount to color in and deposit into your account.

BOOM!

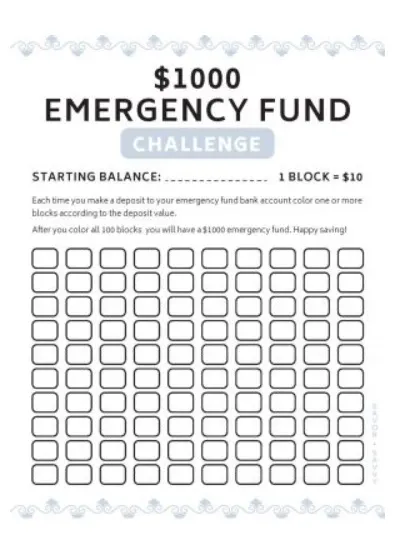

5. $1,000 Emergency Savings Challenge Printable

Use this free printable to help you get to your $1,000 goal, in $10 increments.

6. 52-Week $1,000 Tracker

Are you okay with taking 52 weeks to save up your $1,000 emergency fund? Then you can use this cute printable to track your progress.

Each week, you choose which amount out of the 52 squares you’d like to spend.

And as long as you cross one off per week? Then you’ll get to $1,000 this time next year.

Which one of these free printable emergency fund trackers motivates you enough to get going on your goal? That's the one you should choose!

Gwendolyn

Sunday 5th of March 2023

I have been cash budgeting, and these saving challenges will be so helpful for my yearly savings.

Amanda L Grossman

Tuesday 7th of March 2023

Way to go, Gwendolyn! I'm so happy to hear these savings challenges are going to help in your journey.

Tonya

Tuesday 26th of July 2022

I recently started a savings for 6 different things. These trackers would be so helpful for me

Amanda L Grossman

Friday 29th of July 2022

Awesome, Tonya! Just click on the trackers you want, and you'll see how to download them.

nicole

Wednesday 23rd of March 2022

Need copies to print please.

Amanda L Grossman

Friday 25th of March 2022

Yes, Nicole! Just click on the links throughout the article, and find the worksheets to print out. Good luck with getting your emergency fund up-and-running!