Many different types of arbitrage can help you earn extra cash. Learn 6 arbitrage strategies people are successfully doing.

There are lots of people who commit money arbitrage every day.

We’re not talking about the Warren Buffetts of the world. We’re talking about the mother down the street, your cubicle neighbor, and personal finance bloggers you like to read.

So what exactly is arbitrage…and how can you get in on the game?

I decided to ask my personal finance blogging friends and community what types of money arbitrage they are doing. And you know what? They didn't disappoint.

Let's dig in.

What is Arbitrage, Defined?

If you do a Swagbucks search for the definition of arbitrage, here’s what comes up:

“the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.”

Basically, it’s buying something from one place – coins, shampoo, bushels of wheat, etc. – in order to take advantage of a price difference for the same thing in another market (so you would sell it in the other market and reap the profit).

Here's the thing: you don't need to be some financial guru or stock market trader or anything like that to practice money arbitrage.

Common Types of Arbitrage + Real Life Examples

Sound intriguing? Let me show you how this translates to examples of arbitrage opportunities in your everyday life.

Arbitrage Type #1: Geo Arbitrage

When I reached out to my personal finance blogging colleagues and friends, I noticed that several of them were doing something called geo arbitrage.

Geo arbitrage basically means the act of relocating to take advantage of lower costs elsewhere.

Let me show you what I mean with some real-life examples of people who are actually doing this:

Example #1: Geoarbitrage in Your Own County

Josh Overmyer from JoshOvermyer.com geo arbitraged in his own county.

He writes,

“Most people think of taking their digital marketing job from the big city and moving to somewhere cheap and exotic like SE Asia or South or Central America. My version happened at a much smaller scale: Geo-arbitrage within my own county. I live in the Fort Myers, FL area. We have thousands of million-dollar homes along our beach communities such as Bonita Springs, Fort Myers Beach, Sanibel, Capitiva and Boca Grande, but I don't have millions of dollars. For a tiny fraction of that cost, I get to live in the same climate, enjoy the same golf and beaches, and truthfully – deal with less traffic!

My home just appraised for $103k last month, and it's a 2 bedroom, 2.5 bathroom townhouse with 1,180 square feet under air conditioning. It's not huge, but I'm a single guy and it's been great for me to have room for guests who like to get away from the cold winters up North.”

Josh explains that his townhouse is in the “unincorporated” part of the County – just one block east of the city boundary – which saves him from having to pay additional City Taxes and higher City utility bills (but still being able to enjoy central water and sewer services).

This saves him a collective $160/month (or almost $2,000/year). The utility savings amount to about $60/month, and avoiding City taxes is easily $100 in savings or more.

He adds,

“My smaller mortgage payment allows me to save over 50% of my income towards retirement.”

Example #2: Geoarbitrage Your Cost of Living Between Countries

Juan from FinanceClever.com is from Colombia but came to the U.S. for college.

He writes,

“Geoarbitrage works on the premise that goods and services have varying prices across geographies, both at a national and at an international level. A classic example of geo arbitrage is medical tourism where someone from a place where healthcare is very expensive (i.e. USA) goes to a place where healthcare is more affordable (i.e. Mexico, Thailand) to get some sort of healthcare (i.e. dental work).”

His personal geo arbitrage items have included:

- Purchasing a tuxedo while on a trip to Colombia for a wedding back in the U.S. that cost less than $122 (just to RENT a tuxedo in the U.S. would have cost at least $250).

- Getting an eye exam and prescription glasses in Colombia for $75 (without vision insurance). Same exam + glasses in the U.S. would cost around $200 (at the very low end).

- Getting wisdom teeth removed in Colombia for $60. Not sure what the cost would have been in the U.S., but probably multiples of that.

Juan wants to add,

“Be careful with medical tourism. As with anything else, do your research. Start small, perhaps with a teeth cleaning, and get to know doctors/hospitals that way.”

Arbitrage Type #2: Loan Arbitrage

There are some truly interesting (and, potentially, risky) ways you can grow your money by taking out loans. Let me give you some examples of loan arbitrage.

Example #1: Loan Arbitrage with Indexed Universal Life Insurance

Chris Abrams – Indexed Universal Life Insurance Expert from AbramsInc.com – started working with indexed universal life insurance policies 10 years ago. That's when he figured out the power of building wealth with life insurance.

I'll let Chris take over from here, as he's got a lot of details to share in order to explain this.

How does an Indexed Universal Life Policy Work?

In order to understand how arbitrage works with an indexed universal life (IUL) insurance policy, it’s important to understand how IUL works in general. An IUL is a type of permanent life insurance. The policy has a death benefit and also can build up cash. This cash can be accessed tax-free through policy loans or withdrawals.

Interest is credited to an IUL based on an index with the most common index being the S&P 500. The insurance company is not investing your money into the S&P but rather is using the S&P as a gauge to determine how much interest to credit to your policy.

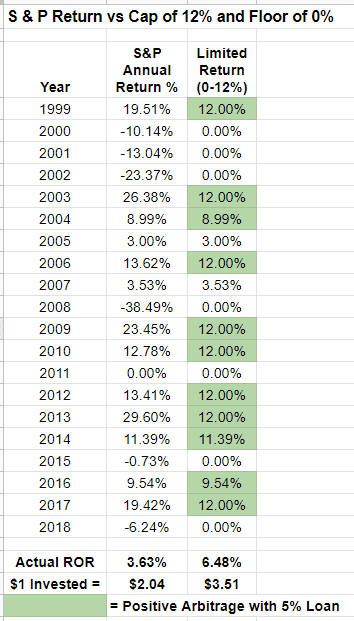

If the S&P increases 10% for the year, then your policy is credited with 10% interest. The policy owner will receive the same return as the S & P, with 2 exceptions:

- If the S&P is negative for the year, then you receive 0% interest. This protects your principal from loss in a declining market.

- The S&P index has a cap. A cap is the maximum interest that is credited per year. Average caps for the S&P index are around 12% currently. Therefore if the S & P increases 15% and you have a 12% cap, then you will receive 12% for the year.

In summary:

you give up some of the upside potential for removing the downside risk. Over time, avoiding the losses has proven to be more important than taking the risk to capture all of the upside.

Life Insurance Loan Arbitrage

Now that you have a basic understanding of IULs, let’s talk about how loan arbitrage works. The arbitrage has to do with the indexed loans that you take from the policy. When you borrow money from your IUL, the money you borrow is not taken out of your policy. Instead, this money comes from the general account of the insurance company.

So even though you have a “loan”, your money is still in your policy earning interest.

Arbitrage Example on a Car Purchase

Let’s say you buy a car and need $25,000 to pay for it. I did this last year. You call up the insurance company and they send you a check for $25,000. As a side note, there is no credit check nor any loan documents to complete. The money in your policy is your money to use as you wish. You don’t have to wait until you are age 59.5 to access your money without penalty and taxes.

The insurance company charges you a 5% interest rate on your loan. (Most insurance companies charge around 5-6% on indexed loans currently). You have the $25,000 from the insurance company, but your $25,000 is still in your policy earning indexed interest. If the S&P index is up 10% for the year, then you just earned 5% arbitrage on the money you borrowed. That’s pretty sweet!

Now you won’t get a positive arbitrage every year. Some years, the policy will get 0% interest so your cash value will be charged the 5%. If I look back at the last 20 years, there was a positive arbitrage for 11 out of 20 years (see table below). Many of those years, the indexed maxed out at 12% so the policy earned a 7% positive arbitrage.

The available indices vary by company. Some are uncapped, but still have a floor of 0. I can tell you that my personal policy has averaged 9.42%/year, starting in 2012. Past results are no guarantee of future performance. I’m very happy with this due to the purchasing power and other benefits it provides.

Paying back the loan

IUL offers unstructured loan payments. This means you decide how long you take to pay back the loan. Could be 2 years or 10 years. It’s up to you. If you decide not to pay back the loan, then the balance is deducted from your death benefit when you pass.

So as you can see, an IUL is a great tool for making large purchases. It can also do the same thing for creating retirement income. Due to the arbitrage, it will provide income for a longer duration than most other financial vehicles.

Retirement arbitrage with an IUL

Let’s say you have been saving money into your life insurance policy for 20 years and now it’s time to retire. You stop putting money in and start taking indexed loans out for retirement income. Now you are really maximizing the arbitrage since you are earning interest on 20 years of contributions, growth and now on your retirement income.

In retirement, if the policy is set up correctly, the interest earned can replenish some of the loans. That is why income from a life insurance policy can last longer than other vehicles.

Things to be aware of

While an IUL can be a great asset for arbitrage and other reasons; it must be designed by a knowledgeable agent to maximize the benefits and reduce the cost. Some points to keep in mind:

- Your insurance agent must know how to design the policy for your best interest. In other words, you want the minimum death benefit for the premiums paid.

- The policy must be maximum funded up to the IRS guidelines.

- You have to qualify healthwise for a policy. If you have health issues, the policy could be placed on a spouse.

- Your agent should review the policy with you annually to confirm it’s performing as intended and you are paying premiums as scheduled.

- You need to build up cash in the policy to be able to borrow it.

Example #2: Mortgage Arbitrage

Doug Nordman from TheMilitaryGuide.com started his mortgage arbitrage strategy almost 15 years ago, when he refinanced their home to 30 years, fixed, at 5.5%. Doing so earned him an 8% return on his money.

Doug writes,

“We’re borrowing against our home and investing it in the stock market for three decades. We make money when the stock market’s after-tax returns are higher than the mortgage’s interest rate.

This is very risky, of course, and the worst case would be losing the home to foreclosure. However we’ve hedged our payment risk with our reliable income and we’re comfortable with carrying the debt.

I’d only recommend this tactic for investors who have very reliable income, like an inflation-indexed annuity or stock dividends rising faster than inflation. Mortgage arbitrage also works best when it’s invested in an asset allocation that’s very high in equities. I would not invest in anything returning less than the mortgage’s fixed interest rate (like short-term bonds) and I’d minimize the cash in the portfolio.

Finally, investors have to be able to sleep comfortably at night despite the leverage. It’s hard to focus on the 30-year goal when you’re in the middle of a nasty recession.”

The amount that Doug had taken out at a mortgage at 5.5%, he also invested in a small-cap value index fund.

Here's the digits:

- At 14 years (October 2018) the after-tax annualized total return of our investment peaked at 9.53%. As of the fund’s last dividend (June 2019), the annual return had dropped to 8.03%. It’s very volatile. Late 2018 turned out to be an all-time high for that fund, and by June its value had dropped over 14%. Over the long term of 30 years, our after-tax annualized total return will probably be about 7% per year.

- Our living expenses (including the mortgage) are covered by my inflation-adjusted U.S. military pension and our other dividend income. The mortgage lender approved our income and our debt-to-income ratio.

- This leverage didn’t always work. During the Great Recession, our return dropped below the interest rate of the mortgage and didn’t recover for over two years. From late 2008 until early 2011, if we had cashed out then we would have lost money.

- Over the long term, though, the stock market has outperformed the cost of borrowing the funds. Mortgage interest rates have dropped even further since 2004, and in 2017 we restarted the loan for 30 years at 3.50%. I’ll make my last payment when I’m 87 years old.

Arbitrage Type #3: Media Buying Arbitrage

Example #1: Facebook Ad Arbitrage

Kelan and Brittany Kline – Co-Owners of The Savvy Couple – started to run Facebook ads to grow their email list. But instead, they stumbled upon a viable money-profit opportunity.

Kelan explains,

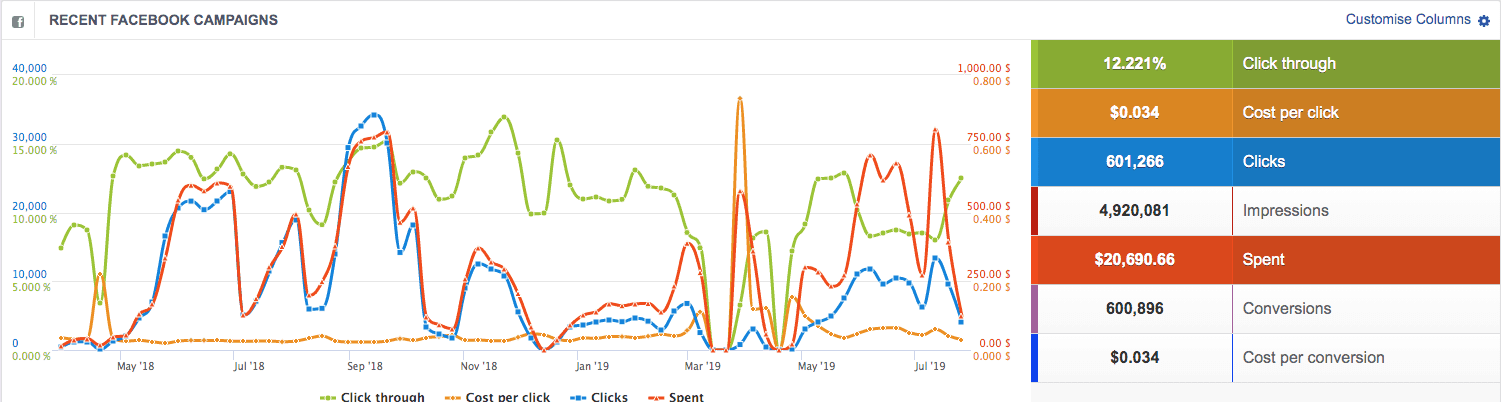

“We quickly learned that we could not only grow our email list but turn a profit from display ads. We simply needed to get our CPC (cost per click) as a number that was less than what we would make from display ads. When we found a formula for making this happen we started running more and more traffic campaigns to our blog.

In running a blog you can make money from display ads, affiliate marketing, and selling your own products. Once you have a proven article that is optimized for monetization you can run targeted Facebook ad campaigns at it to get more exposure. If your display ads and affiliate marketing are running hot and your CPC on your Facebook ads are low you can turn a profit. We have been able to do this for a handful of our campaigns.

We have spent over $20,000 on Facebook ads and our lifetime CPC average is currently $0.034. Meaning if we can make above that number we are turning a profit on those ads. The campaigns we were running display ad arbitrage with we were able to get our CPC below $0.03.”

Kelan adds,

“Facebook ads are a great way to grow your online business much faster than most others. It takes some time to learn and experiment but once you get the basics down and find a profitable campaign it's like an ATM of profit. We have taken multiple courses on Facebook ads and use AdEsspresso to manage them.”

Example #2: Media Buying Arbitrage

Tom from ThisOnlineWorld.com first stumbled upon media buying arbitrage in his first internship in college.

Tom explains,

“Media buying arbitrage is what many popular ‘clickbait' companies rely on for generating revenue. Companies who engage in media buying arbitrage typically create ‘viral' style content on landing pages that are heavily monetized with advertisements and affiliate links (think BuzzFeed, as a style).

To be successful at media buying arbitrage, you need to run advertising campaigns on platforms like Google Ads or Facebook to attract visitors to your website, where you can generate revenue if users click on ads or purchase affiliate products. The tricky part, of course, is that you have to buy traffic for a cheap enough amount to maintain your margins, otherwise you will not recoup your advertising spend.

This form of arbitrage works largely because of the viral model that is built in, as well as how algorithms work on platforms like Facebook. A company might spend $5,000 promoting a post, and only recoup $4,500 in advertising revenue. However, with enough shares, comments, and likes, the content might start spreading like wildfire on it's own/without the need to continue spending.

Suddenly, you might be in a position where an additional 20,000 people visit your website due to social shares, and this could net a profit.

Margins are generally very thin in media buying arbitrage, and it's a tough balancing act to promote quality content while also presenting a heavily monetized landing page experience. At the end of the day, I think it is important that users remain aware that sometimes the ad they are clicking on might be part of a larger marketing strategy and not just another trendy article in their feed.”

Arbitrage Type #4: Retail Arbitrage

Retail arbitrage, where people buy products from one market and then sell them for a higher price on another market (taking advantage of pricing irregularities — either intentional or not), is pretty common.

Example #1: Buying from a Brick-and-Mortar Store, and Selling Online

McKinzie Bean from MomMakeCents.com started her retail arbitrage in the fall of 2015.

She explains,

“I was a new stay at home mom and money was tight. I've always loved finding good deals and I thought it could be a good way to bring in extra income for our family. Retail arbitrage is essentially buying products from retail stores (think Target, Kohls, etc.) and selling them online for a markup. If you can find things in the store at a low enough discount or stack coupons to significantly lower the price there may be enough demand online to flip them for a profit.”

Here is an example of this in action:

- “One store I loved to shop at is Kohl's. With a Kohl's charge card they often do big discounts like 30% off + other stacked coupons like $10 off $50 or even 1-2 times a year $10 off $25. If you can find items that sell on Amazon for 2-3x the price that you are going to pay at the retailer you can bring in a great ROI. I remember one night Kohl's had coupons that overlapped for a few hours so I stayed up late placing multiple orders for children's toys that I was able to flip and sell on Amazon during Black Friday.”

A final tip from McKinzie:

“Another great place to look is the thrift store. One time I found a CD at Savers for $2 and I later sold it in used condition on Amazon for over $40!”

Example #2: Amazon Arbitrage

What is Amazon arbitrage? Here's an article about how to do arbitrage by using Amazon's Fulfillment by Amazon program.

Arbitrage Type #5: Currency Arbitrage

There's two different kinds of currency arbitrage we'll talk about.

- Domestic Currency Arbitrage: There’s a stark difference in the cost of a penny, $0.01, and the value of the actual copper used to produce pre-1982 pennies, roughly $0.023 (the markets change daily, hourly, etc.). So by saving all the pre-1982 pennies you can find, you would reap twice the cost you paid for the penny! Of course, you can’t liquidate pennies legally in the United States (nor, ThePennyHoarder.com points out, can you take them out of the country to do that). But people are hoarding these pre-1982 pennies in the hopes that one day the US government will get rid of the penny altogether like other countries have done to their smallest form of currency. In the meantime, Kyle from The Penny Hoarder outlines a way for you to cash out on your pre-1982 penny hoarding anyway.

- Foreign Currency Arbitrage: If you’ve ever traveled abroad and used that country’s currency, then you know how often currency exchange rates change relative to each other. For example, when I was living in Japan, we had to make our several-month rent payment of a few thousand dollars all at once. So we watched the currency market to see when the most beneficial day was to convert our lump sum into Japanese Yen (that’s a kind of arbitrage right there!). Well, you don’t need to live in another country to take advantage of foreign currency arbitrage. Here is Pauline’s experience with forex trading.

Arbitrage Type #6: Balance Transfer (or Credit Card) Arbitrage

People with good credit can take advantage of credit card arbitrage.

The idea is you open a credit card with a 12-month, 0% APR balance transfer promotion.

Then you transfer a balance through a “convenience check” with the credit card company. Deposit that money into your high-yield savings account (not to be spent, by the way).

Make the minimum payments needed each month on the card, and be sure to pay the card off before the balance transfer 0% APR promotion ends (or you could be hit with some significant fees). In the meantime, you earn interest on that money in your account.

Madison from My Dollar Plan has a good rundown of this, where she's taken advantage of $200,000 in balance transfers at a time.

So, what do you guys think? Any of these sound interesting to you? Have you ever done arbitrage, and what was your financial gain? I'd love to hear about it in the comments below.

Glen

Tuesday 22nd of September 2015

Thanks for the mention Amanda :)

Arbitrage can be a really lucrative income stream if you get good at it. Some people even make a full time job out of it.

Amanda L Grossman

Wednesday 23rd of September 2015

You're most welcome! I love finding people who think of or experiment with new ways of keeping + earning income:).