I've learned a lot since becoming debt-free 11 years ago. I'm going to share what is the best strategy for paying off debt, and much more.

You live, you learn, right?

After paying off the remaining $25,000 of our combined $59,496 in debt back in 2010, as well as studying how others have paid off their debts for the last 11 years, I can confidently say that my money knowledge has grown.

Exponentially.

So I thought I'd take the chance to put my current self back into my old position of being in debt, and show you some awesome strategies to use, plus what I would have done differently in my own debt journey so that you can learn how to get better at managing your money.

These strategies I'm about to share will help you answer the question of what's the best strategy for paying off debt so that you can get out of debt quicker, and so much more.

What is the Best Strategy for Paying Off Debt?

When you ask this question, are you just thinking about which of the debt payoff methods makes the most sense: Snowball, Avalanche, or Tsunami?

We'll get to those.

But you should know that there are other strategies to use as well, with the first one being super important for anyone trying to pay their way to a debt-free future.

Strategy #1: Use a Progress Map for Visual Gratification

Amy at Map Your Progress came along well after we were through our own debt repayment strategies. And wow she came up with an awesome idea to help all future debt payees to come.

In a swirly, debt-free nutshell: while Amy was in $26,000 of credit card debt payoff mode, she decided to keep herself motivated by creating a visual swirly map of her progress. Each swirl was worth $100, so every time she sent in a payment, she would get to color in the corresponding amount on her progress map.

In the end, she created a work of art…and a debt-free life! Not to mention she now runs a biz based on her progress-mapping creations. You can get a free, 10-swirl heart map here.

Here are 7 other visual debt payoff charts to help you out.

Strategy #2: Estimate the Amount of Interest You'll Pay Using Three Different Methods

I'm all about strategy with your money, and with my money.

My husband and I used a hybrid approach to our debt payoff strategy. It really worked well for us, and I suggest you also create a mix of your own debt repayment strategy based on what's available.

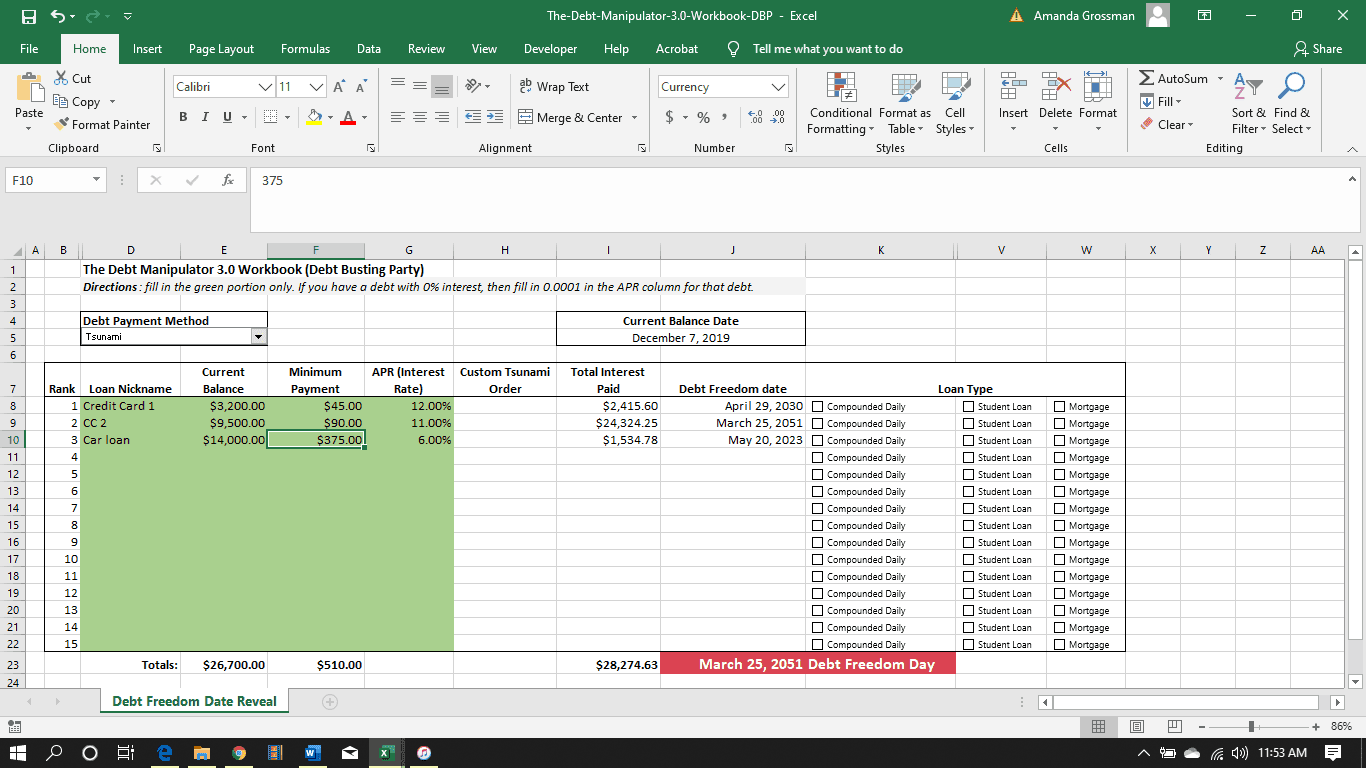

Before we dive into these, you can check out my free Debt Busting Challenge to get this spreadsheet, where you plugin in your own debt information and it spits out how much interest you'll pay using each of the debt payoff strategies.

Here are debt elimination strategies for you to consider when getting out of debt:

Dave Ramsey's Snowball (aka, “Quick Wins”)

What: The snowball method of debt repayment is great for people who owe lots of different creditors at varying balances, and who wish to get quick wins. This is because you are going to pay off each of your debts from the smallest balance to the largest balance, regardless of the interest rates. Since the smallest debt balance amount is first, it should not take long to pay off (one creditor down = quick win!).

How this Strategy Works: Pay minimums on every debt owed. Throw any extra toward the smallest debt. Once you knock that debt out, you then take all of the extra money + minimum payments you were throwing towards the first debt and roll it into the next smallest debt. In essence, you are making a “repayment snowball” that keeps getting larger and larger after each debt payoff to ram into the next debt owed.

Snapshot: Pay debts from smallest to highest principal amount owed.

Suze Orman's Avalanche (aka, “Interest Payment Minimizer)

What: Detach yourself from the emotions of debt and pay off debt in the most logical, interest-saving way using the Avalanche strategy. You simply pay off your debts in the order of highest to lowest interest rates, regardless of the balance amounts (look on your credit card bills for an interest rate – or call your creditors).

How this Strategy Works: Pay minimums on every debt owed. Throw any extra cash toward the amount of debt with the highest interest rate. Once you knock that debt out, you then take all of the extra money + minimum payment amount you were throwing towards the first debt and roll it into the payment of the next highest-interest debt (thus creating an avalanche of money as you travel down your debt payoff list).

By doing this, you will get rid of your most expensive debt first, giving less of your hard-earned money to creditors in the form of interest paid.

Snapshot: Pay debts from highest to smallest interest rate percentage being charged.

Adam Baker's Tsunami (aka, “Offload Emotional Baggage First”)

What: You’re in the heat of August. Perhaps the A/C isn’t keeping up, or you are on the last quarter mile of a jog. Either way, it’s hot. You take your hat, a notepad, a fan, or whatever physical object you can find and fan your face. It feels better, even briefly. Yet you’ve undoubtedly heard that doing so – fanning yourself – does not cool you down because the benefits are absorbed by the energy it takes to do the fanning. You continue flapping away anyway. Why? Because even though scientifically speaking flapping air into your face makes you hotter, not cooler, it provides instantaneous relief.

Paying down debt using the tsunami strategy works the same way. It’s not about the math; we all know 2 – 3 = a negative number, and most of us make enough income to permanently take us off of the debt treadmill. Yet millions of Americans are in debt. Why? Because for many, it’s not simple math. It’s a mental and emotional game.

How this Strategy Works: Pay minimums on every debt owed. Then figure out shedding which of your debts will give you the most lift and will relieve you of the most emotional pain (could be a debt from an ended relationship or marriage, from a family member lording it over you, a business line of credit on a business idea that sunk, paying on a car that was wrecked, from a big mistake, etc.). These emotionally charged debts become the ones you tackle first, no matter what the balance amount or the interest rate is compared with your other debts.

Offloading some of this emotional baggage – gaining instead validation, repairing relationships, and all of the other things you feel you are lacking because of these particular debt obligations – will give you the strength and hope you need to tackle the other debts when the time comes.

After you list the debts that have caused you pain and there are no others that bother you, list the remaining debts in order from the highest interest rate to the lowest interest rate. Pay the minimum on each of the debts, and then throw any extra money you have towards paying off the debt that is most emotionally charged (first on your list).

Once that debt is paid off, take any extra payments you were making + minimum payments on it and roll it into the next debt on your list. In essence, you are making a “repayment tsunami” that keeps getting larger and larger after each debt payoff to ram into the next debt owed.

Snapshot: Pay debts from highest to lowest emotional load first, and highest to lowest interest rate after.

Strategy #3: Rethink How You Consolidate Your Student Loans

Part of my debt (the largest part) was student loans. So one thing I would do differently today is to figure out how much interest I would pay under the various student loan repayment plans in the period just after graduating college.

Psst: looking for one of the smartest ways to pay off student loans? Here's my article on income-driven repayment plans.

Because in those first few years after graduating college, you can make the biggest dents in terms of paying gobs of less interest overall. But you need to know which loans to send the extra payments into and overall how to manage your loans (I don't know about you, but I had about 7 different loans to send money into).

The answer might sound simple enough − the loans with the highest interest rate.

But doing something like consolidating a small-amount but high-interest rate loan (say, $1500 loan at 9% interest) into several larger-amounts, but smaller-interest rate loans (say $17,600 with 2.5% and $5,000 at 5%) is going to blow your interest payments out of proportion.

Consolidating those two together will raise the interest rate on the larger amount of money, causing you to pay much more in interest over time. (Strategy in case you're in this position: pay off the smaller loan with the high-interest rate by itself and consolidate the rest).

You can use this student loan repayment estimator to tell you the information about your own student loan debt repayment strategies.

Psst: check out this article to help you figure out is refinancing a car worth it.

Strategy #4: Rethink Your Gazelle Intensity Level

I love a good debt-payoff story.

In fact, during my 30-day Debt Bustin' Challenge, I took the time to research + highlight one debt payoff story a day (you can still get super inspired by these on my Debt Bustin' Challenge Pinterest Board).

That's 30 different debt-payoff stories. And I probably could have kept on going.

These are people who, mostly, were gazelle-intense about their debt payoff strategies. They did some crazy things that resulted in some crazy goodness: reaching the debt freedom promised land years earlier than their creditors wanted them to.

Yet some of them − myself included when we decided to gut our $7,600 savings account to pay down the remainder of my Sallie Mae student loan debt − got downright lucky.

Luckily something big financially didn't happen to them while they had exposed themselves to the wilds of Africa.

Let me explain what I'm talking about.

Debt Snowball Method: Getting Gazelle Intense Exposes Yourself + Your Family

The idea behind invoking the intensity of a gazelle into your debt repayment strategy is that you will get to the other side much more quickly (especially since they can run up to 55 mph!).

Your job after that is to quickly save up an additional 3 to 6 months of living expenses in an emergency fund.

In the meantime, you're supposed to have saved up $1,000 to stave off any small emergencies while you've exposed yourself in the vast wilds of Africa.

Got that?

Step #1: $1,000 in an emergency fund

Step #2: get gazelle intense and pay off all that debt as quickly as possible

Step #3: mitigate your exposure to those wily cheetahs by beefing up your emergency fund to a more proper 3 to 6 months' worth of expenses

Three Times When You Should Mimic a Sloth's Debt Repayment Strategy

It's a sexy plan, I gotta say.

And we mostly kept to it during our last debt repayment push to pay off our remaining $25,000 of debt before we walked down the aisle together (though really we used a hybrid between Dave Ramsey's plan and Suze Orman's strategy).

But sometimes, it's not the most sound financial advice.

Sometimes the signs around you indicate that it would make much more sense to use all that extra money you're sending into your debts for something else instead because a nasty financial surprise might be lurking at the next water hole.

Here are three such times I'd like to point out:

- Shaky Job Atmosphere: If things are looking a little shaky around your job − like that guy, third cubicle down on the right, is no longer there, and come to think of it, that woman you used to exchange hello's within the hallway is no longer there, and now they're talking furloughs in the breakroom… − then you have got to stop putting all your money into your debt repayment strategy. In the event of a layoff, you have no real idea how long it will take you to secure new employment (fyi my husband and I have been laid off four times between the two of us, and each time it took between 3-5 months to find new employment). In the meantime, you're overexposing yourself by taking all of your money − money that can be used to pay immediate bills like food + the mortgage − and sending it out the door. Another word of caution here: if you have any 401(k) loans, then you might want to funnel money to those instead. Check out my layoff empowerment kit + free checklist for more info on why your 401(k) loan gets quirky post-employment + lots of other things you need to be aware of.

- You Find Out You've Got a Little One on the Way: Having all of your debt (especially all of your non-mortgage debt) paid off before a little one comes into your world is absolutely awesome. What's not so awesome is only having $1,000 in an emergency fund for their arrival. Extra costs are coming, I assure you. Things you couldn't even think about are coming. For example, in our own case, we paid close to $10,000 out of pocket after health insurance due to unforeseen circumstances…and we had thought saving an extra $5,000 would be plenty. Then those unforeseen medical circumstances cascaded into me not being able to breastfeed, which meant formula costs of about $150/month we weren't expecting. And it just snowballs from there.

- You Find Out $1,000 Isn't Enough to Cover Your Insurance Deductibles: Take a minute to add up all of your insurance deductibles on your various policies. This includes things like flood insurance, car insurance, homeowner's insurance, etc. Does the total equal more than $1,000 (heck, one policy alone might equal more than $1,000)? Then it's time to save up more in your emergency fund. Trust me, you're talking to a person who has faced several insurance deductibles in the last few years. Things can and will happen, and if you don't have enough to cover the deductible in order to do the work you need done…well let's just say you're overexposing yourself.

I'm all about gazelle intensity. I'm all about paying off your debt ASAP (a lump sum payoff is awesome!). But I'm also smart, and there's more strategy to money than what meets the eye. Think about your own personal situation, and if you get that little feeling in your gut that a herd of jackals is coming around your water hole, well then it might be time to modify your debt repayment strategy.

Strategy #5: Think Twice about Depleting Your Entire Savings for the Last Push

I recently talked about this, but it's worth mentioning again (hindsight is 20-20, right?). In order to get ourselves out of debt and cross that finish line, we decided to gut our $7,600 worth of savings. I think we had a little left afterward, but not much.

The fact is, we got lucky. Luckily something else didn't happen to us that would have sent us right back into debt, or worse, without a way to pay for something.

You see, while you're getting all gazelle-intense like that, you're really exposing yourself to the wilds of Africa. Which is precisely what we did.

It worked out, but now that I'm a bit older and wiser (and have a 19-month-old), I think I'd not be so fast to gut our savings. Instead, I'd beef up the emergency fund savings to over $1,000 ($1,000 is what's recommended by Dave Ramsey while you're gazelle-intense). Probably to about $5,000. Then anything over that I'd feel more comfortable sending to our creditors.

Well, here's my list of three debt repayment strategies I'd use today if I were back on the debt payoff journey. Are you in debt payoff mode, closer to becoming debt-free? Out of it? I'd love to hear what you would do differently if you could do it all over again.

Strategy #6: Learn How to Feel Free, Even While in Debt

A great question you might have about yourself is how can you free yourself from debt.

I think this question goes wayyyy beyond just the numbers.

Debt can be this monkey on our backs, this chain around our necks, and a seemingly sticky place to be at the moment. It is stress-inducing, anxiety-producing, and just makes you want to curl up in a corner to the dull tunes of a television show.

I know, because I used to be in debt myself. I also know that these are some of the very words you all used to describe your debt situations in the survey I offered last November. Many of your responses were what most of us would consider typical for people in debt, such as feeling stress, living with fear, and dodging creditors at all points of entry into our lives.

Here's the thing:

If you really want to free yourself from debt? You need to start the process NOW. Even while you're in debt.

I'm talking about continuing to enjoy your life, despite being saddled with debt.

Because in the time vs money debate? Your time is your most precious resource. And you don't want to spend it feeling miserable.

How to Continue to Enjoy Your Life, While Saddled with Debt

In that survey, there were two responses that were radically different. To the question, “How is Debt Affecting Your Life,” two people answered in very optimistic, inspiring ways by essentially saying that even though they felt down about it from time to time, they did not let it get in the way of their overall quality of life.

That is two people out of 50 total respondents.

What does this say to me? The number of respondents is too small of a sample to write up a paper with any conclusive evidence. However, from being in debt myself and from the answers provided, I can tell that debt is sucking the enjoyment out of many lives.

So how can we come back to enjoying our lives again, despite our debt loads?

- Confront, Confront, Confront: If there is one thing I have figured out in my short thirty years on this earth it is this: something is always scarier in the dark when you have no idea of its boundaries, shape, or characteristics. Many people’s instinct with debt and other difficult challenges is to hide and ignore the situation. At least you know the situation that you find yourself in now, right? It’s comfortable. The unknown is uncomfortable, and it takes courageous people to walk into it. But a little-known fact is that confronting something head-on – finding out each creditor that you owe, interest rates, the amounts, and debt payoff date –will bring down your stress and anxiety levels significantly. When Gail Vaz-Oxlade goes into people’s homes on ‘Til Debt Do Us Part, at the first on-camera sit-down she runs through all of the honest, and oftentimes ugly, numbers. It’s typically a screen full of negatives, with a total equaling more than the sum of the couple’s annual salary. Many times the people are completely shocked because they likely had never done so themselves. Some cry, others laugh nervously. But then something amazing happens: they have the motivation to do something about it, and for the first time in a while they are filled with some hope.

- Have Faith and Gratitude: Faith and gratitude will keep your mindset positive, and keep your thoughts out of the endless negative chatter that oftentimes surrounds debt. Having faith gives you hope, and allows you to dream again. Having gratitude makes you thankful for all of the wonders in your life, which truly helps to lighten your mood. Each of these positive feelings will likely open your eyes to ideas you had not thought of before.

- Do Not Always Forsake the Present for Your Delicious, Debt-Free Future: Everyone looks forward to the day when they can finally declare themselves deliciously debt-free. People call into Dave Ramsey’s radio show all the time and you can just feel the tension over the airwaves from the exhilarated person(s) who can’t wait to yell out, “We’re Debt-Free!!!!” Trust me, these are precious moments. We declared our own debt freedom from $25,000 on September 1, 2010. The promises of this gorgeous day are so seductive that it becomes easy to only go through the motions of living in the now without really living. Do not wish your life away, whether you are chained down with debt or not. You may live to regret the five years you spent in a holding pattern, and the taste of that eventual debt freedom may be more bitter than sweet.

- Be Social Anyway: One of the surprising and heartbreaking comments received from several people is how their debt has cut them off from relationships and from being social by either finding new friends or spending time with old ones. Sure, you may not be able to go out to posh restaurants anymore or meet up with a group of people for drinks. But what is stopping you from meeting up with a buddy to go for a run? Joining a free group like knitting or playing cards or a book club that meets at someone’s house, admitting to your old circle of friends that you just don’t have the funds to splurge right now but would love to continue hanging out with them? Realize that it is likely you have friends and relatives who are in the same boat as you. Debt should never be a reason to become a hermit.

- Realize the Lessons You Teach Your Children and the Time that You Spend with Them are Far More Important than the Things You Buy Them: I have a few items left from my childhood that I brought into my adulthood: the thesaurus my aunt bought me in 7th grade, the children’s book my great-grandmother typed for me with me and my sister as the main characters, two scrapbooks from the year I was Chester County Dairy Princess. Yes, I treasure these belongings. Out of all of the Christmases and Birthdays of my youth, I can only recall a handful of the actual gifts that were bought for me. What do I remember most? Playing badminton on the front lawn with Dad, feeling happy and joyous around the holidays when all of our family would gather, playing Scrabble as a family on vacations, going to my great-grandmother’s pool with my mother, sister, and brother. These are feelings, moments, and experiences, not gadgets, electronics, or things. And these are what I will carry with me for the rest of my life. You can do the same for your children, regardless of your current financial situation.

Many of us will spend decades getting out of debt. But really, we should look at these decades as not getting out of debt, but as living with debt. It’s already caused financial havoc, why allow it to cause more havoc? What is in our control is to continue living our lives despite. Don’t allow debt to ruin relationships, take away the trust that we have with one another, or forsake those decades by saving up all of the living we want to do for some future date.

Life is now, pieces and all. So let’s make the most of it.

Debt Free Lifestyle

One more thought – the debt-free lifestyle. YOU are going to make it to this land of milk and honey one day (and, of course, you should still be happy with your life in the meantime! See the section above).

My husband and I have been debt-free (except for our mortgage) since September 2010.

From living a debt-free lifestyle (though, with a mortgage) for the last 8 years, I'd like to give you a few tidbits about what it really is like.

- Your debt-free vows will get tested: We made a vow to never go back into debt again, once we had gotten out from under it. And yes, our debt-free vows have been tested over, and over again. This is mainly due to the second point here.

- You have to get okay with coughing up large amounts of money from savings: Since we made that debt-free vow, life did not stop happening. What I mean is, that we've had to shell out thousands of dollars for home repairs, vehicles after they were flooded in hurricanes, and all kinds of things that cost a lot of money. That money had to come out of our savings. And I have to say – from a very grateful heart – that it is hard to let go of cash when it's in cash form!

- Your cash flow opens up: Suddenly, you have more cash flow than you did before because it's not going toward debt. We had an extra $950/month open up because that was what we were sending to our creditors to get out of debt extreme gazelle fast! My suggestion for you is to use that new cash flow for something big so that you can continue to meet your financial goals. Like…send it into your mortgage now, or directly to savings (see the second point above).

You can read more about the debt free lifestyle here.

Amanda L Grossman

Latest posts by Amanda L Grossman (see all)

- 5 Surprising Ways to Cut Household Costs (Saved us over $1,412!) - March 11, 2024

- The No Spend Challenge Guide (Money Game-Changing Tool) - January 31, 2024

- 47 Seasonal Jobs in Alaska with Housing (Hiring for this Summer) - December 1, 2023