In need of extreme couponing tips? I'm going to let you in on some industry secrets that will save you enough money each month to finally afford that family vacation!

I’ve caught a few episodes of the show Extreme Couponing in the past, and each time it has led me to wonder about the logistics of these people’s lives:

- how do they find space to house their stockpiles?

- how can they possibly use up all of the products in a meaningful way before expiration?

- how do their families truly feel about their obsession?

- are they abiding by the coupon fine print, or committing coupon fraud?*

It may give them a rush to purchase 348 bottles of barbecue sauce for under $20 (true story), but so what?

Most of us do not want to spend the hours that it can take to legally walk out of a grocery store paying less than $10 for thousands of dollars worth of groceries.

We are happy to leave these shenanigans to the extreme couponers.

But does that mean we should write off coupons all together?

You know my answer to this: heck no!

Coupons are like cash in our household and they can supplement your income as well. Without taking on the burden of a couponing obsession, there are many things we can learn from these guys to make each of us above-average couponers.

Coupons are like cash in our household and they can supplement your income as well. Click To Tweet*You should know that I was contacted by Bud Miller from Coupon Information Center, who says, “Please use great caution if you are approached to participate on any coupon or shopping “reality” show. Be sure that all the terms and conditions are followed with the use of coupons. Verify that any featured coupons are being used for the correct products, including size and specific brands, and that the coupons themselves are legitimate. Please also be sure you pay special attention to ensure that any electronic discounts, such as digital coupons, are being used in an appropriate manner.”

Secret #1: Stacking Coupons Multiplies Your Savings

Why only use one coupon per product when sometimes you can use more than one?

Learn to stack your coupons by using both a store coupon AND a manufacturer coupon when shopping (fact: many stores allow this, so it's not coupon fraud).

Stores that typically offer their own store coupons are:

- Target (on their website as well as in the Sunday coupon inserts)

- Kroger’s (through mailers to your home)

- HEB (look for yellow store coupons throughout the store)

- Whole Foods (check out their free issues of the Whole Deal)

- CVS (through their ExtraCare Bucks program)

- Walgreens (look for store coupons in a monthly coupon booklet they issue at the front of their store), but you can also find many of these coupons through sites like Coupon Sherpa too

Strategy Example: if Target issues a coupon for $3.00 off Pampers diapers, and you have a manufacturer coupon for $3.00 off Pampers diapers, then you can stack these two coupons in the same transaction and save $6 off one pack of one package of Pampers diapers.

This might be one of my most favorite frugal tips with a big impact to our household's (and yours) bottom line.

Secret #2: Hand Over Your Coupons in a Specific Order

You always want to give the cashier the price-minimum coupon before you use any other coupons in your transaction.

This is because if you start handing over the manufacturer coupons and your total goes under the price-minimum coupon, then you need to either grab filler items to get your total back up to minimum price in order to receive the discount, or you'll receive none at all.

I typically put the price-minimum coupon on top of the pile that I hand to the cashier.

Strategy Example: if you have a store coupon that gives you $5 off of a $20 purchase ($5/$20) and three manufacturer coupons for $0.50 each, you give the $5/$20 coupon first and then hand over the manufacturer coupons. This is because if you start handing over the manufacturer coupons and your total goes under $20, then you need to either grab filler items to meet the $20 threshold to receive the $5 (or not get the discount at all).

Secret #3: Decrease Your Tax Bill by Using Coupons

Did you know that in several states (including Texas) sales tax is assessed on the post-coupon total of both manufacturer and store coupons rather than the pre-coupon total?

This means that using coupons has a compounded effect; it not only lowers your overall purchase amount but it also lowers your overall sales tax bill for the year.

I don’t know about the sales tax rate where you live, but here in Houston (where we do not pay state income tax), the tax rate is 8.25%. I’d love to shave a few points off of that!

Strategy Example: Using a $0.50 coupon will actually save you approximately $0.54 when the tax savings are taken into consideration. Imagine your tax savings if you use coupons regularly!

Secret #4: Barcodes Mean Something

I always used to think that barcodes were strictly a method of communication between manufacturers and retailers. It turns out that consumers can benefit from memorizing a few important barcode digits.

Strategy Example: If a coupon code begins with the digit 5, then it will double according to store policy (even if the coupon states “no doubling”). If the coupon code begins with the digit 9, then the coupon will not double. Interested in decoding more numbers? Knock yourself out.

Secret #5: Using Coupons with Rebates will Generally Make You a Profit

Many rebates will refund you the money of the total purchase price before any coupons that you use, which is how people make a profit from rebates.

Strategy Example: Let’s say you purchase a shampoo for $3.99 using a $1.00 manufacturer coupon. Now let’s say you were playing the drugstore game, and so you paid your $2.99 balance using ExtraCare® bucks (CVS store credit). You will still be reimbursed $3.99 by the company, meaning you have just profited real cash from your transaction.

Secret #6: Many Stores Accept Competitor’s Coupons

I have been pleasantly surprised several times by asking a store manager if they accept competitor’s coupons.

Strategy Example: Ace Hardware coupons can be used at The Home Depot, and JoAnn's or Michael's coupons can be used at Hobby Lobby. I've personally tried these two out. I wonder what other stores will accept competitor’s coupons just because you ask?

Secret #7: Expired Coupons Still have a Purpose

It turns out that expired coupons are still accepted in places that need our support: overseas military bases. Expired coupons can be clipped and sent to military families across the world who can still use them at their on-base grocery store for six months past the expiration date. This can truly help their cost of living expenses.

Perhaps Paul and I will never have an $8.37 bill for two weeks’ worth of groceries.

But between using coupons on groceries and toiletries we can pretty easily shave $100 off of our monthly bill, which is very much worth our time.

What Stores Allow Extreme Couponing?

While no store will come out and say “extreme couponing, allowed here!”, you can kind of figure out which ones give friendlier couponing terms — the kind you need in order to extreme coupon — by looking at their coupon policies.

Let me show you some examples, with screenshots.

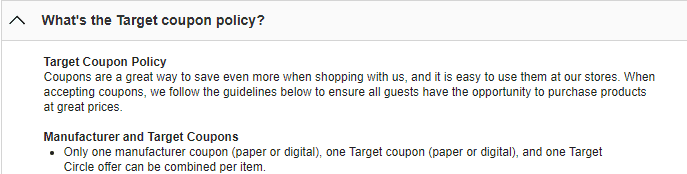

Target Coupon Policy

Target allows you to stack up to three coupons at once. Here's a snapshot of their policy:

CVS Coupon Policy

CVS most definitely allows stacking of coupons – that's how I and others can play the drugstore game.

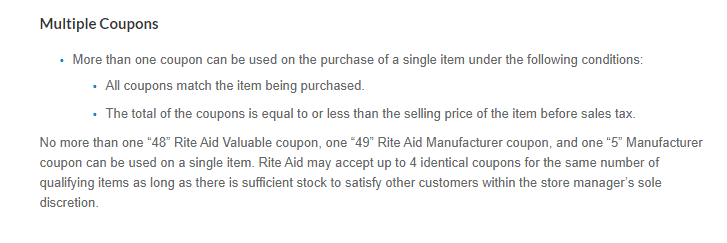

RiteAid Coupon Policy

Yes, RiteAid allows multiple coupons. Here's a snapshot of that part of their coupon policy:

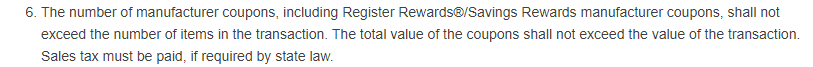

Walgreen's Coupon Policy

Walgreens allows multiple coupons, as long as the number of coupons does not exceed the number of items that you have. Meaning, maybe you have one item where you want to stack two coupons on — you would then need to have another item in the order where you are using no coupons (2 coupons = 2 items).

What is the Best App for Extreme Couponing?

Ever wondered how do extreme couponers get so many coupons? One source they get coupons from are couponing apps.

There are a ton of coupon apps out there, but I have to say, the best app for extreme couponing? Is the one you're actually going to use.

Think about it — you, me, and everyone else with a smartphone have a bunch apps we downloaded with good intentions that never actually get used. And the ones we open on a daily or weekly basis? THOSE are the best apps for us, because they're actually changing our lives.

Here are a bunch of great coupon apps to try out (but be sure to actually use them — otherwise, just delete the clutter on your smartphone screen).

Are you an extreme couponer? Let me know what else you do in the comments below, and help others save money.

Amanda L Grossman

Latest posts by Amanda L Grossman (see all)

- 5 Surprising Ways to Cut Household Costs (Saved us over $1,412!) - March 11, 2024

- The No Spend Challenge Guide (Money Game-Changing Tool) - January 31, 2024

- 47 Seasonal Jobs in Alaska with Housing (Hiring for this Summer) - December 1, 2023

Jackie

Wednesday 3rd of November 2021

I am just now getting back into couponing. We moved from Tennessee to New Mexico in 1999 and where we have lived it has been hard to get the newspaper coupons. I am going to try and get a couple stores to save me the coupons from the papers after the papers change on Sunday night. Don't know if it will work or not but now I am just trying to keep up with getting printable coupons in time before they are all gone.

kariah

Tuesday 2nd of April 2013

i seen yhe show extreme couponning and its amazing on how little to nothing these people pay for grocery and every day needs but in the state of fl theres a rule you cant double coupons on anything so if you live in fl its not possible to be a extreme couponer.

FruGal

Sunday 7th of April 2013

We used to have a grocery store that doubled coupons in Houston...but sadly they phased out that program last year. I believe Randall's still doubles coupons, but only for one of the same coupon.

Sandra

Tuesday 12th of March 2013

Thanks for the tip about the price minimum coupons. I always took the other coupons into consideration first. Don't know why it never occured to me to hand over the price minimum first. I'm smacking myself on the forehead now.

FruGal

Tuesday 12th of March 2013

I am happy to hear that I helped you! Imagine all of your savings moving forward:).

S. B.

Sunday 3rd of March 2013

I have mixed feeling about using a lot of coupons. They certainly can save you money and I use them myself. However, I think there are a lot of pitfalls.

The companies that issue these coupons are not in the charity business. They issue coupons because they know that in the aggregate, they will gain more in profits in the long run than they they lose on the coupons. For example, if you have a coupon for a free appetizer at a new restaurant, you might go there, just order the appetizer and make out with $7. But if you come back to the restaurant 6 months later just one time for dinner, you probably give back the $7. It's easy to get hooked on products of all sorts and the manufacturers and retailers know that when that happens, your recurring business might be worth 10x or even 100x the cost of the coupon. Buyer beware!

FruGal

Tuesday 5th of March 2013

You are correct--businesses need to make a profit. If you have a lot of discipline though, then you can use coupons to your own advantage (i.e. not be brand specific, wait for more coupons, and play the Drugstore/Grocery store games).

Edward Antrobus

Wednesday 27th of February 2013

Now that we have a huge basement, I've been thinking about building a stockpile. It's just hard to find coupons that can compete with the 10% discount my wife gets on store brands.

FruGal

Thursday 28th of February 2013

Where does your wife get the 10% discount at?